Micro-mobility insurance specifically covers e-scooters, bikes, and other small electric vehicles against damages, theft, and liability for accidents involving riders or third parties. Product liability insurance protects manufacturers and sellers from claims arising due to defects or malfunctions causing injury or property damage from their products. Explore the key differences and benefits of each insurance type to determine the best coverage for your needs.

Why it is important

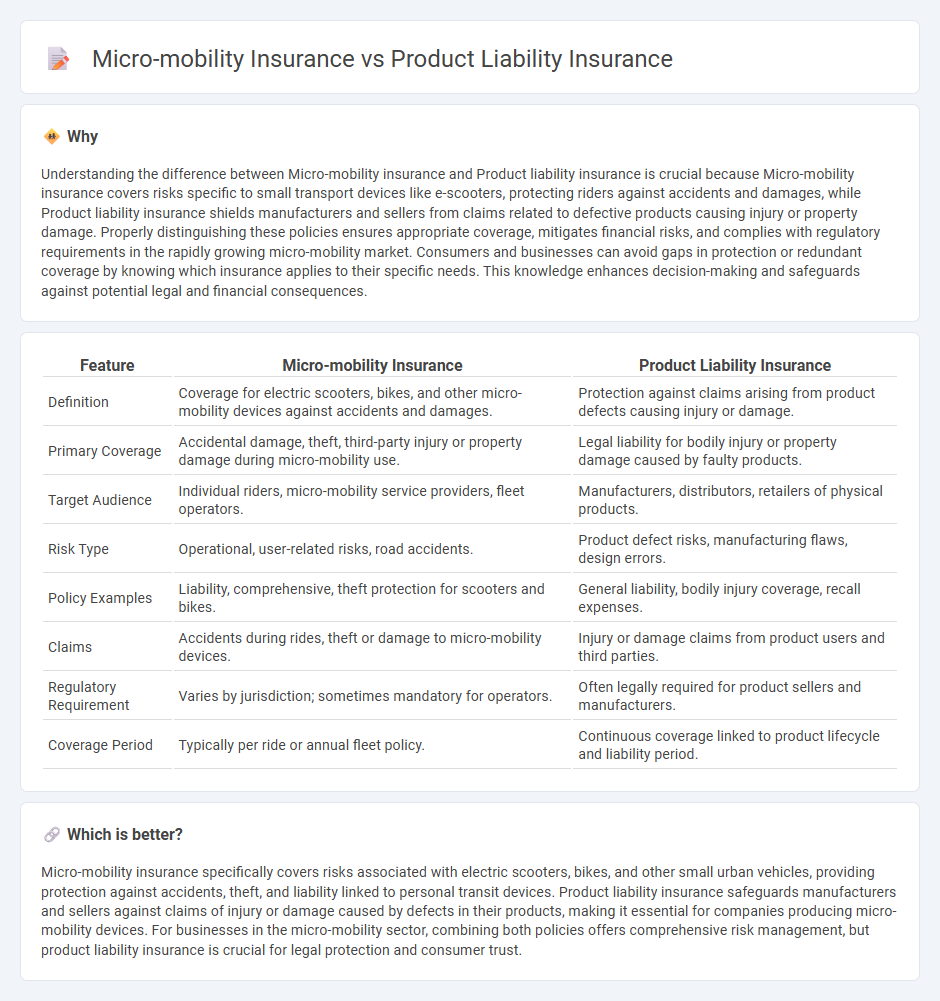

Understanding the difference between Micro-mobility insurance and Product liability insurance is crucial because Micro-mobility insurance covers risks specific to small transport devices like e-scooters, protecting riders against accidents and damages, while Product liability insurance shields manufacturers and sellers from claims related to defective products causing injury or property damage. Properly distinguishing these policies ensures appropriate coverage, mitigates financial risks, and complies with regulatory requirements in the rapidly growing micro-mobility market. Consumers and businesses can avoid gaps in protection or redundant coverage by knowing which insurance applies to their specific needs. This knowledge enhances decision-making and safeguards against potential legal and financial consequences.

Comparison Table

| Feature | Micro-mobility Insurance | Product Liability Insurance |

|---|---|---|

| Definition | Coverage for electric scooters, bikes, and other micro-mobility devices against accidents and damages. | Protection against claims arising from product defects causing injury or damage. |

| Primary Coverage | Accidental damage, theft, third-party injury or property damage during micro-mobility use. | Legal liability for bodily injury or property damage caused by faulty products. |

| Target Audience | Individual riders, micro-mobility service providers, fleet operators. | Manufacturers, distributors, retailers of physical products. |

| Risk Type | Operational, user-related risks, road accidents. | Product defect risks, manufacturing flaws, design errors. |

| Policy Examples | Liability, comprehensive, theft protection for scooters and bikes. | General liability, bodily injury coverage, recall expenses. |

| Claims | Accidents during rides, theft or damage to micro-mobility devices. | Injury or damage claims from product users and third parties. |

| Regulatory Requirement | Varies by jurisdiction; sometimes mandatory for operators. | Often legally required for product sellers and manufacturers. |

| Coverage Period | Typically per ride or annual fleet policy. | Continuous coverage linked to product lifecycle and liability period. |

Which is better?

Micro-mobility insurance specifically covers risks associated with electric scooters, bikes, and other small urban vehicles, providing protection against accidents, theft, and liability linked to personal transit devices. Product liability insurance safeguards manufacturers and sellers against claims of injury or damage caused by defects in their products, making it essential for companies producing micro-mobility devices. For businesses in the micro-mobility sector, combining both policies offers comprehensive risk management, but product liability insurance is crucial for legal protection and consumer trust.

Connection

Micro-mobility insurance and product liability insurance intersect through risk management for electric scooters, bikes, and shared mobility devices, covering damages or injuries caused by product defects or operational failures. Micro-mobility insurance specifically addresses liability and property damage for users and providers, while product liability insurance protects manufacturers and suppliers from claims related to defective design, manufacturing flaws, or inadequate warnings. Together, both insurances mitigate financial risks across the micro-mobility ecosystem by ensuring accountability from device creation to daily user operation.

Key Terms

**Product Liability Insurance:**

Product liability insurance protects manufacturers, distributors, and retailers from legal claims related to injuries or damages caused by defective products, covering costs such as legal fees, settlements, and verdicts. In contrast, micro-mobility insurance specifically addresses risks associated with shared electric scooters, bikes, and other small urban transport devices, often including liability for user accidents. Explore comprehensive coverage options and tailored policies to safeguard your business from product-related risks.

Manufacturer

Product liability insurance for manufacturers covers damages arising from defective products causing injury or property damage, crucial in micro-mobility sectors where electric scooters and bikes are prone to safety issues. Micro-mobility insurance, on the other hand, often extends coverage to operational risks, including theft, vandalism, and user accidents, but may not fully protect manufacturers from product-related claims. Explore detailed differences and tailored coverage options to ensure comprehensive protection for your manufacturing business.

Defective Product

Product liability insurance offers protection against claims resulting from defective products causing injury or damage, making it essential for manufacturers and retailers within the micro-mobility industry. Micro-mobility insurance specifically covers electric scooters, bikes, and other small vehicles, addressing unique risks such as accidents caused by product malfunctions or design flaws. Explore the differences and coverage options to ensure your micro-mobility business is fully protected against defective product claims.

Source and External Links

Product Liability Insurance Guide for Small Businesses - Product liability insurance protects businesses from legal claims and financial losses due to bodily injury or property damage caused by products they make, distribute, or repair, covering design defects, manufacturing flaws, marketing errors, and insufficient warnings.

Product Liability Insurance Explained - This insurance covers a business's liability for injuries or losses caused by defective products, including manufacturing defects, design defects, and defective warnings or instructions.

Product Liability Insurance - Progressive Commercial - Product liability insurance safeguards businesses against customer claims of harm, injury, or damage caused by products or services, covering medical costs, legal fees, and damage reimbursements, applicable even if the business was not directly responsible for the defect.

dowidth.com

dowidth.com