Weather index insurance provides payouts based on predefined weather parameters such as rainfall or temperature, reducing claim processing time and minimizing moral hazard. Property insurance covers physical assets against risks like fire, theft, or natural disasters, requiring thorough damage assessment for claims. Explore more to understand which insurance best suits your risk management needs.

Why it is important

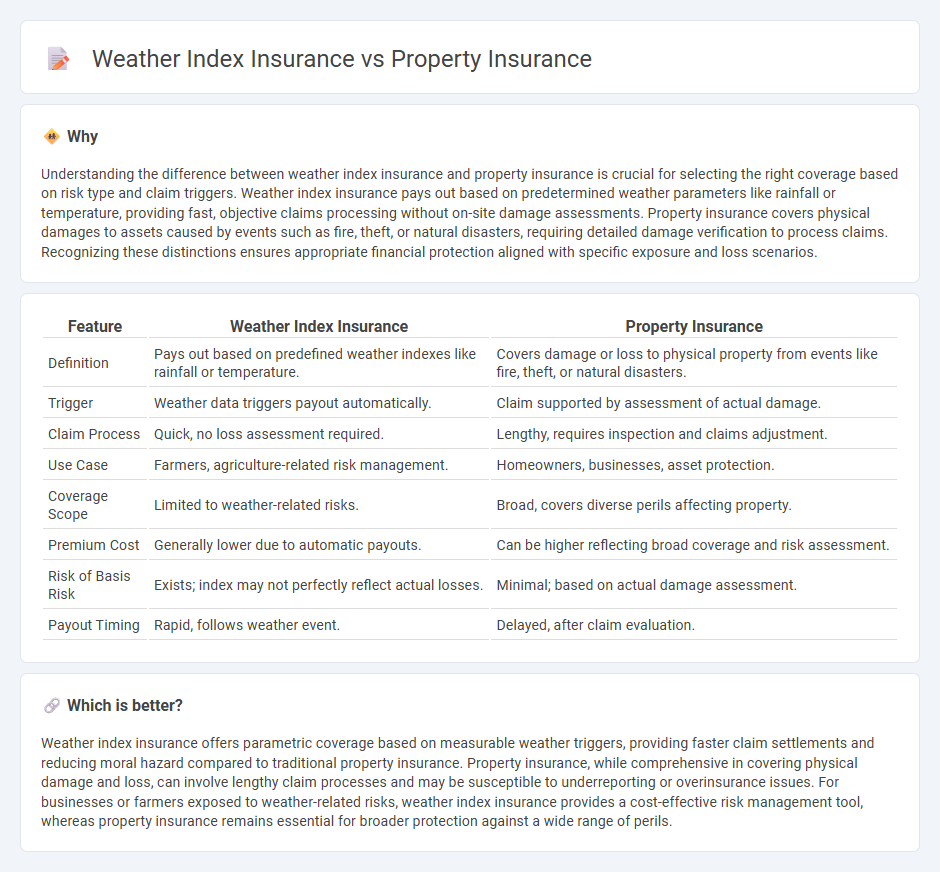

Understanding the difference between weather index insurance and property insurance is crucial for selecting the right coverage based on risk type and claim triggers. Weather index insurance pays out based on predetermined weather parameters like rainfall or temperature, providing fast, objective claims processing without on-site damage assessments. Property insurance covers physical damages to assets caused by events such as fire, theft, or natural disasters, requiring detailed damage verification to process claims. Recognizing these distinctions ensures appropriate financial protection aligned with specific exposure and loss scenarios.

Comparison Table

| Feature | Weather Index Insurance | Property Insurance |

|---|---|---|

| Definition | Pays out based on predefined weather indexes like rainfall or temperature. | Covers damage or loss to physical property from events like fire, theft, or natural disasters. |

| Trigger | Weather data triggers payout automatically. | Claim supported by assessment of actual damage. |

| Claim Process | Quick, no loss assessment required. | Lengthy, requires inspection and claims adjustment. |

| Use Case | Farmers, agriculture-related risk management. | Homeowners, businesses, asset protection. |

| Coverage Scope | Limited to weather-related risks. | Broad, covers diverse perils affecting property. |

| Premium Cost | Generally lower due to automatic payouts. | Can be higher reflecting broad coverage and risk assessment. |

| Risk of Basis Risk | Exists; index may not perfectly reflect actual losses. | Minimal; based on actual damage assessment. |

| Payout Timing | Rapid, follows weather event. | Delayed, after claim evaluation. |

Which is better?

Weather index insurance offers parametric coverage based on measurable weather triggers, providing faster claim settlements and reducing moral hazard compared to traditional property insurance. Property insurance, while comprehensive in covering physical damage and loss, can involve lengthy claim processes and may be susceptible to underreporting or overinsurance issues. For businesses or farmers exposed to weather-related risks, weather index insurance provides a cost-effective risk management tool, whereas property insurance remains essential for broader protection against a wide range of perils.

Connection

Weather index insurance and property insurance are connected through their shared goal of mitigating financial risks caused by environmental factors. Weather index insurance uses measurable weather data, such as rainfall or temperature, to trigger payouts, directly addressing climate-related losses affecting properties. Property insurance complements this by covering physical damage to assets, together providing comprehensive protection against weather-induced damages.

Key Terms

Indemnity

Property insurance provides indemnity based on actual loss or damage to physical assets, ensuring compensation corresponds directly to the repair or replacement costs. Weather index insurance offers indemnity based on predefined weather parameters, such as rainfall or temperature indices, triggering payouts without the need for loss assessment. Explore the detailed differences and advantages of both insurance types to optimize your risk management strategy.

Parametric

Property insurance provides coverage based on actual loss assessments resulting from property damage, whereas weather index insurance relies on predefined weather parameters like rainfall or temperature exceeding certain thresholds to trigger payouts. Parametric insurance, a subset of weather index insurance, offers rapid, transparent compensation by using objective data such as wind speed or precipitation levels measured by independent sources, minimizing claim disputes and administrative costs. Explore how parametric insurance can enhance risk management strategies in weather-sensitive sectors.

Trigger Event

Property insurance provides coverage based on actual damage incurred to physical assets, activating claims after verified losses like fire or flood. Weather index insurance triggers payouts through specific weather parameters such as rainfall levels or temperature thresholds, eliminating the need for loss assessment on the ground. Explore detailed comparisons and practical applications of both insurance types to better understand their benefits and limitations.

Source and External Links

Property insurance - Provides protection against most risks to property, such as fire, theft, and some weather damage, through open perils or named perils policies.

Homeowners Insurance - Online Quotes - Helps cover repairs or replacement of your home and belongings, legal fees, and temporary housing after events like fire, theft, or liability claims, but often requires separate policies for floods or earthquakes.

Homeowners Insurance - Get a Home Insurance Quote - Customizable coverage for your home, belongings, and liability, with payment amounts based on location, construction, use, and personal details, and claims paid after deductibles.

dowidth.com

dowidth.com