Digital health insurance leverages technology to offer streamlined access to medical services, often featuring telemedicine and app-based claims processing for enhanced convenience. Preferred Provider Organization (PPO) plans provide a network of approved healthcare providers, allowing policyholders flexibility to see specialists without referrals while benefiting from negotiated rates. Explore how these insurance models compare to find the best fit for your healthcare needs.

Why it is important

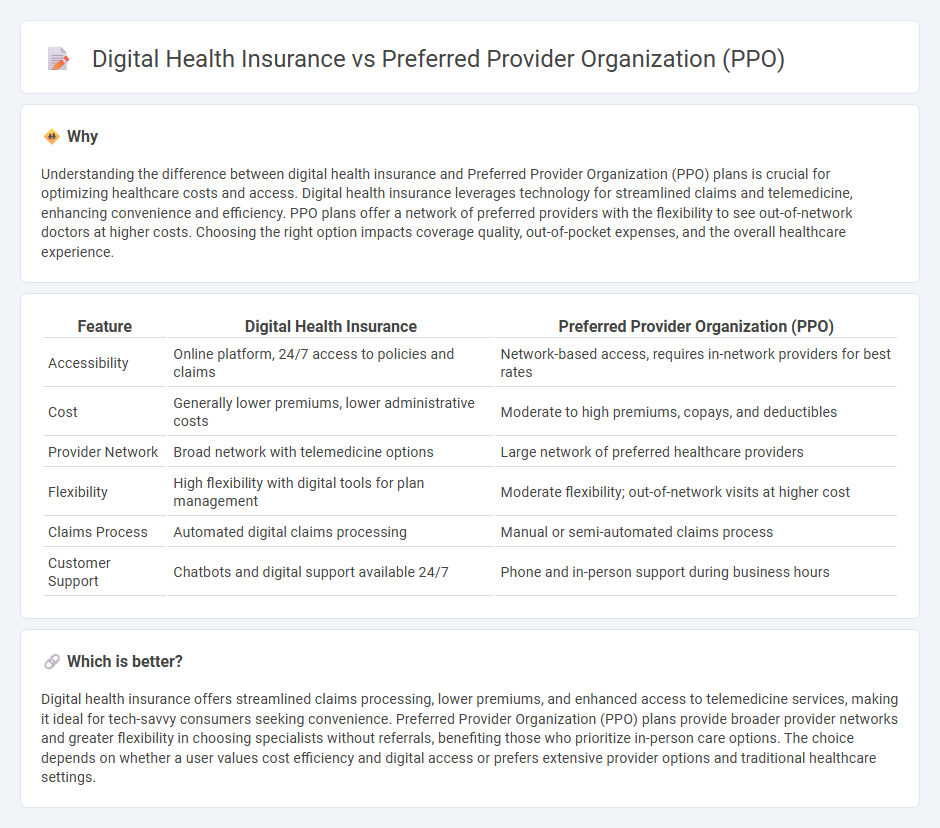

Understanding the difference between digital health insurance and Preferred Provider Organization (PPO) plans is crucial for optimizing healthcare costs and access. Digital health insurance leverages technology for streamlined claims and telemedicine, enhancing convenience and efficiency. PPO plans offer a network of preferred providers with the flexibility to see out-of-network doctors at higher costs. Choosing the right option impacts coverage quality, out-of-pocket expenses, and the overall healthcare experience.

Comparison Table

| Feature | Digital Health Insurance | Preferred Provider Organization (PPO) |

|---|---|---|

| Accessibility | Online platform, 24/7 access to policies and claims | Network-based access, requires in-network providers for best rates |

| Cost | Generally lower premiums, lower administrative costs | Moderate to high premiums, copays, and deductibles |

| Provider Network | Broad network with telemedicine options | Large network of preferred healthcare providers |

| Flexibility | High flexibility with digital tools for plan management | Moderate flexibility; out-of-network visits at higher cost |

| Claims Process | Automated digital claims processing | Manual or semi-automated claims process |

| Customer Support | Chatbots and digital support available 24/7 | Phone and in-person support during business hours |

Which is better?

Digital health insurance offers streamlined claims processing, lower premiums, and enhanced access to telemedicine services, making it ideal for tech-savvy consumers seeking convenience. Preferred Provider Organization (PPO) plans provide broader provider networks and greater flexibility in choosing specialists without referrals, benefiting those who prioritize in-person care options. The choice depends on whether a user values cost efficiency and digital access or prefers extensive provider options and traditional healthcare settings.

Connection

Digital health insurance platforms enhance the efficiency and accessibility of Preferred Provider Organization (PPO) plans by streamlining claim processing and provider network management through advanced technology. PPOs benefit from digital tools that facilitate real-time provider verification and seamless patient data exchange, improving care coordination and member satisfaction. Integration of digital health solutions with PPO networks supports personalized care options and cost-effective healthcare delivery.

Key Terms

Network Flexibility

Preferred provider organizations (PPOs) offer extensive network flexibility, allowing members to see any healthcare provider, including specialists, without a referral and often with partial coverage for out-of-network services. Digital health insurance integrates technology platforms to enhance access and care coordination but may have more defined network restrictions to manage costs and quality. Explore how network flexibility varies between PPOs and digital health plans to make informed coverage decisions.

Telemedicine

Preferred provider organization (PPO) plans typically offer broad provider networks and flexible access to specialists without referrals, enhancing patient choice in telemedicine services. Digital health insurance integrates advanced technology platforms that streamline virtual care, improve patient engagement, and reduce costs through AI-driven diagnostics and real-time data sharing. Explore the evolving landscape of PPO coverage and digital health solutions to optimize telemedicine access and quality of care.

Claims Processing

Preferred Provider Organization (PPO) plans streamline claims processing through established networks and negotiated rates, ensuring faster reimbursements and reduced out-of-pocket costs for members. Digital health insurance leverages advanced algorithms and automation for real-time claims adjudication, minimizing errors and accelerating approval workflows. Discover how these systems optimize efficiency and improve patient experience in claims management.

Source and External Links

Preferred provider organization - A preferred provider organization (PPO) is a managed care arrangement where a network of doctors and hospitals agree to provide services at reduced rates to members, offering more flexibility than HMOs but typically at a higher premium.

Preferred Provider Organization (PPO) Plans - Cigna Healthcare - PPO plans allow members to choose from a large network of providers without needing a primary care physician, while out-of-network care is covered at higher costs and often requires self-submitted claims.

What is a PPO health plan? - United Healthcare - With a PPO plan, you pay less out of pocket when using in-network providers, but you can also access out-of-network care, though at a higher cost and with separate deductibles.

dowidth.com

dowidth.com