Embedded insurance integrates coverage directly into the purchase of products or services, offering seamless protection without separate policy management. Standalone insurance requires independent acquisition and management, providing more customizable but often less convenient coverage options. Explore the advantages of each to determine the best fit for your insurance needs.

Why it is important

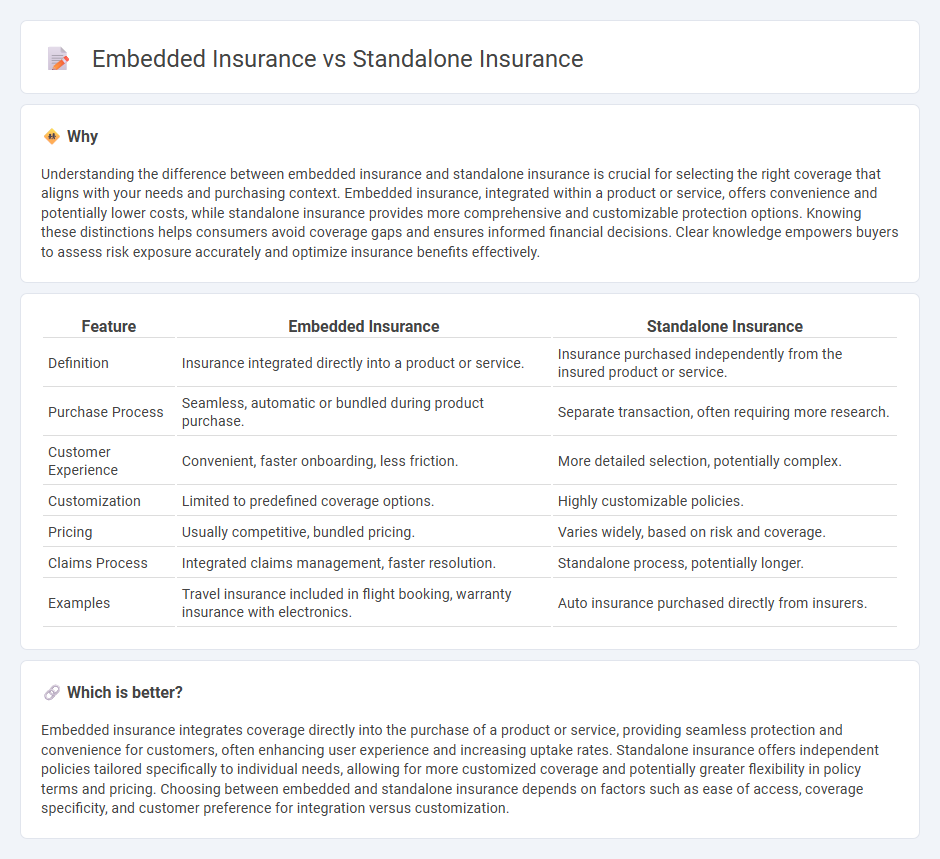

Understanding the difference between embedded insurance and standalone insurance is crucial for selecting the right coverage that aligns with your needs and purchasing context. Embedded insurance, integrated within a product or service, offers convenience and potentially lower costs, while standalone insurance provides more comprehensive and customizable protection options. Knowing these distinctions helps consumers avoid coverage gaps and ensures informed financial decisions. Clear knowledge empowers buyers to assess risk exposure accurately and optimize insurance benefits effectively.

Comparison Table

| Feature | Embedded Insurance | Standalone Insurance |

|---|---|---|

| Definition | Insurance integrated directly into a product or service. | Insurance purchased independently from the insured product or service. |

| Purchase Process | Seamless, automatic or bundled during product purchase. | Separate transaction, often requiring more research. |

| Customer Experience | Convenient, faster onboarding, less friction. | More detailed selection, potentially complex. |

| Customization | Limited to predefined coverage options. | Highly customizable policies. |

| Pricing | Usually competitive, bundled pricing. | Varies widely, based on risk and coverage. |

| Claims Process | Integrated claims management, faster resolution. | Standalone process, potentially longer. |

| Examples | Travel insurance included in flight booking, warranty insurance with electronics. | Auto insurance purchased directly from insurers. |

Which is better?

Embedded insurance integrates coverage directly into the purchase of a product or service, providing seamless protection and convenience for customers, often enhancing user experience and increasing uptake rates. Standalone insurance offers independent policies tailored specifically to individual needs, allowing for more customized coverage and potentially greater flexibility in policy terms and pricing. Choosing between embedded and standalone insurance depends on factors such as ease of access, coverage specificity, and customer preference for integration versus customization.

Connection

Embedded insurance integrates protection coverage directly into the purchase of products or services, enhancing customer convenience and streamlining the buying process. Standalone insurance operates independently, offering specialized policies tailored to specific risks without being linked to another transaction. Both models complement each other by expanding market reach and providing diverse options that meet varied consumer needs in the insurance industry.

Key Terms

Coverage Scope

Standalone insurance policies provide comprehensive coverage tailored to specific risks such as auto, health, or home insurance, offering detailed protection options and flexibility. Embedded insurance integrates coverage directly into products or services, often limited in scope but convenient for immediate, contextual risks like travel or electronics protection. Explore the differences in coverage scope to determine which insurance model best suits your needs.

Distribution Channel

Standalone insurance relies heavily on traditional distribution channels such as agents, brokers, and direct online platforms, ensuring personalized customer engagement and product customization. Embedded insurance integrates seamlessly within non-insurance ecosystems like e-commerce, travel booking sites, or automotive sales platforms, offering convenience and instant coverage at the point of sale. Explore how these distribution strategies transform insurance accessibility and customer experience in today's dynamic market.

Customization

Standalone insurance offers extensive customization options, allowing customers to tailor policies based on specific needs such as coverage limits, deductibles, and additional riders. Embedded insurance integrates coverage directly into products or services, often providing simplified, standardized options that prioritize convenience over personalization. Explore the differences in customization capabilities to determine which insurance model best fits your unique requirements.

Source and External Links

What Is Standalone Insurance? - Standalone insurance refers to policies that cover specialized risks not covered by standard policies, such as flood or earthquake insurance.

What Are the Three Types of Long-Term Care Insurance? - Standalone long-term care insurance is a policy that focuses specifically on long-term care needs without other combined benefits.

General Liability Stand alone - General liability insurance as a standalone policy provides coverage for third-party claims due to bodily injury or property damage.

dowidth.com

dowidth.com