Pre-existing condition coverage ensures individuals with prior health issues receive necessary insurance benefits without denial or exclusions, providing critical financial protection. Guaranteed issue policies offer coverage regardless of health status but often come with higher premiums and limited benefits compared to traditional plans. Explore the differences between these options to find the best insurance solution for your needs.

Why it is important

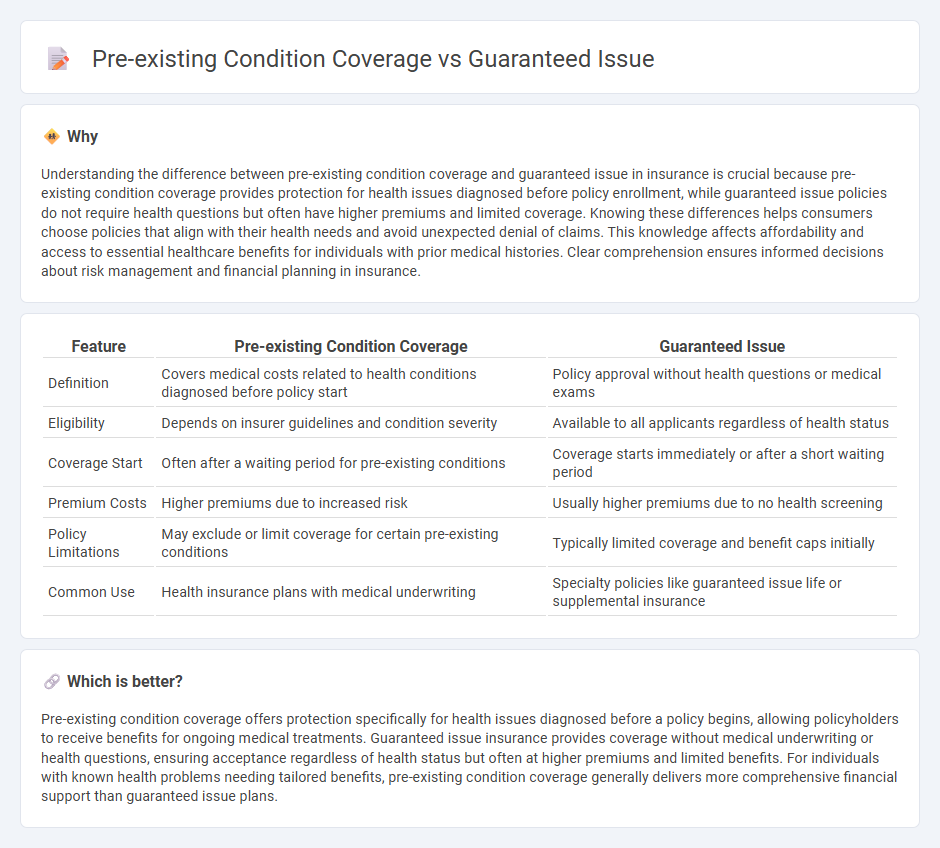

Understanding the difference between pre-existing condition coverage and guaranteed issue in insurance is crucial because pre-existing condition coverage provides protection for health issues diagnosed before policy enrollment, while guaranteed issue policies do not require health questions but often have higher premiums and limited coverage. Knowing these differences helps consumers choose policies that align with their health needs and avoid unexpected denial of claims. This knowledge affects affordability and access to essential healthcare benefits for individuals with prior medical histories. Clear comprehension ensures informed decisions about risk management and financial planning in insurance.

Comparison Table

| Feature | Pre-existing Condition Coverage | Guaranteed Issue |

|---|---|---|

| Definition | Covers medical costs related to health conditions diagnosed before policy start | Policy approval without health questions or medical exams |

| Eligibility | Depends on insurer guidelines and condition severity | Available to all applicants regardless of health status |

| Coverage Start | Often after a waiting period for pre-existing conditions | Coverage starts immediately or after a short waiting period |

| Premium Costs | Higher premiums due to increased risk | Usually higher premiums due to no health screening |

| Policy Limitations | May exclude or limit coverage for certain pre-existing conditions | Typically limited coverage and benefit caps initially |

| Common Use | Health insurance plans with medical underwriting | Specialty policies like guaranteed issue life or supplemental insurance |

Which is better?

Pre-existing condition coverage offers protection specifically for health issues diagnosed before a policy begins, allowing policyholders to receive benefits for ongoing medical treatments. Guaranteed issue insurance provides coverage without medical underwriting or health questions, ensuring acceptance regardless of health status but often at higher premiums and limited benefits. For individuals with known health problems needing tailored benefits, pre-existing condition coverage generally delivers more comprehensive financial support than guaranteed issue plans.

Connection

Pre-existing condition coverage ensures that individuals with prior health issues receive insurance benefits without denial or increased premiums. Guaranteed issue policies require insurers to offer coverage regardless of health history, directly supporting those with pre-existing conditions. Together, they provide comprehensive access to insurance for high-risk applicants, eliminating barriers related to health status.

Key Terms

Underwriting

Guaranteed issue insurance requires no medical underwriting, offering coverage regardless of health status or pre-existing conditions, which ensures approval for all applicants. Pre-existing condition coverage is often subject to underwriting, where insurers assess medical history to determine eligibility, premiums, and exclusions. Explore how underwriting impacts policy options and benefits to make informed choices.

Waiting period

Guaranteed issue policies provide coverage without medical underwriting, often with a waiting period ranging from 6 to 12 months before benefits fully apply, whereas pre-existing condition coverage in health insurance plans typically involves a waiting period designed to prevent immediate claims related to past illnesses, usually lasting 12 months. Waiting periods protect insurers from adverse selection but can temporarily limit access to benefits, impacting policyholders seeking immediate treatment for pre-existing conditions. Explore detailed comparisons and insights on waiting periods in guaranteed issue versus pre-existing condition coverage to make informed decisions.

Exclusions

Guaranteed issue health insurance policies typically do not require medical underwriting and accept all applicants regardless of health history, but they often exclude coverage for pre-existing conditions during an initial waiting period. Pre-existing condition coverage can vary by state and plan, with some policies imposing specific limitations or exclusion periods before coverage begins for those conditions. Explore detailed comparisons and policy specifics to understand how exclusions impact your health insurance options.

Source and External Links

What is guaranteed issue? - Guaranteed issue means health insurance must be offered to any applicant regardless of health status, age, or medical history, a requirement implemented broadly by the Affordable Care Act in 2014 with enrollment limited to specific periods.

Guaranteed issue - Guaranteed issue is the requirement that health insurance policies be sold to all eligible applicants without regard to health conditions, widely established under the ACA to ensure access for people with pre-existing conditions.

What is Guaranteed Issue in Health Insurance? - Guaranteed issue policies eliminate medical underwriting for major individual health plans, allowing anyone to enroll during restricted enrollment periods to prevent adverse selection and "death spirals" in insurance markets.

dowidth.com

dowidth.com