Reciprocal insurance involves a group of individuals who exchange insurance contracts and share risks directly among members, often managed by an attorney-in-fact. Mutual insurance companies, owned by policyholders, pool premiums to provide coverage and distribute profits back to members as dividends or reduced future premiums. Explore the nuances and benefits of each insurance model to determine which suits your risk management needs.

Why it is important

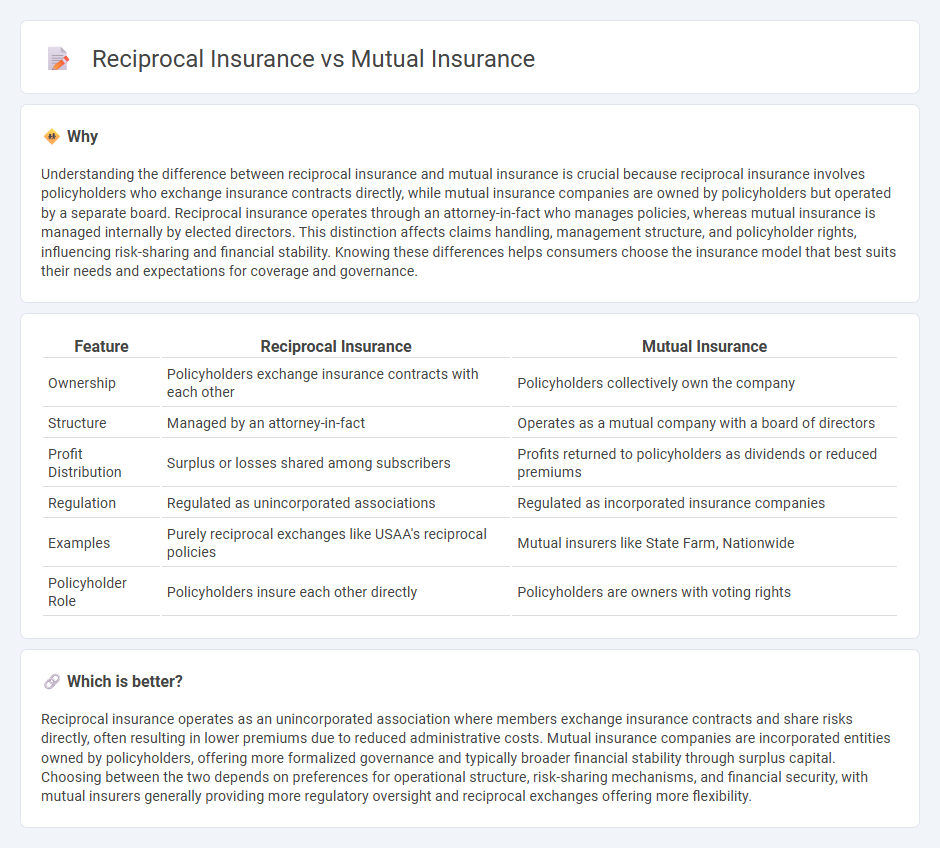

Understanding the difference between reciprocal insurance and mutual insurance is crucial because reciprocal insurance involves policyholders who exchange insurance contracts directly, while mutual insurance companies are owned by policyholders but operated by a separate board. Reciprocal insurance operates through an attorney-in-fact who manages policies, whereas mutual insurance is managed internally by elected directors. This distinction affects claims handling, management structure, and policyholder rights, influencing risk-sharing and financial stability. Knowing these differences helps consumers choose the insurance model that best suits their needs and expectations for coverage and governance.

Comparison Table

| Feature | Reciprocal Insurance | Mutual Insurance |

|---|---|---|

| Ownership | Policyholders exchange insurance contracts with each other | Policyholders collectively own the company |

| Structure | Managed by an attorney-in-fact | Operates as a mutual company with a board of directors |

| Profit Distribution | Surplus or losses shared among subscribers | Profits returned to policyholders as dividends or reduced premiums |

| Regulation | Regulated as unincorporated associations | Regulated as incorporated insurance companies |

| Examples | Purely reciprocal exchanges like USAA's reciprocal policies | Mutual insurers like State Farm, Nationwide |

| Policyholder Role | Policyholders insure each other directly | Policyholders are owners with voting rights |

Which is better?

Reciprocal insurance operates as an unincorporated association where members exchange insurance contracts and share risks directly, often resulting in lower premiums due to reduced administrative costs. Mutual insurance companies are incorporated entities owned by policyholders, offering more formalized governance and typically broader financial stability through surplus capital. Choosing between the two depends on preferences for operational structure, risk-sharing mechanisms, and financial security, with mutual insurers generally providing more regulatory oversight and reciprocal exchanges offering more flexibility.

Connection

Reciprocal insurance and mutual insurance are connected through their foundational principle of policyholder ownership, where members pool resources to share risk and provide coverage. Both structures emphasize cooperative risk management, with reciprocal insurance operating through exchanges managed by an attorney-in-fact, while mutual insurance is governed by a formal mutual company framework. This alignment in member-driven risk sharing creates a synergy in promoting policyholder benefits and financial stability within the insurance industry.

Key Terms

Ownership structure

Mutual insurance companies are owned by policyholders who share in the profits and governance through voting rights, while reciprocal insurance exchanges operate through a group of subscribers who mutually insure each other under attorney-in-fact management. The ownership structure in mutual insurance is more formalized with a board of directors representing policyholder interests, whereas reciprocal insurance relies on a less centralized, contract-based framework for risk sharing among members. Explore further to understand how these distinct ownership models impact policyholder control and financial outcomes.

Policyholder participation

Mutual insurance companies are owned by policyholders who share profits through dividends and participate in governance decisions, reinforcing their financial stake. Reciprocal insurance exchanges operate through subscribers who exchange insurance contracts and are managed by an attorney-in-fact, emphasizing shared risk without direct profit distribution. Explore further to understand how policyholder participation shapes these distinct insurance structures.

Risk-sharing mechanism

Mutual insurance operates with policyholders as members who collectively share risks and profits, managed by a board elected from within the membership. Reciprocal insurance involves subscribers agreeing to mutually indemnify losses among themselves, facilitated by an attorney-in-fact who oversees operations. Explore the distinct mechanisms and benefits of each risk-sharing model to understand which suits your needs best.

Source and External Links

Mutual Insurance - Mutual insurance companies are owned entirely by their policyholders, distributing profits through dividends or reduced premiums.

Amica Mutual Insurance - Amica Mutual Insurance provides auto, home, and life insurance with a focus on customer service and empathy since 1907.

Nationwide - Started as a mutual auto insurance company, Nationwide now offers a wide range of insurance and financial services across various sectors.

dowidth.com

dowidth.com