Micro-mobility insurance offers specialized coverage for electric scooters, bikes, and other small personal transport devices, protecting riders against theft, damage, and liability risks common in urban environments. Personal accident insurance provides financial compensation for injuries, disability, or death resulting from accidents, covering medical expenses and loss of income regardless of the accident context. Explore more to understand which insurance best suits your mobility and personal safety needs.

Why it is important

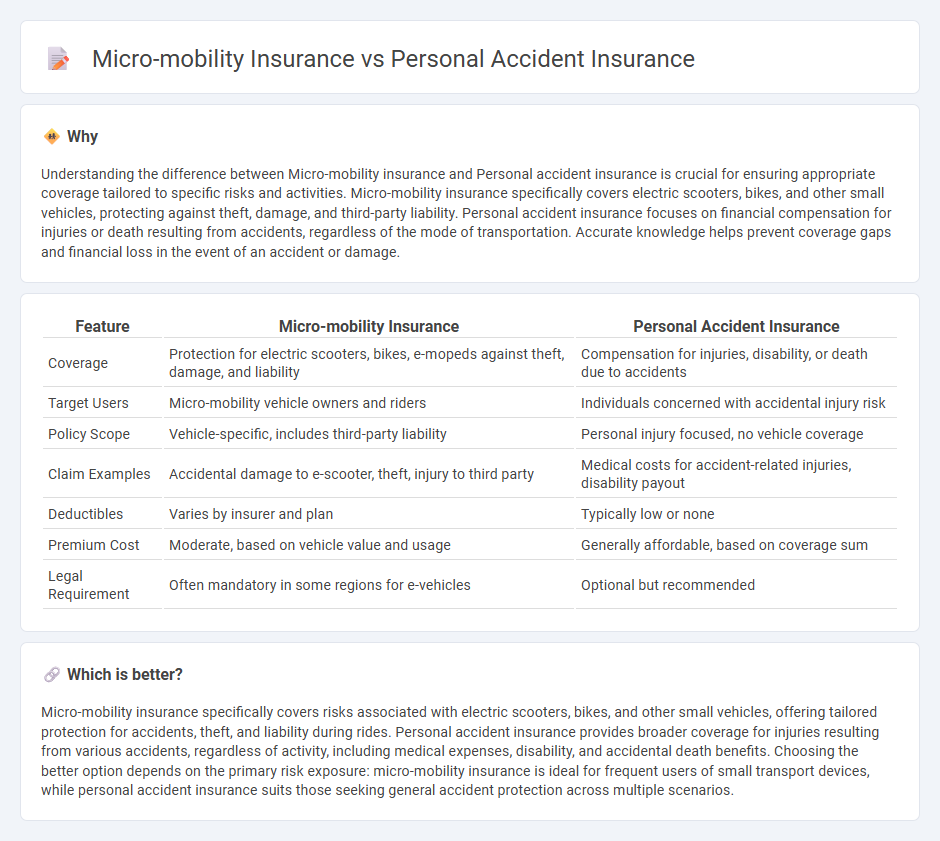

Understanding the difference between Micro-mobility insurance and Personal accident insurance is crucial for ensuring appropriate coverage tailored to specific risks and activities. Micro-mobility insurance specifically covers electric scooters, bikes, and other small vehicles, protecting against theft, damage, and third-party liability. Personal accident insurance focuses on financial compensation for injuries or death resulting from accidents, regardless of the mode of transportation. Accurate knowledge helps prevent coverage gaps and financial loss in the event of an accident or damage.

Comparison Table

| Feature | Micro-mobility Insurance | Personal Accident Insurance |

|---|---|---|

| Coverage | Protection for electric scooters, bikes, e-mopeds against theft, damage, and liability | Compensation for injuries, disability, or death due to accidents |

| Target Users | Micro-mobility vehicle owners and riders | Individuals concerned with accidental injury risk |

| Policy Scope | Vehicle-specific, includes third-party liability | Personal injury focused, no vehicle coverage |

| Claim Examples | Accidental damage to e-scooter, theft, injury to third party | Medical costs for accident-related injuries, disability payout |

| Deductibles | Varies by insurer and plan | Typically low or none |

| Premium Cost | Moderate, based on vehicle value and usage | Generally affordable, based on coverage sum |

| Legal Requirement | Often mandatory in some regions for e-vehicles | Optional but recommended |

Which is better?

Micro-mobility insurance specifically covers risks associated with electric scooters, bikes, and other small vehicles, offering tailored protection for accidents, theft, and liability during rides. Personal accident insurance provides broader coverage for injuries resulting from various accidents, regardless of activity, including medical expenses, disability, and accidental death benefits. Choosing the better option depends on the primary risk exposure: micro-mobility insurance is ideal for frequent users of small transport devices, while personal accident insurance suits those seeking general accident protection across multiple scenarios.

Connection

Micro-mobility insurance and personal accident insurance both provide financial protection against injuries sustained from urban transportation methods like e-scooters and bicycles. Personal accident insurance covers medical expenses and loss of income due to accidents, while micro-mobility insurance specifically addresses risks associated with short-distance travel devices. Integrating these policies enhances safety net benefits by addressing the unique hazards of micro-mobility alongside standard accident coverage.

Key Terms

Personal accident insurance:

Personal accident insurance provides financial protection against injuries, disability, or death resulting from accidents, covering medical expenses, loss of income, and rehabilitation costs. It typically applies broadly to various accident scenarios, unlike micro-mobility insurance which specifically insures risks related to electric scooters, bicycles, and other small personal transport devices. Explore comprehensive options and benefits of personal accident insurance to secure your financial safety effectively.

Accidental Death Benefit

Personal accident insurance covers accidental death and provides a fixed sum assured to beneficiaries regardless of the accident context, offering broad protection for unforeseen events. Micro-mobility insurance specifically targets users of devices like e-scooters and bikes, focusing on accidents during their use and often includes tailored accidental death benefits relevant to micro-mobility risks. Explore more to understand which policy best suits your lifestyle and safety needs.

Permanent Disability Cover

Personal accident insurance provides broad coverage for permanent disability resulting from various accidents, including workplace and home incidents. Micro-mobility insurance specifically targets injuries sustained through devices like e-scooters and bicycles, often offering tailored permanent disability benefits reflecting the unique risks of urban transport. Explore how each option safeguards your financial future after a disabling event in micro-mobility contexts.

Source and External Links

Personal Accident Insurance - Provides coverage for accidents, including death, disability, and medical expenses, offering financial support during recovery.

Personal Accident Insurance - Offers additional financial protection against serious injuries or death from accidents, providing benefits both on and off the job.

Accident Insurance - Provides benefits for covered accidental injuries, helping with extra expenses like medical bills and daily living costs.

dowidth.com

dowidth.com