Embedded insurance integrates coverage directly into the purchase of products or services, offering seamless protection without separate transactions. Bancassurance involves partnerships between banks and insurance companies to distribute insurance products through the bank's channels, leveraging existing customer bases. Explore how these insurance models enhance customer convenience and financial security.

Why it is important

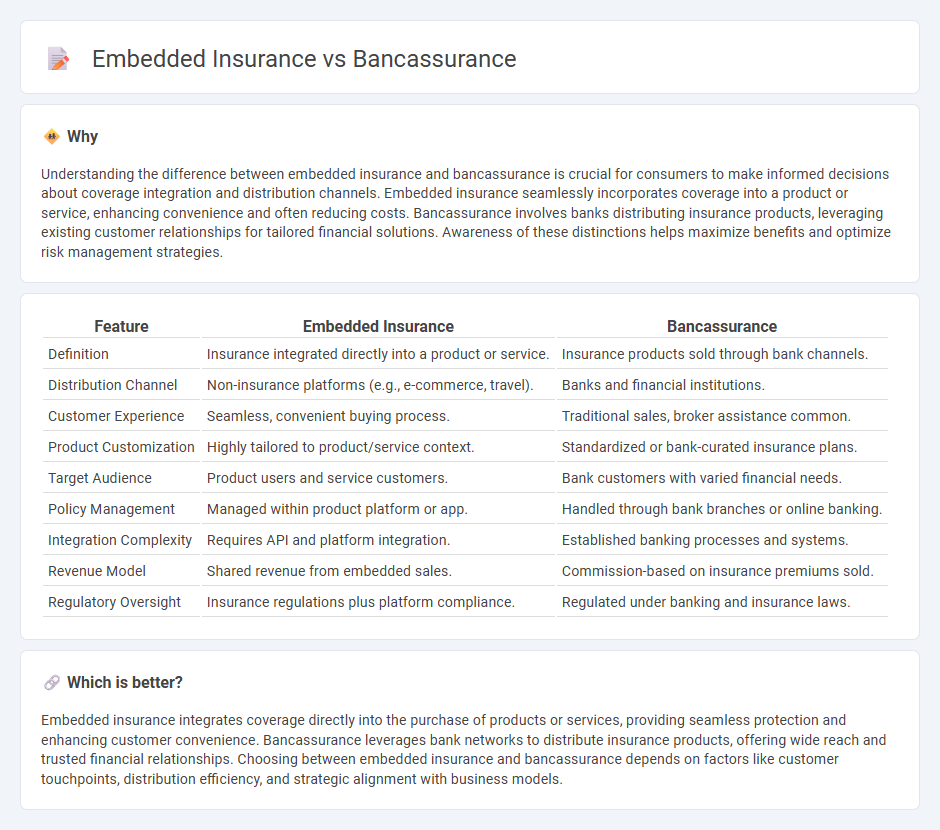

Understanding the difference between embedded insurance and bancassurance is crucial for consumers to make informed decisions about coverage integration and distribution channels. Embedded insurance seamlessly incorporates coverage into a product or service, enhancing convenience and often reducing costs. Bancassurance involves banks distributing insurance products, leveraging existing customer relationships for tailored financial solutions. Awareness of these distinctions helps maximize benefits and optimize risk management strategies.

Comparison Table

| Feature | Embedded Insurance | Bancassurance |

|---|---|---|

| Definition | Insurance integrated directly into a product or service. | Insurance products sold through bank channels. |

| Distribution Channel | Non-insurance platforms (e.g., e-commerce, travel). | Banks and financial institutions. |

| Customer Experience | Seamless, convenient buying process. | Traditional sales, broker assistance common. |

| Product Customization | Highly tailored to product/service context. | Standardized or bank-curated insurance plans. |

| Target Audience | Product users and service customers. | Bank customers with varied financial needs. |

| Policy Management | Managed within product platform or app. | Handled through bank branches or online banking. |

| Integration Complexity | Requires API and platform integration. | Established banking processes and systems. |

| Revenue Model | Shared revenue from embedded sales. | Commission-based on insurance premiums sold. |

| Regulatory Oversight | Insurance regulations plus platform compliance. | Regulated under banking and insurance laws. |

Which is better?

Embedded insurance integrates coverage directly into the purchase of products or services, providing seamless protection and enhancing customer convenience. Bancassurance leverages bank networks to distribute insurance products, offering wide reach and trusted financial relationships. Choosing between embedded insurance and bancassurance depends on factors like customer touchpoints, distribution efficiency, and strategic alignment with business models.

Connection

Embedded insurance integrates coverage seamlessly into the purchase of financial products, often offered through banking channels, which aligns closely with bancassurance models where banks distribute insurance products. Both strategies leverage the existing customer base and distribution networks of banks to provide convenient access to insurance, enhancing customer experience and driving product penetration. This convergence optimizes risk management and fosters financial ecosystem synergy by combining banking services with tailored insurance solutions.

Key Terms

Bancassurance:

Bancassurance integrates insurance products directly into banking services, allowing banks to distribute life, health, and property insurance to their existing customer base through established branches and digital platforms. This model leverages the trust and extensive customer data of banks to cross-sell insurance, enhancing customer retention and generating additional revenue streams for financial institutions. Explore more about how bancassurance transforms the insurance landscape and benefits both banks and policyholders.

Distribution Channel

Bancassurance leverages traditional banking networks to distribute insurance products, integrating insurance sales within bank branches and using bank advisors to reach existing customers. Embedded insurance, conversely, integrates insurance offerings directly into non-insurance platforms such as e-commerce, travel bookings, or automotive purchases, enabling seamless coverage at the point of sale. Explore the evolving strategies in distribution channels to understand how these models optimize customer experience and market reach.

Partner Bank

Partner banks leverage bancassurance to integrate insurance products within their financial services, enhancing customer convenience and revenue streams through cross-selling opportunities. Embedded insurance, by contrast, seamlessly incorporates insurance coverage directly into the customer journey, offering instant protection during transactions without requiring separate purchases. Explore how partner banks optimize customer experience and profitability by choosing between bancassurance and embedded insurance solutions.

Source and External Links

Bancassurance - Bancassurance is a relationship between a bank and an insurance company aimed at offering insurance products or benefits through the bank's channels.

What is Bancassurance? - Login - Bancassurance combines banking and insurance services, allowing banks to sell insurance products using their branch networks, lowering premiums and enabling one-stop financial services.

Bancassurance - Overview, History, Products, Challenges - Bancassurance is an agreement where insurance companies use banks' distribution channels to sell products, benefiting from established customer networks while banks earn fees.

dowidth.com

dowidth.com