Drone insurance provides coverage tailored to protect unmanned aerial vehicles from risks such as crashes, theft, and liability claims, ensuring operators can recover financial losses and comply with regulatory requirements. Credit insurance safeguards businesses against potential non-payment of debts by customers, reducing financial risk and improving cash flow stability. Explore the key differences in coverage, benefits, and applications to determine which insurance best fits your needs.

Why it is important

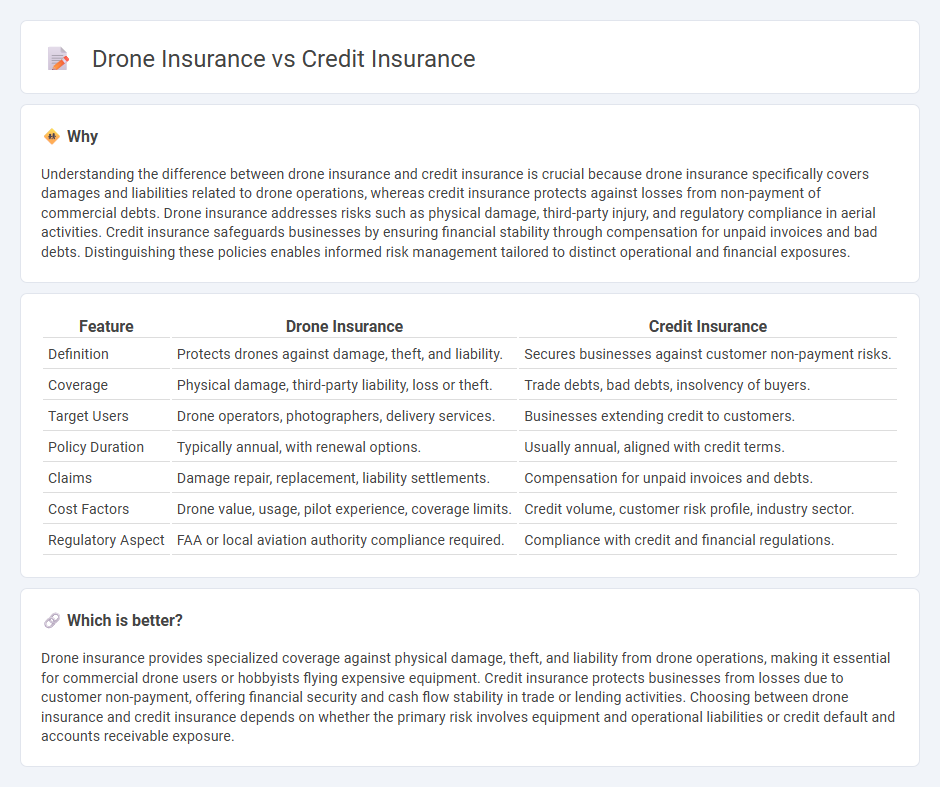

Understanding the difference between drone insurance and credit insurance is crucial because drone insurance specifically covers damages and liabilities related to drone operations, whereas credit insurance protects against losses from non-payment of commercial debts. Drone insurance addresses risks such as physical damage, third-party injury, and regulatory compliance in aerial activities. Credit insurance safeguards businesses by ensuring financial stability through compensation for unpaid invoices and bad debts. Distinguishing these policies enables informed risk management tailored to distinct operational and financial exposures.

Comparison Table

| Feature | Drone Insurance | Credit Insurance |

|---|---|---|

| Definition | Protects drones against damage, theft, and liability. | Secures businesses against customer non-payment risks. |

| Coverage | Physical damage, third-party liability, loss or theft. | Trade debts, bad debts, insolvency of buyers. |

| Target Users | Drone operators, photographers, delivery services. | Businesses extending credit to customers. |

| Policy Duration | Typically annual, with renewal options. | Usually annual, aligned with credit terms. |

| Claims | Damage repair, replacement, liability settlements. | Compensation for unpaid invoices and debts. |

| Cost Factors | Drone value, usage, pilot experience, coverage limits. | Credit volume, customer risk profile, industry sector. |

| Regulatory Aspect | FAA or local aviation authority compliance required. | Compliance with credit and financial regulations. |

Which is better?

Drone insurance provides specialized coverage against physical damage, theft, and liability from drone operations, making it essential for commercial drone users or hobbyists flying expensive equipment. Credit insurance protects businesses from losses due to customer non-payment, offering financial security and cash flow stability in trade or lending activities. Choosing between drone insurance and credit insurance depends on whether the primary risk involves equipment and operational liabilities or credit default and accounts receivable exposure.

Connection

Drone insurance and credit insurance intersect through risk management strategies that protect businesses from potential financial losses. Drone insurance covers liabilities and damages arising from drone operations, while credit insurance safeguards against unpaid debts, ensuring business continuity and financial stability. Both types of insurance support operational resilience by mitigating distinct but complementary risks in technology-driven commercial environments.

Key Terms

Credit Insurance:

Credit insurance protects businesses from losses due to customers' non-payment of invoices, safeguarding cash flow and reducing credit risk exposure. It covers various trade receivables, ensuring financial stability in uncertain markets and facilitating easier access to financing and improved business planning. Explore more about how credit insurance can secure your business's financial future.

Accounts Receivable

Credit insurance protects accounts receivable by covering potential losses from customer defaults, ensuring businesses maintain cash flow despite non-payment risks. Drone insurance differs by safeguarding the physical assets and liability of drone operations rather than focusing on financial receivables. Discover more about how each insurance type secures your business's financial stability.

Default Risk

Credit insurance mitigates default risk by protecting lenders against borrower non-payment, ensuring financial stability in receivables management. Drone insurance primarily covers physical damage, theft, and liability risks, with limited focus on default risk in commercial drone operations. Discover the nuances of risk protection strategies tailored to credit and drone industries to enhance your risk management approach.

Source and External Links

credit insurance | Wex | US Law | LII / Legal Information Institute - Credit insurance is a policy purchased by borrowers to protect lenders from loss if the borrower becomes insolvent, disabled, deceased, or unemployed, and it includes types like credit life, disability, unemployment, personal property, and trade credit insurance, with payments made directly to the lender.

What Is Credit Insurance? - NerdWallet - Credit insurance is an optional policy covering loan or credit payments if the borrower cannot pay due to death, disability, or unemployment, with four main types: credit life, involuntary unemployment, disability, and property insurance protecting the lender's interest.

Credit insurance | Office of the Insurance Commissioner - Credit insurance pays the lender on loans or credit accounts if the borrower dies, becomes disabled, or loses their job, but costs can be high and it is voluntary, not a loan requirement, with types like life, disability, involuntary unemployment, and property protection insurance.

dowidth.com

dowidth.com