Pet insurance provides financial coverage for veterinary expenses related to illness or injury, safeguarding your pet's health and your budget. Critical illness insurance offers a lump-sum payment upon diagnosis of major health conditions like cancer or heart attack, helping cover treatment costs and income loss. Explore the differences between these insurance types to make an informed decision tailored to your needs.

Why it is important

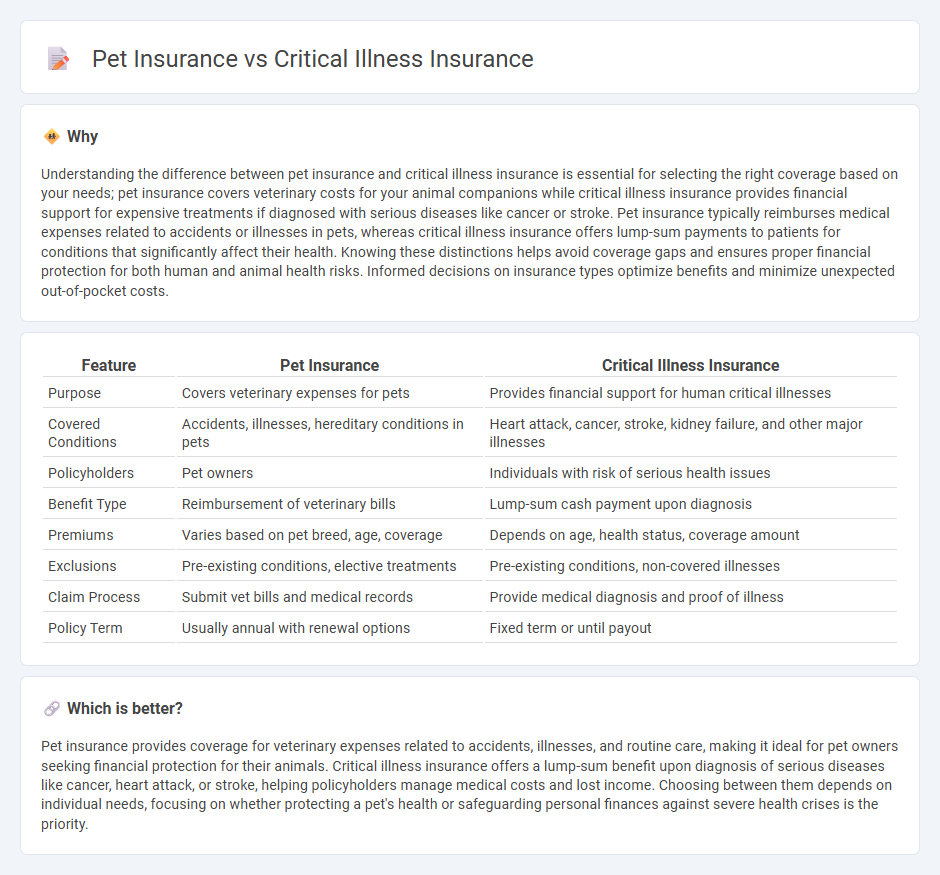

Understanding the difference between pet insurance and critical illness insurance is essential for selecting the right coverage based on your needs; pet insurance covers veterinary costs for your animal companions while critical illness insurance provides financial support for expensive treatments if diagnosed with serious diseases like cancer or stroke. Pet insurance typically reimburses medical expenses related to accidents or illnesses in pets, whereas critical illness insurance offers lump-sum payments to patients for conditions that significantly affect their health. Knowing these distinctions helps avoid coverage gaps and ensures proper financial protection for both human and animal health risks. Informed decisions on insurance types optimize benefits and minimize unexpected out-of-pocket costs.

Comparison Table

| Feature | Pet Insurance | Critical Illness Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Provides financial support for human critical illnesses |

| Covered Conditions | Accidents, illnesses, hereditary conditions in pets | Heart attack, cancer, stroke, kidney failure, and other major illnesses |

| Policyholders | Pet owners | Individuals with risk of serious health issues |

| Benefit Type | Reimbursement of veterinary bills | Lump-sum cash payment upon diagnosis |

| Premiums | Varies based on pet breed, age, coverage | Depends on age, health status, coverage amount |

| Exclusions | Pre-existing conditions, elective treatments | Pre-existing conditions, non-covered illnesses |

| Claim Process | Submit vet bills and medical records | Provide medical diagnosis and proof of illness |

| Policy Term | Usually annual with renewal options | Fixed term or until payout |

Which is better?

Pet insurance provides coverage for veterinary expenses related to accidents, illnesses, and routine care, making it ideal for pet owners seeking financial protection for their animals. Critical illness insurance offers a lump-sum benefit upon diagnosis of serious diseases like cancer, heart attack, or stroke, helping policyholders manage medical costs and lost income. Choosing between them depends on individual needs, focusing on whether protecting a pet's health or safeguarding personal finances against severe health crises is the priority.

Connection

Pet insurance and critical illness insurance both provide financial protection by covering unexpected medical expenses related to health emergencies, reducing the burden of costly treatments. Both insurance types utilize risk assessment and claims processes to manage coverage efficiently, ensuring policyholders receive timely support during critical health events. By mitigating financial risks associated with severe illnesses in pets and humans, these insurances help maintain overall well-being and financial stability.

Key Terms

Coverage

Critical illness insurance primarily covers severe health conditions such as cancer, heart attack, and stroke, offering lump-sum payments to help manage treatment costs and income loss. Pet insurance focuses on veterinary expenses, including accidents, illnesses, and preventive care for pets, with plans varying from basic accident coverage to comprehensive illness and wellness care. Explore the detailed benefits and limitations of each policy type to choose the best protection for you and your loved ones.

Exclusions

Critical illness insurance typically excludes pre-existing conditions, cosmetic surgeries, and non-life-threatening illnesses, focusing on major diseases like cancer, heart attack, and stroke. Pet insurance often excludes hereditary conditions, pre-existing illnesses, and routine care such as vaccinations or wellness visits. Explore more about these exclusions to choose the right coverage for your needs.

Premium

Critical illness insurance premiums are typically higher due to coverage of severe health events like cancer, heart attack, or stroke, reflecting the significant financial risk involved. Pet insurance premiums vary widely based on factors such as breed, age, and coverage level, often making them more affordable but with varying benefits. Explore detailed comparisons to find the best option that fits your financial protection needs.

Source and External Links

Critical Illness Insurance - Provides financial support by offering a lump sum or monthly payments to cover expenses related to major illnesses like heart attacks, strokes, and cancer.

Critical Illness Insurance - Offers a lump sum payment if the policyholder is diagnosed with a specified critical illness, often requiring a minimum survival period and specific diagnostic criteria.

MetLife Critical Illness Insurance - Helps alleviate financial burdens with lump-sum payments for critical illnesses, providing financial support beyond medical insurance coverage.

dowidth.com

dowidth.com