Silent cyber coverage addresses gaps in traditional insurance policies by covering cyber risks that are not explicitly excluded or named, providing broader protection against emerging digital threats. Named peril coverage, on the other hand, limits protection to specific cyber incidents explicitly listed in the policy, potentially leaving significant exposures unaddressed. Explore the differences in coverage scope and risk management strategies to determine which option best suits your organization's cybersecurity needs.

Why it is important

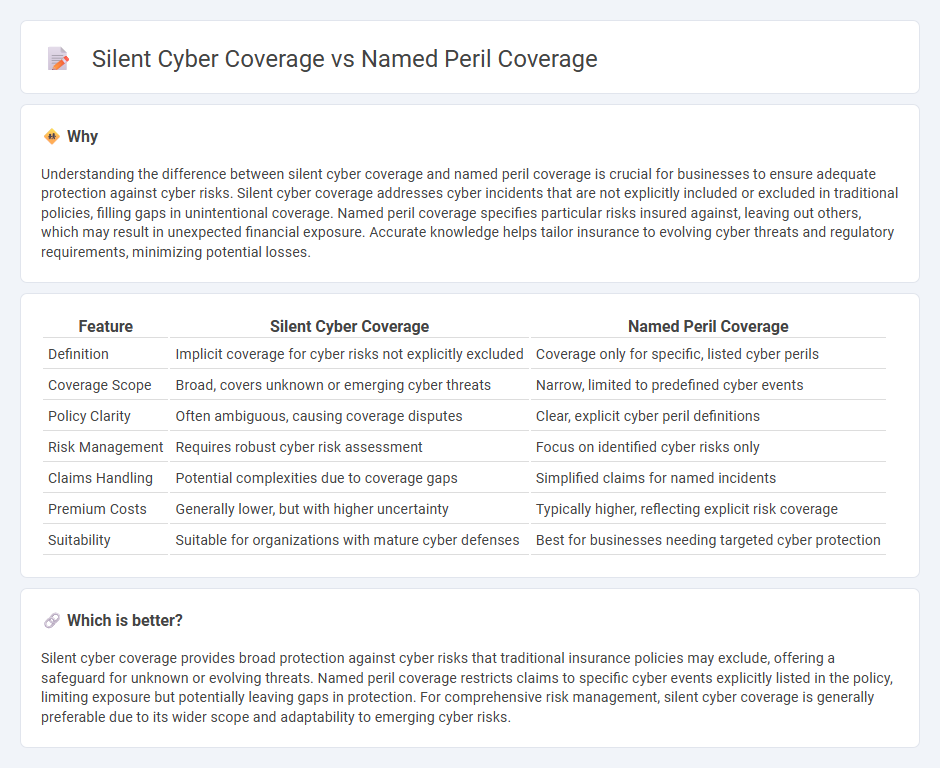

Understanding the difference between silent cyber coverage and named peril coverage is crucial for businesses to ensure adequate protection against cyber risks. Silent cyber coverage addresses cyber incidents that are not explicitly included or excluded in traditional policies, filling gaps in unintentional coverage. Named peril coverage specifies particular risks insured against, leaving out others, which may result in unexpected financial exposure. Accurate knowledge helps tailor insurance to evolving cyber threats and regulatory requirements, minimizing potential losses.

Comparison Table

| Feature | Silent Cyber Coverage | Named Peril Coverage |

|---|---|---|

| Definition | Implicit coverage for cyber risks not explicitly excluded | Coverage only for specific, listed cyber perils |

| Coverage Scope | Broad, covers unknown or emerging cyber threats | Narrow, limited to predefined cyber events |

| Policy Clarity | Often ambiguous, causing coverage disputes | Clear, explicit cyber peril definitions |

| Risk Management | Requires robust cyber risk assessment | Focus on identified cyber risks only |

| Claims Handling | Potential complexities due to coverage gaps | Simplified claims for named incidents |

| Premium Costs | Generally lower, but with higher uncertainty | Typically higher, reflecting explicit risk coverage |

| Suitability | Suitable for organizations with mature cyber defenses | Best for businesses needing targeted cyber protection |

Which is better?

Silent cyber coverage provides broad protection against cyber risks that traditional insurance policies may exclude, offering a safeguard for unknown or evolving threats. Named peril coverage restricts claims to specific cyber events explicitly listed in the policy, limiting exposure but potentially leaving gaps in protection. For comprehensive risk management, silent cyber coverage is generally preferable due to its wider scope and adaptability to emerging cyber risks.

Connection

Silent cyber coverage addresses cyber risks not explicitly listed in traditional insurance policies, filling gaps left by named peril coverage, which only protects against specified threats. Named peril coverage excludes many cyber-related incidents by default, making silent cyber coverage essential for comprehensive risk management. Integrating both ensures businesses protect against a broader spectrum of cyber risks, including those unforeseen or emerging in the digital landscape.

Key Terms

Specific Perils

Named peril coverage specifically protects against losses caused by explicitly listed events such as fire, theft, or windstorm, making it crucial for policyholders seeking targeted risk management. Silent cyber coverage, in contrast, addresses cyber risks not expressly excluded or covered in standard policies, often filling gaps where cyber threats are indirectly implicated but unnamed. Explore more to understand how these coverages mitigate unique exposures in evolving risk landscapes.

Exclusions

Named peril coverage explicitly lists risks covered, excluding all not specified, often omitting cyber-related incidents unless specifically endorsed. Silent cyber coverage addresses gaps by covering cyber losses not explicitly excluded, but exclusions may still apply for known cyber threats or acts of war. Explore our detailed analysis to understand how exclusions impact risk management strategies.

Affirmative Coverage

Named peril coverage explicitly lists covered risks, providing clear protection against specified threats like fire or theft, while silent cyber coverage addresses cyber risks not explicitly excluded in traditional policies, often leading to ambiguous exposure. Affirmative coverage requires insurers to explicitly include cyber risks within the policy terms, ensuring transparent and deliberate protection against cyber incidents. Explore more about how affirmative coverage shapes risk management in cyber insurance.

Source and External Links

Named Perils vs. All Risks Explained in Plain English - Named peril coverage means an insurance policy specifically names the perils it covers, so only losses caused by those listed perils are covered, with the burden on the insured to prove the loss was from a named peril.

Understanding Named Perils: What You Need to Know - Named peril coverage lists specific risks covered, such as fire or theft, and only damages caused by those named perils are covered, resulting in generally lower premiums but more limited coverage compared to "all risks" policies.

Named Peril | HUB International - Named peril policies cover only perils listed by name, ideal for lowering premiums, but coverage applies only if damage is caused by those perils, and exclusions and policy limits still apply.

dowidth.com

dowidth.com