Micro-mobility insurance covers electric scooters, bikes, and other small urban vehicles, protecting riders against accidents, theft, and liability claims. Homeowners insurance safeguards residential property, providing coverage for damages, theft, and personal liability within the home. Explore in-depth comparisons to determine which insurance best fits your specific needs.

Why it is important

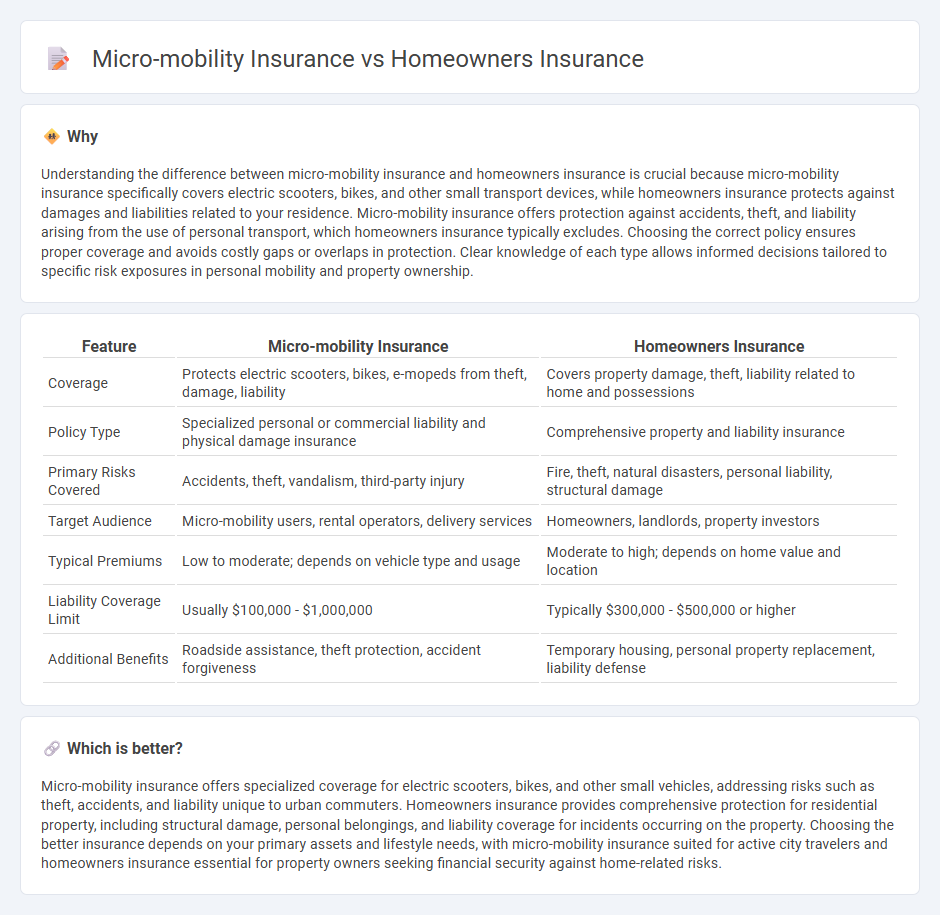

Understanding the difference between micro-mobility insurance and homeowners insurance is crucial because micro-mobility insurance specifically covers electric scooters, bikes, and other small transport devices, while homeowners insurance protects against damages and liabilities related to your residence. Micro-mobility insurance offers protection against accidents, theft, and liability arising from the use of personal transport, which homeowners insurance typically excludes. Choosing the correct policy ensures proper coverage and avoids costly gaps or overlaps in protection. Clear knowledge of each type allows informed decisions tailored to specific risk exposures in personal mobility and property ownership.

Comparison Table

| Feature | Micro-mobility Insurance | Homeowners Insurance |

|---|---|---|

| Coverage | Protects electric scooters, bikes, e-mopeds from theft, damage, liability | Covers property damage, theft, liability related to home and possessions |

| Policy Type | Specialized personal or commercial liability and physical damage insurance | Comprehensive property and liability insurance |

| Primary Risks Covered | Accidents, theft, vandalism, third-party injury | Fire, theft, natural disasters, personal liability, structural damage |

| Target Audience | Micro-mobility users, rental operators, delivery services | Homeowners, landlords, property investors |

| Typical Premiums | Low to moderate; depends on vehicle type and usage | Moderate to high; depends on home value and location |

| Liability Coverage Limit | Usually $100,000 - $1,000,000 | Typically $300,000 - $500,000 or higher |

| Additional Benefits | Roadside assistance, theft protection, accident forgiveness | Temporary housing, personal property replacement, liability defense |

Which is better?

Micro-mobility insurance offers specialized coverage for electric scooters, bikes, and other small vehicles, addressing risks such as theft, accidents, and liability unique to urban commuters. Homeowners insurance provides comprehensive protection for residential property, including structural damage, personal belongings, and liability coverage for incidents occurring on the property. Choosing the better insurance depends on your primary assets and lifestyle needs, with micro-mobility insurance suited for active city travelers and homeowners insurance essential for property owners seeking financial security against home-related risks.

Connection

Micro-mobility insurance and homeowners insurance intersect through coverage of personal liability and property protection, specifically when micro-mobility devices such as e-scooters or bikes are used on private property or stored at home. Both insurance types may provide liability coverage if a guest is injured by a micro-mobility device on the insured property. Integrating these policies helps ensure comprehensive protection against damages and accidents related to micro-mobility usage within the homeowner's environment.

Key Terms

Coverage Limits

Homeowners insurance typically provides limited or no coverage for micro-mobility devices such as e-scooters and e-bikes, with standard liability limits often insufficient for accident claims involving these vehicles. Micro-mobility insurance offers specialized policies that include higher coverage limits tailored to both personal injury and property damage specific to micro-mobility usage. Explore our detailed guide to understand how coverage limits differ and which policy best suits your micro-mobility risk management needs.

Personal Property

Homeowners insurance typically covers personal property such as furniture, electronics, and clothing against risks like theft, fire, or vandalism within the insured residence. Micro-mobility insurance, designed for devices like e-scooters and electric bikes, often includes coverage for theft, damage, and liability specific to these personal transport assets. Explore how tailored policies protect your valuable belongings and personal devices differently.

Liability Protection

Homeowners insurance primarily covers property damage and personal liability related to your residence, while micro-mobility insurance offers specialized liability protection for electric scooters, bikes, and other small urban vehicles. Liability coverage in micro-mobility insurance addresses accidents and injuries occurring during vehicle use, which homeowners policies typically exclude. Explore detailed comparisons to understand which insurance best safeguards your personal and micro-mobility risks.

Source and External Links

Homeowners Insurance - Online Quotes - Homeowners insurance protects your home and belongings against damage or loss, covering the dwelling, personal property, personal liability, and additional living expenses if you can't live in your home due to a covered event.

Homeowners Insurance - Get a Free Home Insurance Quote | GEICO - Homeowners insurance covers risks such as theft, fire, windstorm damage, frozen plumbing, and water damage, and typically is required by mortgage lenders though not legally mandated otherwise.

Homeowners Insurance: Get a Free Quote - Progressive - A homeowners policy can be personalized to protect your home's structure, belongings, living expenses if displaced, and liability for damages or injuries to others, with options to add coverage for high-value items.

dowidth.com

dowidth.com