Pay-as-you-drive insurance charges premiums based on actual miles driven, offering cost efficiency for low-mileage drivers by linking insurance costs directly to usage. Comprehensive insurance provides broader protection, covering damages from non-collision events such as theft, fire, or natural disasters, regardless of miles traveled. Explore more to understand which insurance type best suits your driving habits and coverage needs.

Why it is important

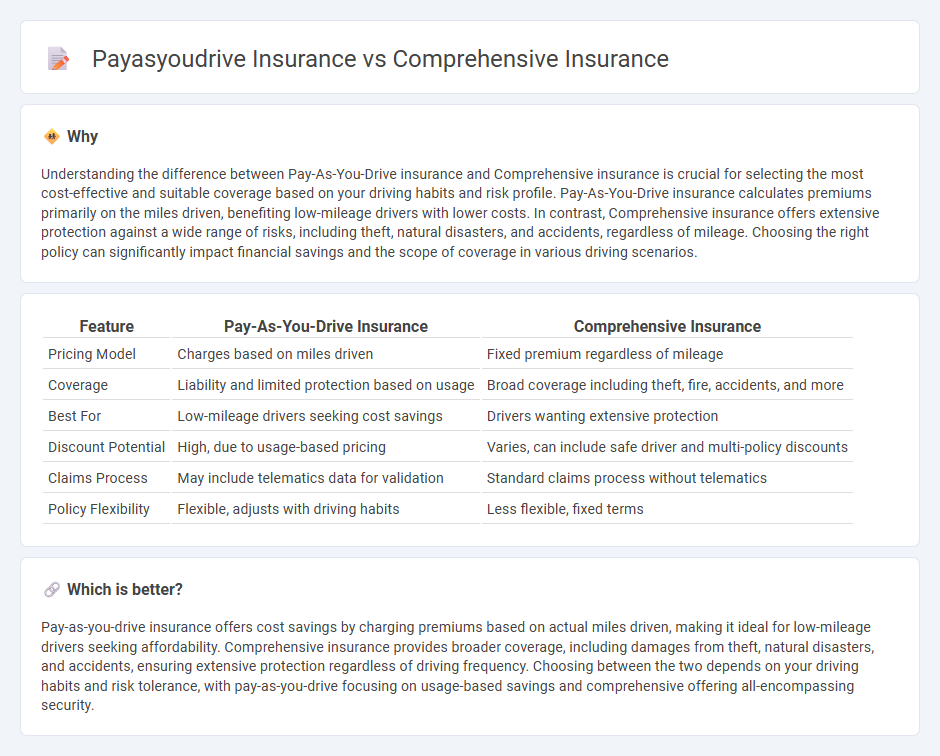

Understanding the difference between Pay-As-You-Drive insurance and Comprehensive insurance is crucial for selecting the most cost-effective and suitable coverage based on your driving habits and risk profile. Pay-As-You-Drive insurance calculates premiums primarily on the miles driven, benefiting low-mileage drivers with lower costs. In contrast, Comprehensive insurance offers extensive protection against a wide range of risks, including theft, natural disasters, and accidents, regardless of mileage. Choosing the right policy can significantly impact financial savings and the scope of coverage in various driving scenarios.

Comparison Table

| Feature | Pay-As-You-Drive Insurance | Comprehensive Insurance |

|---|---|---|

| Pricing Model | Charges based on miles driven | Fixed premium regardless of mileage |

| Coverage | Liability and limited protection based on usage | Broad coverage including theft, fire, accidents, and more |

| Best For | Low-mileage drivers seeking cost savings | Drivers wanting extensive protection |

| Discount Potential | High, due to usage-based pricing | Varies, can include safe driver and multi-policy discounts |

| Claims Process | May include telematics data for validation | Standard claims process without telematics |

| Policy Flexibility | Flexible, adjusts with driving habits | Less flexible, fixed terms |

Which is better?

Pay-as-you-drive insurance offers cost savings by charging premiums based on actual miles driven, making it ideal for low-mileage drivers seeking affordability. Comprehensive insurance provides broader coverage, including damages from theft, natural disasters, and accidents, ensuring extensive protection regardless of driving frequency. Choosing between the two depends on your driving habits and risk tolerance, with pay-as-you-drive focusing on usage-based savings and comprehensive offering all-encompassing security.

Connection

Pay-as-you-drive insurance calculates premiums based on actual miles driven, promoting cost efficiency and personalized coverage. Comprehensive insurance protects against non-collision-related damages such as theft, vandalism, and natural disasters, complementing pay-as-you-drive policies by covering a broader range of risks. Together, they offer a tailored approach: pay-as-you-drive addresses usage-based costs, while comprehensive ensures extensive protection beyond driving habits.

Key Terms

Coverage Scope

Comprehensive insurance offers broad protection against a wide range of risks including theft, natural disasters, and accidents, ensuring financial security in diverse situations. Pay-as-you-drive insurance charges premiums based on actual mileage, providing cost efficiency for low-mileage drivers but with coverage primarily focused on accidents and liability during driven miles. Explore detailed comparisons to determine which policy aligns best with your driving habits and coverage needs.

Premium Calculation

Comprehensive insurance premiums are calculated based on factors including vehicle value, driver history, location, and coverage limits, offering a fixed-cost model regardless of driving behavior. Pay-as-you-drive insurance adjusts premiums dynamically, using telematics data such as miles driven, driving patterns, and time of day to provide a personalized pricing structure. Discover how each model impacts your expenses and coverage by exploring detailed premium calculation methods.

Usage-Based Pricing

Comprehensive insurance offers broad coverage for damages and theft regardless of driving behavior, while pay-as-you-drive insurance uses telematics to monitor mileage and driving habits, enabling usage-based pricing tailored to risk exposure. This model incentivizes safer driving and can lower premiums for low-mileage drivers. Discover how usage-based pricing transforms insurance costs and benefits policyholders by exploring further details.

Source and External Links

Comprehensive Car Insurance Coverage - Comprehensive insurance helps pay to replace or repair your vehicle if it's stolen or damaged by non-collision incidents like fire, vandalism, or hail.

What is Comprehensive Car Insurance and What Does It Cover? - Comprehensive car insurance covers losses like theft, vandalism, hail, flooding, or hitting an animal.

What Is Comprehensive Insurance? - Comprehensive car insurance helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision, such as fire, vandalism, or falling objects.

dowidth.com

dowidth.com