Cyber risk insurance provides coverage against data breaches, cyberattacks, and other technology-related threats, protecting businesses from financial losses and reputational damage. Professional liability insurance, also known as errors and omissions insurance, safeguards professionals against claims of negligence, malpractice, or mistakes in delivering their services. Explore the key differences and benefits of each insurance type to determine the best protection for your business needs.

Why it is important

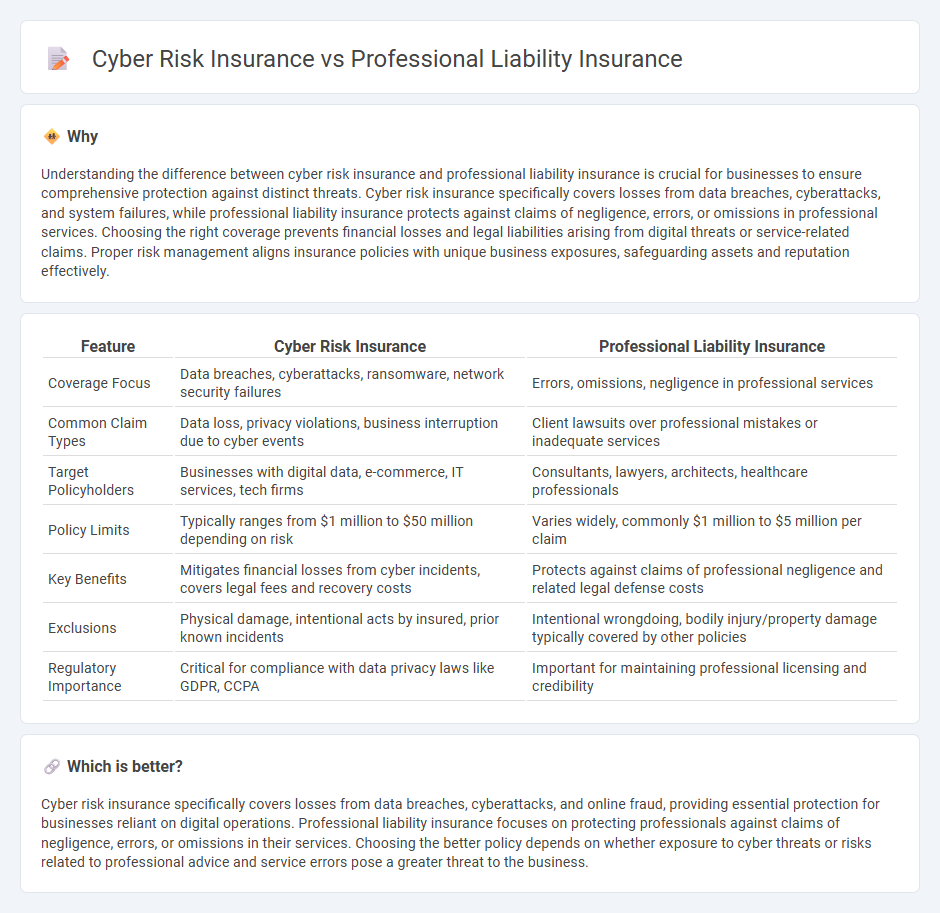

Understanding the difference between cyber risk insurance and professional liability insurance is crucial for businesses to ensure comprehensive protection against distinct threats. Cyber risk insurance specifically covers losses from data breaches, cyberattacks, and system failures, while professional liability insurance protects against claims of negligence, errors, or omissions in professional services. Choosing the right coverage prevents financial losses and legal liabilities arising from digital threats or service-related claims. Proper risk management aligns insurance policies with unique business exposures, safeguarding assets and reputation effectively.

Comparison Table

| Feature | Cyber Risk Insurance | Professional Liability Insurance |

|---|---|---|

| Coverage Focus | Data breaches, cyberattacks, ransomware, network security failures | Errors, omissions, negligence in professional services |

| Common Claim Types | Data loss, privacy violations, business interruption due to cyber events | Client lawsuits over professional mistakes or inadequate services |

| Target Policyholders | Businesses with digital data, e-commerce, IT services, tech firms | Consultants, lawyers, architects, healthcare professionals |

| Policy Limits | Typically ranges from $1 million to $50 million depending on risk | Varies widely, commonly $1 million to $5 million per claim |

| Key Benefits | Mitigates financial losses from cyber incidents, covers legal fees and recovery costs | Protects against claims of professional negligence and related legal defense costs |

| Exclusions | Physical damage, intentional acts by insured, prior known incidents | Intentional wrongdoing, bodily injury/property damage typically covered by other policies |

| Regulatory Importance | Critical for compliance with data privacy laws like GDPR, CCPA | Important for maintaining professional licensing and credibility |

Which is better?

Cyber risk insurance specifically covers losses from data breaches, cyberattacks, and online fraud, providing essential protection for businesses reliant on digital operations. Professional liability insurance focuses on protecting professionals against claims of negligence, errors, or omissions in their services. Choosing the better policy depends on whether exposure to cyber threats or risks related to professional advice and service errors pose a greater threat to the business.

Connection

Cyber risk insurance and professional liability insurance intersect by addressing financial protection against technology-related errors and data breaches impacting professional services. Both policies mitigate risks from negligence, data loss, and cyberattacks, with cyber risk coverage specializing in electronic threats while professional liability insurance focuses on service errors or omissions. Companies leveraging digital tools benefit from combined coverage to safeguard against legal liabilities and cybersecurity incidents.

Key Terms

**Professional Liability Insurance:**

Professional liability insurance, also known as errors and omissions (E&O) insurance, protects businesses against claims of negligence, misrepresentation, or mistakes in professional services provided. It covers legal fees, settlements, and damages resulting from lawsuits related to professional errors or failures to deliver services as promised. Discover how professional liability insurance safeguards your practice and learn about its essential features.

Errors and Omissions (E&O)

Professional liability insurance, also known as Errors and Omissions (E&O) insurance, specifically covers claims related to negligence, mistakes, or failure to perform professional services, protecting businesses like consultants and legal advisors. Cyber risk insurance addresses data breaches, cyberattacks, and other technology-related losses, providing cover for damages related to information security and privacy violations. Explore further to understand which insurance best suits your business's risk profile and operational requirements.

Negligence

Professional liability insurance covers claims arising from negligence, errors, or omissions in the delivery of professional services, protecting against financial losses due to lawsuits. Cyber risk insurance specifically addresses losses from cyber incidents such as data breaches, hacking, and negligence in safeguarding digital information. Explore the key differences and coverage details to choose the right protection for your business.

Source and External Links

Professional Liability Insurance for Small Businesses | Hiscox - Provides protection against claims related to negligence or mistakes made during professional services, covering various industries like engineering and medical billing.

Professional Liability Insurance - Get Online Quotes | Insureon - Offers financial protection against client lawsuits over unsatisfactory work, covering mistakes, omissions, and ineffective advice.

Professional Liability Insurance ~ Get a Free Quote | GEICO - Covers professionals and businesses against claims of mistakes or negligence, applicable to various sectors including beauticians and IT consultants.

dowidth.com

dowidth.com