Cyber risk underwriting focuses on assessing and pricing coverage for losses related to data breaches, cyberattacks, and technology failures, emphasizing evolving digital threats and regulatory compliance. Professional liability underwriting evaluates risks tied to errors, omissions, and negligence in providing professional services, prioritizing factors such as industry experience and past claims history. Discover more about the distinct challenges and strategies in cyber risk versus professional liability underwriting.

Why it is important

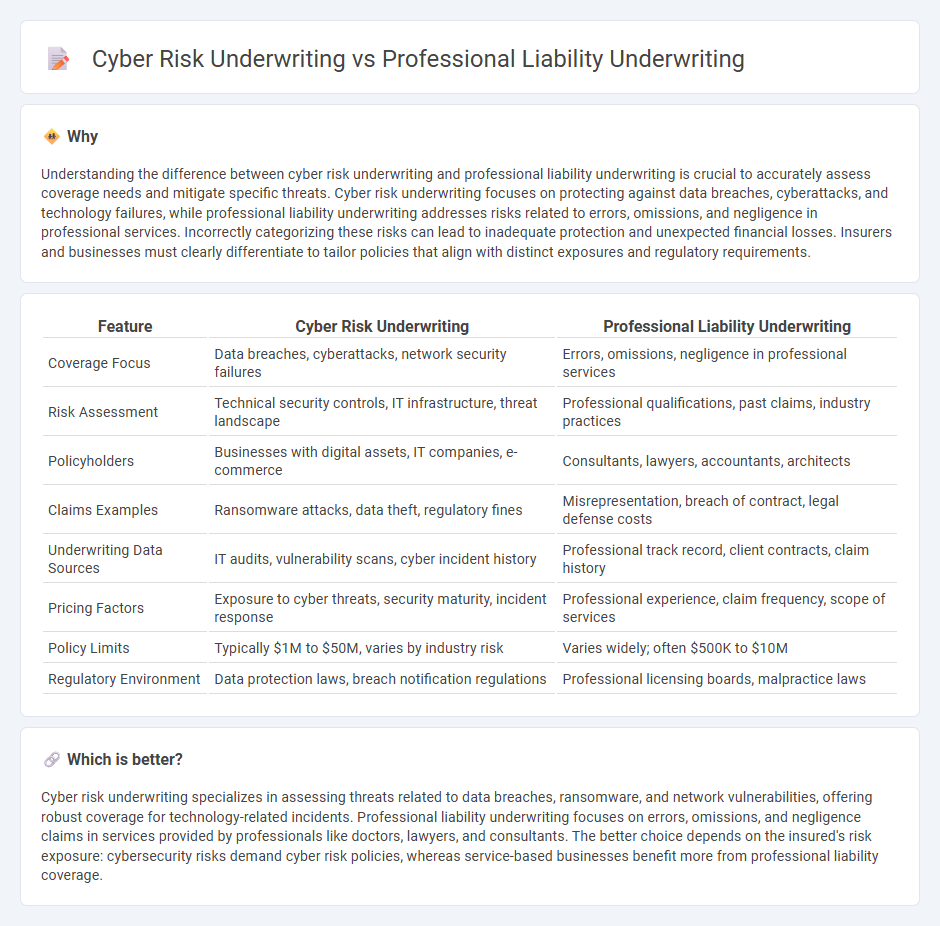

Understanding the difference between cyber risk underwriting and professional liability underwriting is crucial to accurately assess coverage needs and mitigate specific threats. Cyber risk underwriting focuses on protecting against data breaches, cyberattacks, and technology failures, while professional liability underwriting addresses risks related to errors, omissions, and negligence in professional services. Incorrectly categorizing these risks can lead to inadequate protection and unexpected financial losses. Insurers and businesses must clearly differentiate to tailor policies that align with distinct exposures and regulatory requirements.

Comparison Table

| Feature | Cyber Risk Underwriting | Professional Liability Underwriting |

|---|---|---|

| Coverage Focus | Data breaches, cyberattacks, network security failures | Errors, omissions, negligence in professional services |

| Risk Assessment | Technical security controls, IT infrastructure, threat landscape | Professional qualifications, past claims, industry practices |

| Policyholders | Businesses with digital assets, IT companies, e-commerce | Consultants, lawyers, accountants, architects |

| Claims Examples | Ransomware attacks, data theft, regulatory fines | Misrepresentation, breach of contract, legal defense costs |

| Underwriting Data Sources | IT audits, vulnerability scans, cyber incident history | Professional track record, client contracts, claim history |

| Pricing Factors | Exposure to cyber threats, security maturity, incident response | Professional experience, claim frequency, scope of services |

| Policy Limits | Typically $1M to $50M, varies by industry risk | Varies widely; often $500K to $10M |

| Regulatory Environment | Data protection laws, breach notification regulations | Professional licensing boards, malpractice laws |

Which is better?

Cyber risk underwriting specializes in assessing threats related to data breaches, ransomware, and network vulnerabilities, offering robust coverage for technology-related incidents. Professional liability underwriting focuses on errors, omissions, and negligence claims in services provided by professionals like doctors, lawyers, and consultants. The better choice depends on the insured's risk exposure: cybersecurity risks demand cyber risk policies, whereas service-based businesses benefit more from professional liability coverage.

Connection

Cyber risk underwriting and professional liability underwriting are connected through their focus on managing risks associated with technology and professional services errors. Both underwriting processes assess potential financial losses stemming from data breaches, cybercrime, and professional negligence or errors in service delivery. Understanding the intersection of cyber threats and professional duties enables insurers to tailor comprehensive policies mitigating complex modern liabilities.

Key Terms

**Professional liability underwriting:**

Professional liability underwriting centers on evaluating risks associated with errors, omissions, and negligence claims against professionals such as lawyers, doctors, and consultants. This process involves assessing the insured's industry, risk management practices, claim history, and policy limits to accurately price coverage and mitigate potential losses. Explore more about how expert risk assessment in professional liability underwriting safeguards clients and insurers alike.

Errors and Omissions (E&O)

Professional liability underwriting for Errors and Omissions (E&O) involves assessing risks linked to negligence, mistakes, or failure to perform professional duties, primarily in fields like law, medicine, and consulting. Cyber risk underwriting focuses on vulnerabilities related to data breaches, cyberattacks, and technology failures that may lead to E&O claims by compromising client information or disrupting services. Explore deeper insights into how these underwriting approaches address unique risks and coverage nuances in E&O scenarios.

Claims-Made Policy

Professional liability underwriting and cyber risk underwriting differ significantly in their approach to Claims-Made policies, with professional liability focusing on coverage for claims reported during the policy period regardless of when the event occurred, often involving errors and omissions in professional services. Cyber risk underwriting evaluates Claims-Made policies based on incidents of data breaches or cyberattacks reported within the policy term, emphasizing timely notification to mitigate exposure to rapidly evolving cyber threats. Explore further to understand how these underwriting nuances impact risk management and policy design.

Source and External Links

professional liability PL - IRMI - Professional liability underwriting assesses and covers risks arising from errors, omissions, or negligence in the delivery of services, with policies often tailored to specific professions and operating on a claims-made basis with shrinking limits.

Professional Liability Insurance - Zurich North America - Professional liability underwriting at Zurich focuses on protecting professionals and businesses from financial and reputational harm due to lawsuits alleging service failures, offering modular, flexible coverage solutions including cyber and crisis management options.

Professional Lines Underwriting Insurance Programs - Amwins - Amwins provides specialized professional liability underwriting for accountants, architects, engineers, lawyers, and others, with tailored programs that address industry-specific risks and no one-size-fits-all solutions.

dowidth.com

dowidth.com