Crop insurance protects agricultural producers from losses due to natural disasters, pests, and adverse weather conditions, while property insurance safeguards physical assets such as homes, buildings, and personal belongings against risks like fire, theft, and vandalism. Both insurance types play essential roles in mitigating financial risks specific to their sectors, ensuring stability and recovery after unforeseen events. Explore further to understand the distinct benefits and coverage options of crop insurance versus property insurance.

Why it is important

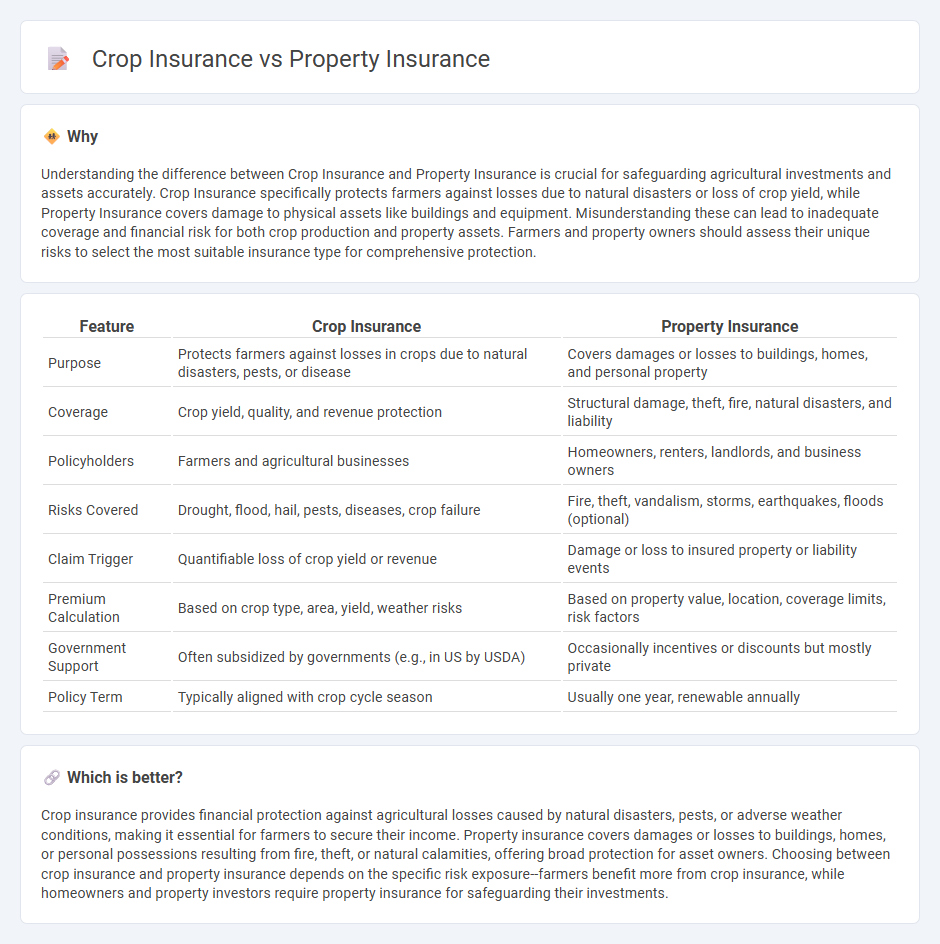

Understanding the difference between Crop Insurance and Property Insurance is crucial for safeguarding agricultural investments and assets accurately. Crop Insurance specifically protects farmers against losses due to natural disasters or loss of crop yield, while Property Insurance covers damage to physical assets like buildings and equipment. Misunderstanding these can lead to inadequate coverage and financial risk for both crop production and property assets. Farmers and property owners should assess their unique risks to select the most suitable insurance type for comprehensive protection.

Comparison Table

| Feature | Crop Insurance | Property Insurance |

|---|---|---|

| Purpose | Protects farmers against losses in crops due to natural disasters, pests, or disease | Covers damages or losses to buildings, homes, and personal property |

| Coverage | Crop yield, quality, and revenue protection | Structural damage, theft, fire, natural disasters, and liability |

| Policyholders | Farmers and agricultural businesses | Homeowners, renters, landlords, and business owners |

| Risks Covered | Drought, flood, hail, pests, diseases, crop failure | Fire, theft, vandalism, storms, earthquakes, floods (optional) |

| Claim Trigger | Quantifiable loss of crop yield or revenue | Damage or loss to insured property or liability events |

| Premium Calculation | Based on crop type, area, yield, weather risks | Based on property value, location, coverage limits, risk factors |

| Government Support | Often subsidized by governments (e.g., in US by USDA) | Occasionally incentives or discounts but mostly private |

| Policy Term | Typically aligned with crop cycle season | Usually one year, renewable annually |

Which is better?

Crop insurance provides financial protection against agricultural losses caused by natural disasters, pests, or adverse weather conditions, making it essential for farmers to secure their income. Property insurance covers damages or losses to buildings, homes, or personal possessions resulting from fire, theft, or natural calamities, offering broad protection for asset owners. Choosing between crop insurance and property insurance depends on the specific risk exposure--farmers benefit more from crop insurance, while homeowners and property investors require property insurance for safeguarding their investments.

Connection

Crop insurance and property insurance both mitigate financial risks by protecting tangible assets from unforeseen events, such as natural disasters or theft. Crop insurance safeguards farmers against losses in agricultural yield due to weather conditions, pests, or disease, while property insurance covers damage to buildings and physical structures. Together, they form a comprehensive risk management strategy for individuals and businesses reliant on land and property assets.

Key Terms

**Property insurance:**

Property insurance offers financial protection against damage or loss to physical assets such as buildings, equipment, and personal property caused by events like fire, theft, or natural disasters. This type of insurance is essential for homeowners, landlords, and businesses seeking to mitigate risks related to property damage and liability claims. Explore further to understand specific coverage options and policy benefits tailored to your property insurance needs.

Perils

Property insurance primarily protects physical assets such as buildings and equipment against perils like fire, theft, vandalism, and natural disasters including storms and earthquakes. Crop insurance specifically covers losses related to agricultural production due to perils such as drought, flood, pests, disease, and adverse weather conditions impacting crop yield. Explore detailed coverage differences and tailor your insurance strategy to safeguard assets effectively.

Replacement Cost

Property insurance covers the replacement cost of buildings and physical structures, ensuring full restoration after damage or loss, whereas crop insurance typically provides indemnity based on expected yield or revenue rather than replacement cost. Replacement cost in property insurance guarantees a payout reflecting current market value without depreciation, essential for maintaining asset value and financial security. Explore the detailed differences between property and crop insurance to optimize your coverage strategy.

Source and External Links

Basic Coverages Available - Alabama Department of Insurance - Property insurance typically covers damage to your home and belongings caused by specified perils such as fire, windstorm, and theft, and often includes coverage for additional living expenses, personal liability, and medical payments.

Homeowners Insurance - Get a Home Insurance Quote - Homeowners insurance is a contract where you pay a premium in exchange for coverage for damages to your home and personal property following covered losses, with costs influenced by factors like location, materials, and use of the home.

Commercial Property Insurance - Commercial property insurance protects business physical assets such as buildings, equipment, and inventory from unexpected events, including coverage for business interruption due to property damage.

dowidth.com

dowidth.com