Crop microinsurance offers protection against losses caused by adverse weather events, pests, and diseases affecting agricultural yields, ensuring financial stability for smallholder farmers. Livestock microinsurance provides coverage for risks such as animal death, disease outbreaks, and theft, helping pastoralists sustain their livelihoods. Explore the key differences and benefits of crop and livestock microinsurance to safeguard your agricultural investments effectively.

Why it is important

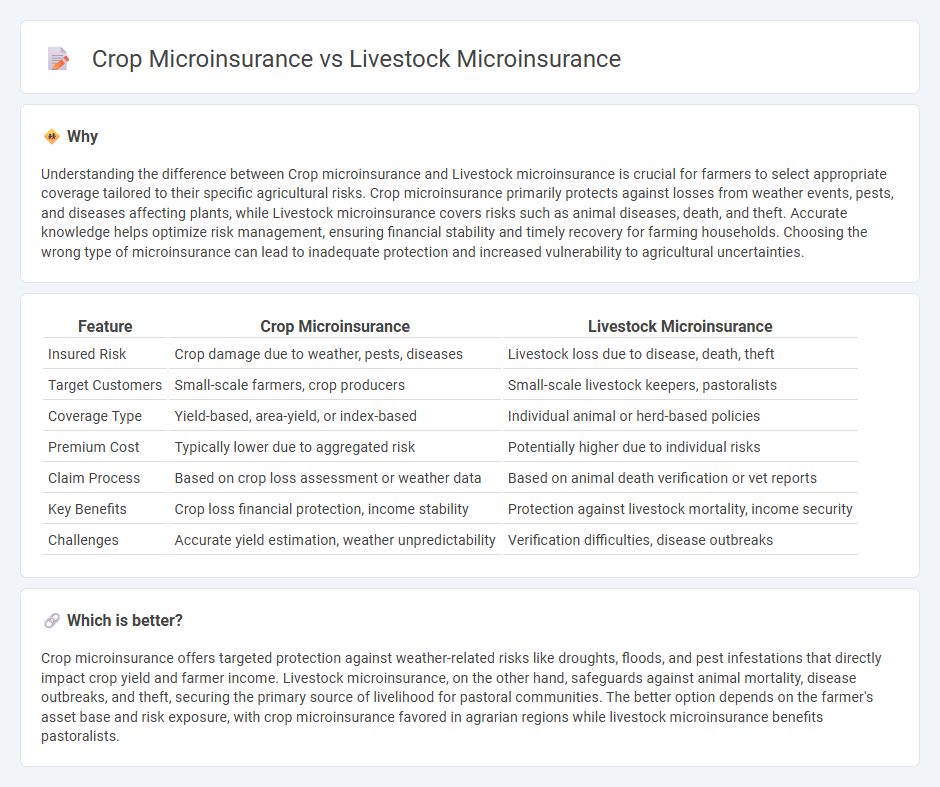

Understanding the difference between Crop microinsurance and Livestock microinsurance is crucial for farmers to select appropriate coverage tailored to their specific agricultural risks. Crop microinsurance primarily protects against losses from weather events, pests, and diseases affecting plants, while Livestock microinsurance covers risks such as animal diseases, death, and theft. Accurate knowledge helps optimize risk management, ensuring financial stability and timely recovery for farming households. Choosing the wrong type of microinsurance can lead to inadequate protection and increased vulnerability to agricultural uncertainties.

Comparison Table

| Feature | Crop Microinsurance | Livestock Microinsurance |

|---|---|---|

| Insured Risk | Crop damage due to weather, pests, diseases | Livestock loss due to disease, death, theft |

| Target Customers | Small-scale farmers, crop producers | Small-scale livestock keepers, pastoralists |

| Coverage Type | Yield-based, area-yield, or index-based | Individual animal or herd-based policies |

| Premium Cost | Typically lower due to aggregated risk | Potentially higher due to individual risks |

| Claim Process | Based on crop loss assessment or weather data | Based on animal death verification or vet reports |

| Key Benefits | Crop loss financial protection, income stability | Protection against livestock mortality, income security |

| Challenges | Accurate yield estimation, weather unpredictability | Verification difficulties, disease outbreaks |

Which is better?

Crop microinsurance offers targeted protection against weather-related risks like droughts, floods, and pest infestations that directly impact crop yield and farmer income. Livestock microinsurance, on the other hand, safeguards against animal mortality, disease outbreaks, and theft, securing the primary source of livelihood for pastoral communities. The better option depends on the farmer's asset base and risk exposure, with crop microinsurance favored in agrarian regions while livestock microinsurance benefits pastoralists.

Connection

Crop microinsurance and livestock microinsurance are interconnected components of agricultural risk management that protect smallholder farmers against losses due to adverse weather, pests, and diseases. Both insurance types enhance financial resilience by providing indemnity payments that stabilize farmers' incomes and secure food production. Integrating these microinsurance products supports comprehensive coverage of farming enterprises, promoting sustainable agricultural livelihoods and rural economic development.

Key Terms

**Livestock Microinsurance:**

Livestock microinsurance protects farmers against financial losses caused by the death, disease, or theft of animals, ensuring income stability for smallholder livestock producers. It covers essential species such as cattle, goats, sheep, and poultry, addressing risks specific to animal husbandry like epidemics and natural disasters. Explore the benefits and tailored solutions of livestock microinsurance to safeguard your agricultural investments.

Mortality Cover

Livestock microinsurance primarily provides mortality cover to protect farmers against losses from animal deaths due to diseases, accidents, or natural disasters, ensuring financial stability for pastoral communities. Crop microinsurance, while covering yield losses, typically emphasizes damage from weather events, pests, and diseases rather than direct mortality, highlighting distinct risk profiles and coverage structures. Explore our detailed comparison to understand which microinsurance solution best safeguards your agricultural investments.

Veterinary Services

Livestock microinsurance primarily covers risks related to animal health, including access to veterinary services, disease treatment, and mortality compensation, ensuring farmers maintain productive herds. Crop microinsurance focuses on covering losses from adverse weather events and pests, with less emphasis on veterinary care but often includes agronomic advisory services. Explore how integrating specialized veterinary support in livestock microinsurance can enhance financial security for farmers.

Source and External Links

Livestock Insurance - Pula Advisors - Pula Advisors offers Index-Based Livestock Insurance (IBLI) protecting pastoralists from livestock loss due to drought or insufficient rangelands, using satellite data to trigger payouts for timely risk mitigation.

Microinsurance for Risk Mitigation and Crisis Recovery - CAS - Livestock microinsurance is used especially in rural microfinance contexts (e.g., Grameen Bank in Bangladesh, SHG partnerships in India) to insure animals financed by loans, covering accidental and natural death risks but faces challenges like high costs and limited capacity.

Livestock microinsurance - Radiant Yacu - This livestock microinsurance policy covers indigenous, crossbred, and exotic cattle, pigs, and poultry against accidental death, epidemics, and natural disasters during a one-year contract, administered under Rwanda's National Agricultural Insurance Scheme.

dowidth.com

dowidth.com