Pandemic business interruption insurance provides coverage for lost income and expenses when a business is forced to halt operations due to a pandemic-related event, helping to mitigate financial risks from government-mandated closures or supply chain disruptions. Trade credit insurance protects businesses against non-payment of commercial debts, ensuring cash flow stability by covering losses from customer insolvency or failure to pay. Explore the key differences and benefits of each policy to safeguard your business effectively.

Why it is important

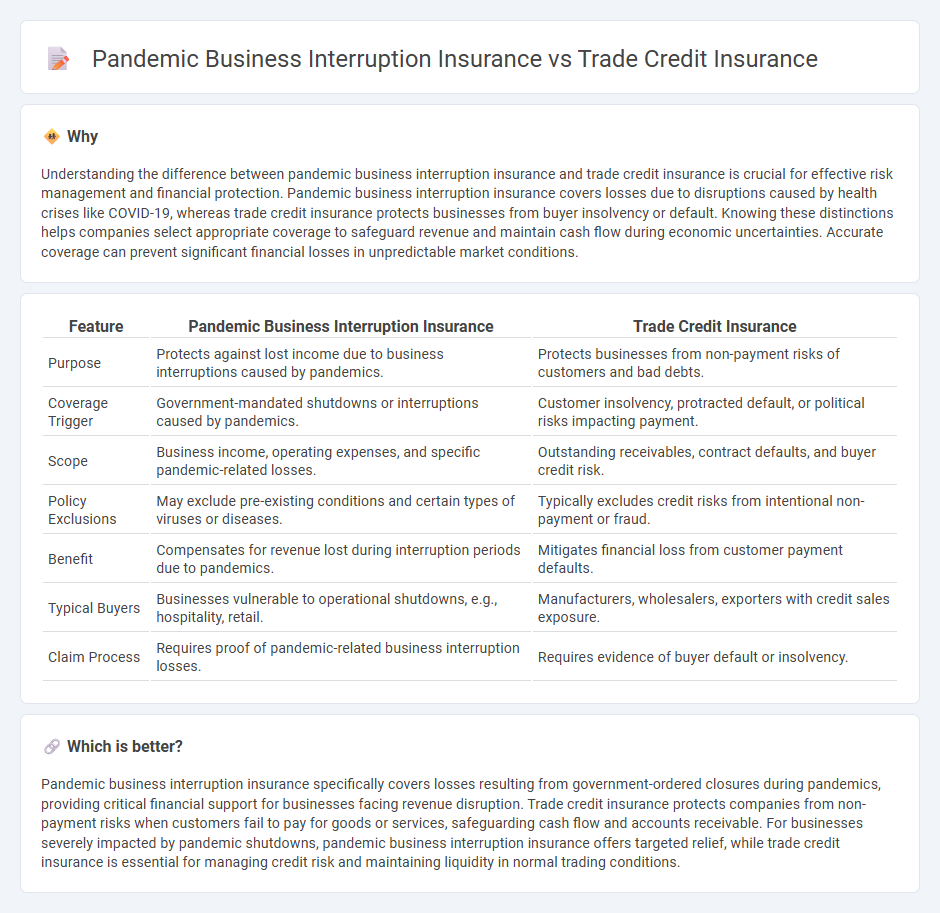

Understanding the difference between pandemic business interruption insurance and trade credit insurance is crucial for effective risk management and financial protection. Pandemic business interruption insurance covers losses due to disruptions caused by health crises like COVID-19, whereas trade credit insurance protects businesses from buyer insolvency or default. Knowing these distinctions helps companies select appropriate coverage to safeguard revenue and maintain cash flow during economic uncertainties. Accurate coverage can prevent significant financial losses in unpredictable market conditions.

Comparison Table

| Feature | Pandemic Business Interruption Insurance | Trade Credit Insurance |

|---|---|---|

| Purpose | Protects against lost income due to business interruptions caused by pandemics. | Protects businesses from non-payment risks of customers and bad debts. |

| Coverage Trigger | Government-mandated shutdowns or interruptions caused by pandemics. | Customer insolvency, protracted default, or political risks impacting payment. |

| Scope | Business income, operating expenses, and specific pandemic-related losses. | Outstanding receivables, contract defaults, and buyer credit risk. |

| Policy Exclusions | May exclude pre-existing conditions and certain types of viruses or diseases. | Typically excludes credit risks from intentional non-payment or fraud. |

| Benefit | Compensates for revenue lost during interruption periods due to pandemics. | Mitigates financial loss from customer payment defaults. |

| Typical Buyers | Businesses vulnerable to operational shutdowns, e.g., hospitality, retail. | Manufacturers, wholesalers, exporters with credit sales exposure. |

| Claim Process | Requires proof of pandemic-related business interruption losses. | Requires evidence of buyer default or insolvency. |

Which is better?

Pandemic business interruption insurance specifically covers losses resulting from government-ordered closures during pandemics, providing critical financial support for businesses facing revenue disruption. Trade credit insurance protects companies from non-payment risks when customers fail to pay for goods or services, safeguarding cash flow and accounts receivable. For businesses severely impacted by pandemic shutdowns, pandemic business interruption insurance offers targeted relief, while trade credit insurance is essential for managing credit risk and maintaining liquidity in normal trading conditions.

Connection

Pandemic business interruption insurance and trade credit insurance both provide financial protection against disruptions caused by widespread crises, such as global pandemics. Business interruption insurance covers loss of income from halted operations due to government-mandated closures, while trade credit insurance safeguards companies against non-payment risks by customers facing economic hardships during such events. Together, these insurance types help businesses manage cash flow risks and maintain financial stability amid pandemic-induced uncertainties.

Key Terms

**Trade Credit Insurance:**

Trade credit insurance protects businesses from losses due to customers' non-payment of commercial debts, ensuring cash flow stability and minimizing financial risks during economic uncertainties. It covers insolvency, protracted default, and political risks affecting receivables, making it essential for companies engaged in domestic and international trade. Discover how trade credit insurance can safeguard your business from credit risk exposure and enhance financial resilience.

Buyer Default

Trade credit insurance primarily protects businesses against buyer default, ensuring compensation if customers fail to pay outstanding invoices due to insolvency or extended payment delays. Pandemic business interruption insurance, however, covers losses from operational shutdowns caused by virus outbreaks but typically excludes buyer default risks linked to pandemics. Explore further to understand how these policies uniquely safeguard your business from different financial threats.

Credit Limit

Trade credit insurance provides coverage by protecting businesses against the risk of customers failing to pay trade invoices, with a focus on securing a credit limit based on customers' creditworthiness and payment history. Pandemic business interruption insurance differs by covering revenue losses during disruptions such as pandemics, but typically does not offer a credit limit feature tied to customer payment risks. Explore further to understand which insurance best safeguards your business's financial exposure during different types of risks.

Source and External Links

Everything You Need to Know About Trade Credit Insurance - Trade credit insurance protects businesses from losses due to buyer non-payment by compensating for unpaid invoices, with coverage amounts and premiums based on receivables and buyer risk profiles.

Trade Credit Insurance in a nutshell - Coface - Trade credit insurance is a credit risk management tool that covers losses from late payments, customer insolvency, and political risks, while also providing business information and debt collection services.

Trade Credit Insurance | Allianz Trade US - Trade credit insurance safeguards accounts receivable, allowing businesses to extend credit and grow domestically and internationally without the risk of bad debt from customer defaults or insolvency.

dowidth.com

dowidth.com