Buy-now-pay-later protection allows policyholders to secure insurance coverage immediately and defer payments over time, enhancing affordability for short-term financial planning. Pay-per-mile insurance calculates premiums based on actual miles driven, offering cost savings for low-mileage drivers and promoting usage-based risk assessment. Explore detailed comparisons to determine which insurance model aligns best with your driving habits and budget preferences.

Why it is important

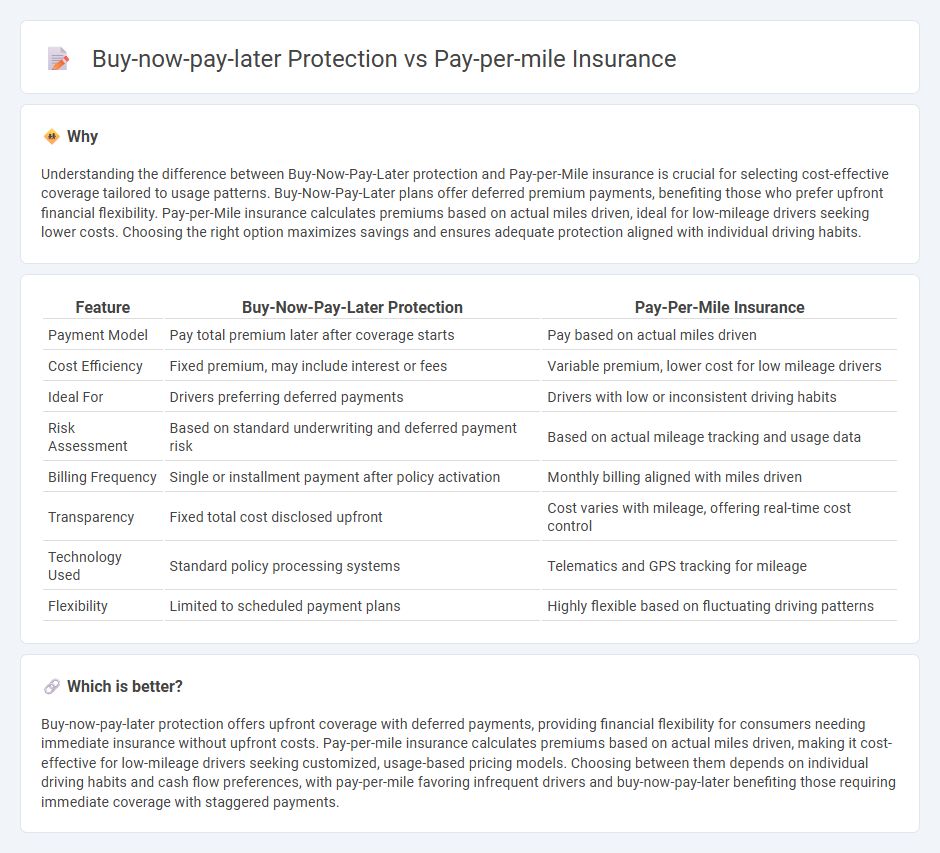

Understanding the difference between Buy-Now-Pay-Later protection and Pay-per-Mile insurance is crucial for selecting cost-effective coverage tailored to usage patterns. Buy-Now-Pay-Later plans offer deferred premium payments, benefiting those who prefer upfront financial flexibility. Pay-per-Mile insurance calculates premiums based on actual miles driven, ideal for low-mileage drivers seeking lower costs. Choosing the right option maximizes savings and ensures adequate protection aligned with individual driving habits.

Comparison Table

| Feature | Buy-Now-Pay-Later Protection | Pay-Per-Mile Insurance |

|---|---|---|

| Payment Model | Pay total premium later after coverage starts | Pay based on actual miles driven |

| Cost Efficiency | Fixed premium, may include interest or fees | Variable premium, lower cost for low mileage drivers |

| Ideal For | Drivers preferring deferred payments | Drivers with low or inconsistent driving habits |

| Risk Assessment | Based on standard underwriting and deferred payment risk | Based on actual mileage tracking and usage data |

| Billing Frequency | Single or installment payment after policy activation | Monthly billing aligned with miles driven |

| Transparency | Fixed total cost disclosed upfront | Cost varies with mileage, offering real-time cost control |

| Technology Used | Standard policy processing systems | Telematics and GPS tracking for mileage |

| Flexibility | Limited to scheduled payment plans | Highly flexible based on fluctuating driving patterns |

Which is better?

Buy-now-pay-later protection offers upfront coverage with deferred payments, providing financial flexibility for consumers needing immediate insurance without upfront costs. Pay-per-mile insurance calculates premiums based on actual miles driven, making it cost-effective for low-mileage drivers seeking customized, usage-based pricing models. Choosing between them depends on individual driving habits and cash flow preferences, with pay-per-mile favoring infrequent drivers and buy-now-pay-later benefiting those requiring immediate coverage with staggered payments.

Connection

Buy-now-pay-later protection and pay-per-mile insurance both provide flexible payment options tailored to customers' financial needs and driving habits. Buy-now-pay-later protection allows policyholders to defer insurance premium payments without penalties, increasing affordability and cash flow management. Pay-per-mile insurance charges premiums based on actual miles driven, promoting cost savings for low-mileage drivers while complementing deferred payment options for enhanced financial flexibility.

Key Terms

Premiums

Pay-per-mile insurance offers lower premiums by charging based on actual miles driven, making it ideal for low-mileage drivers seeking cost-efficiency. Buy-now-pay-later protection typically involves fixed premiums with deferred payment options, appealing to consumers needing immediate coverage without upfront costs. Explore more about how each option impacts your insurance budget and savings.

Usage-based pricing

Usage-based pricing in pay-per-mile insurance allows drivers to pay premiums directly proportional to the miles they drive, optimizing cost efficiency and reflecting real usage patterns. Buy-now-pay-later protection offers flexible payment plans but lacks the granular mileage-based cost control inherent in pay-per-mile models. Explore detailed comparisons to determine which usage-based pricing method aligns best with your driving habits and financial goals.

Deferred payment

Deferred payment in pay-per-mile insurance allows drivers to pay insurance premiums based on actual miles driven, offering flexibility and cost savings for low-mileage users. Buy-now-pay-later protection enables customers to access coverage immediately while spreading payments over time without interest or with minimal fees, enhancing affordability. Explore detailed comparisons to determine which deferred payment option best suits your insurance needs.

Source and External Links

When to Consider Pay-Per-Mile Car Insurance - This article discusses how pay-per-mile insurance works by combining a flat base rate with a per-mile fee, making it suitable for low-mileage drivers.

Pay-Per-Mile Car Insurance: What You Should Know - This resource explains the benefits of pay-per-mile insurance for individuals who drive infrequently, offering savings of up to 40% compared to traditional insurance.

Pros and Cons of Pay-Per-Mile Car Insurance - This article highlights the advantages and disadvantages of pay-per-mile insurance, including potential cost savings and limited availability.

dowidth.com

dowidth.com