NFT insurance offers coverage tailored to digital assets on blockchain platforms, protecting against risks like hacking, theft, and valuation drops. Peer-to-peer insurance leverages a decentralized model where members pool funds to cover claims, reducing costs and increasing transparency. Explore how these innovative insurance models redefine risk management in today's digital economy.

Why it is important

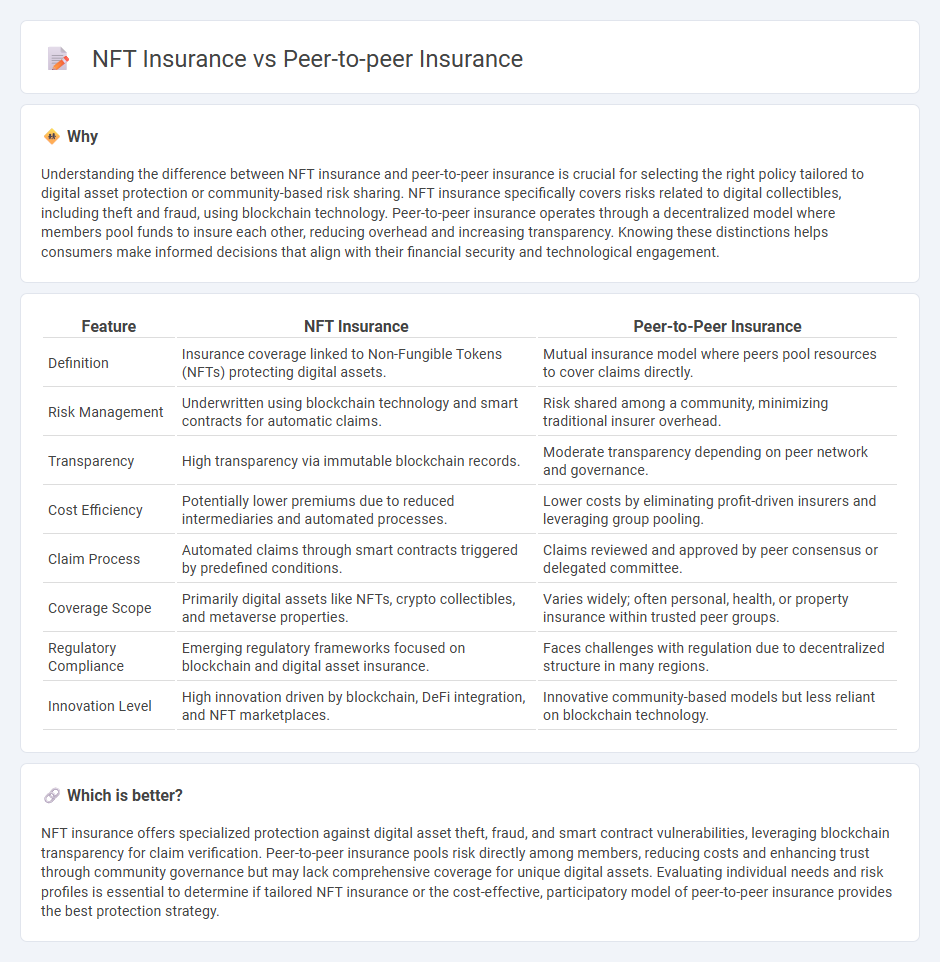

Understanding the difference between NFT insurance and peer-to-peer insurance is crucial for selecting the right policy tailored to digital asset protection or community-based risk sharing. NFT insurance specifically covers risks related to digital collectibles, including theft and fraud, using blockchain technology. Peer-to-peer insurance operates through a decentralized model where members pool funds to insure each other, reducing overhead and increasing transparency. Knowing these distinctions helps consumers make informed decisions that align with their financial security and technological engagement.

Comparison Table

| Feature | NFT Insurance | Peer-to-Peer Insurance |

|---|---|---|

| Definition | Insurance coverage linked to Non-Fungible Tokens (NFTs) protecting digital assets. | Mutual insurance model where peers pool resources to cover claims directly. |

| Risk Management | Underwritten using blockchain technology and smart contracts for automatic claims. | Risk shared among a community, minimizing traditional insurer overhead. |

| Transparency | High transparency via immutable blockchain records. | Moderate transparency depending on peer network and governance. |

| Cost Efficiency | Potentially lower premiums due to reduced intermediaries and automated processes. | Lower costs by eliminating profit-driven insurers and leveraging group pooling. |

| Claim Process | Automated claims through smart contracts triggered by predefined conditions. | Claims reviewed and approved by peer consensus or delegated committee. |

| Coverage Scope | Primarily digital assets like NFTs, crypto collectibles, and metaverse properties. | Varies widely; often personal, health, or property insurance within trusted peer groups. |

| Regulatory Compliance | Emerging regulatory frameworks focused on blockchain and digital asset insurance. | Faces challenges with regulation due to decentralized structure in many regions. |

| Innovation Level | High innovation driven by blockchain, DeFi integration, and NFT marketplaces. | Innovative community-based models but less reliant on blockchain technology. |

Which is better?

NFT insurance offers specialized protection against digital asset theft, fraud, and smart contract vulnerabilities, leveraging blockchain transparency for claim verification. Peer-to-peer insurance pools risk directly among members, reducing costs and enhancing trust through community governance but may lack comprehensive coverage for unique digital assets. Evaluating individual needs and risk profiles is essential to determine if tailored NFT insurance or the cost-effective, participatory model of peer-to-peer insurance provides the best protection strategy.

Connection

NFT insurance leverages blockchain technology to provide transparent and tamper-proof coverage for digital assets, while peer-to-peer insurance utilizes decentralized networks to enable individuals to pool risk and share claims directly. Both models disrupt traditional insurance by promoting trust, reducing intermediaries, and enhancing efficiency through smart contracts and community-driven structures. This convergence fosters innovative risk management solutions tailored to digital economies and interconnected user communities.

Key Terms

Risk Pooling

Peer-to-peer insurance leverages collective risk pooling where members contribute premiums into a shared fund used to cover claims, enhancing transparency and reducing overhead costs. NFT insurance introduces programmable risk pooling via smart contracts on blockchain, enabling automated, trustless claim settlements and customizable coverage linked to digital assets. Explore deeper insights into how these innovative risk pooling models are transforming the insurance landscape.

Smart Contracts

Peer-to-peer insurance leverages smart contracts to automate claims processing and enhance transparency by directly connecting policyholders without intermediaries. NFT insurance incorporates blockchain-based non-fungible tokens to represent insurance policies, enabling unique, tradable coverage with programmable terms secured through smart contracts. Explore the evolving role of smart contracts in redefining insurance models and their impact on efficiency and security.

Decentralization

Peer-to-peer (P2P) insurance leverages decentralization by enabling policyholders to pool resources and share risks directly without traditional intermediaries, fostering transparency and reducing costs. NFT insurance utilizes blockchain technology to create unique, verifiable insurance contracts stored as non-fungible tokens, enhancing security and traceability in decentralized insurance ecosystems. Explore the evolving impact of decentralization in insurance by delving deeper into P2P and NFT insurance models.

Source and External Links

Peer-to-peer insurance - Wikipedia - Peer-to-peer insurance is a collaborative insurance model where participants pool resources to cover risks together, giving members more control over coverage decisions traditionally made by insurers.

How Peer-to-Peer Insurance Works - The Actuary Magazine - Peer-to-peer insurance uses technology and the sharing economy principles to create risk-sharing networks where groups pool funds to insure against common risks, appealing especially to younger consumers seeking alternatives to traditional insurance.

Peer-To-Peer Car Rental Insurance | Progressive - In peer-to-peer car rental insurance, car owners maintain their personal policies but often need additional coverage through the rental platform while their car is rented, and renters' personal auto insurance typically applies during rentals.

dowidth.com

dowidth.com