Cyber risk insurance specifically covers financial losses and damages caused by cyberattacks, data breaches, and online threats, addressing the unique challenges of digital vulnerabilities. General liability insurance provides broader protection against physical injury, property damage, and bodily harm claims occurring on business premises or through business operations. Explore the key differences and benefits of each insurance type to determine the best coverage for your business needs.

Why it is important

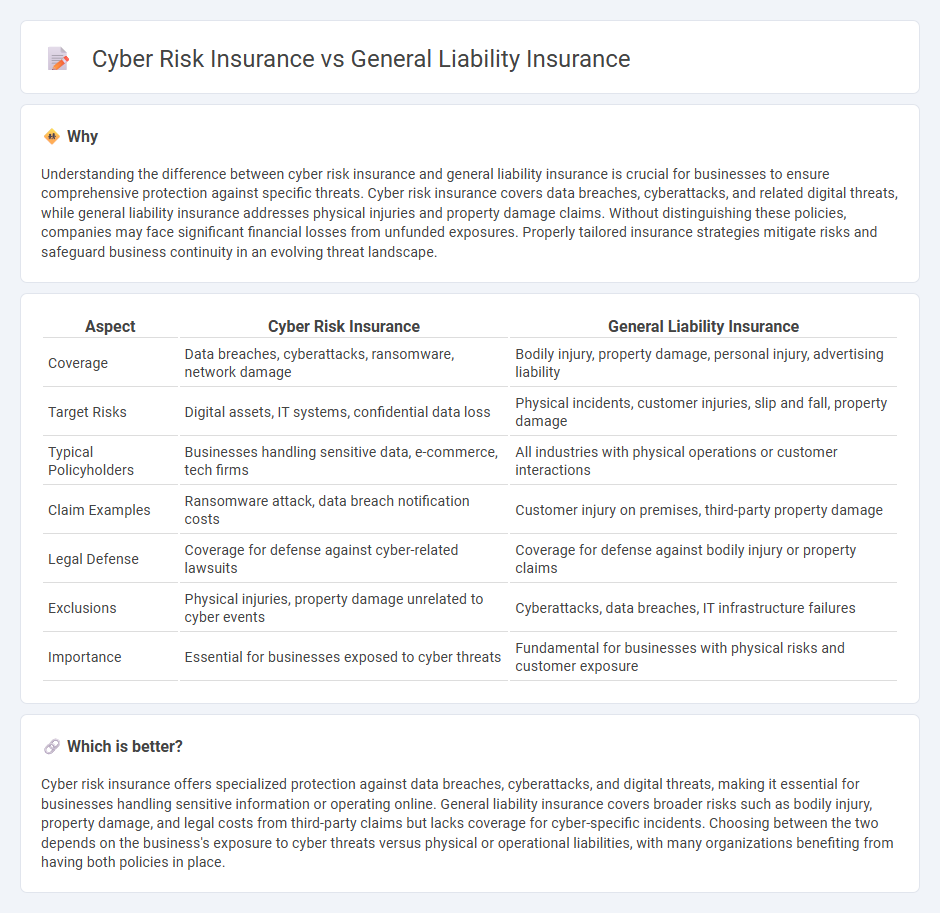

Understanding the difference between cyber risk insurance and general liability insurance is crucial for businesses to ensure comprehensive protection against specific threats. Cyber risk insurance covers data breaches, cyberattacks, and related digital threats, while general liability insurance addresses physical injuries and property damage claims. Without distinguishing these policies, companies may face significant financial losses from unfunded exposures. Properly tailored insurance strategies mitigate risks and safeguard business continuity in an evolving threat landscape.

Comparison Table

| Aspect | Cyber Risk Insurance | General Liability Insurance |

|---|---|---|

| Coverage | Data breaches, cyberattacks, ransomware, network damage | Bodily injury, property damage, personal injury, advertising liability |

| Target Risks | Digital assets, IT systems, confidential data loss | Physical incidents, customer injuries, slip and fall, property damage |

| Typical Policyholders | Businesses handling sensitive data, e-commerce, tech firms | All industries with physical operations or customer interactions |

| Claim Examples | Ransomware attack, data breach notification costs | Customer injury on premises, third-party property damage |

| Legal Defense | Coverage for defense against cyber-related lawsuits | Coverage for defense against bodily injury or property claims |

| Exclusions | Physical injuries, property damage unrelated to cyber events | Cyberattacks, data breaches, IT infrastructure failures |

| Importance | Essential for businesses exposed to cyber threats | Fundamental for businesses with physical risks and customer exposure |

Which is better?

Cyber risk insurance offers specialized protection against data breaches, cyberattacks, and digital threats, making it essential for businesses handling sensitive information or operating online. General liability insurance covers broader risks such as bodily injury, property damage, and legal costs from third-party claims but lacks coverage for cyber-specific incidents. Choosing between the two depends on the business's exposure to cyber threats versus physical or operational liabilities, with many organizations benefiting from having both policies in place.

Connection

Cyber risk insurance and general liability insurance intersect by addressing different dimensions of business risk protection; cyber risk insurance covers financial losses resulting from data breaches and cyberattacks, while general liability insurance protects against third-party claims of bodily injury or property damage. Both policies are critical for comprehensive risk management, especially as cyber incidents increasingly lead to lawsuits and regulatory fines that overlap with general liability coverage areas. Integrating these insurances ensures businesses are safeguarded against both digital threats and traditional liability exposures, enhancing overall resilience in an interconnected risk environment.

Key Terms

**General Liability Insurance:**

General liability insurance provides essential coverage for businesses against claims involving bodily injury, property damage, and personal injury occurring on their premises or through their operations. This insurance typically covers legal fees, medical expenses, and settlements, protecting companies from financial losses due to third-party lawsuits. Explore how general liability insurance safeguards your business to better understand its critical role in risk management.

Bodily Injury

General liability insurance primarily covers bodily injury claims arising from accidents or mishaps occurring on your business premises or due to your products, protecting against legal and medical expenses. Cyber risk insurance, on the other hand, focuses on digital threats and typically does not cover bodily injury, as it is designed to address data breaches, cyberattacks, and related financial losses. Explore the distinct coverages to determine which insurance best safeguards your business's specific risks.

Property Damage

General liability insurance covers property damage caused by accidents or negligence in physical spaces, protecting businesses from claims related to bodily injury or physical property harm. Cyber risk insurance focuses on digital threats like data breaches and cyberattacks, offering coverage for financial losses and damages linked to cyber incidents rather than tangible property harm. Explore the key differences between these policies to safeguard your business comprehensively.

Source and External Links

Liability Insurance - General Coverage for Your Business - GEICO - General liability insurance protects businesses from claims related to bodily injuries, medical payments, property damage, and more during normal business operations.

General Liability Insurance for Contractors - General liability insurance for contractors covers risks such as accidental damage to clients' property or customer injuries, helping them meet insurance requirements for contracts and leases.

Best General Liability Insurance for Small Businesses in 2025 - General liability insurance protects businesses against claims of harm to people or property, but does not cover employee injuries or certain product-related claims.

dowidth.com

dowidth.com