Pay-as-you-drive insurance offers a flexible, mileage-based premium ideal for low-mileage drivers seeking cost efficiency, while comprehensive insurance provides extensive coverage against a wide range of risks including theft, natural disasters, and accidents regardless of mileage. Pay-as-you-drive plans leverage telematics technology to monitor driving behavior and distance, resulting in personalized rates, whereas comprehensive policies ensure broad protection and peace of mind for all drivers. Discover how to choose the insurance model that best fits your driving habits and financial needs.

Why it is important

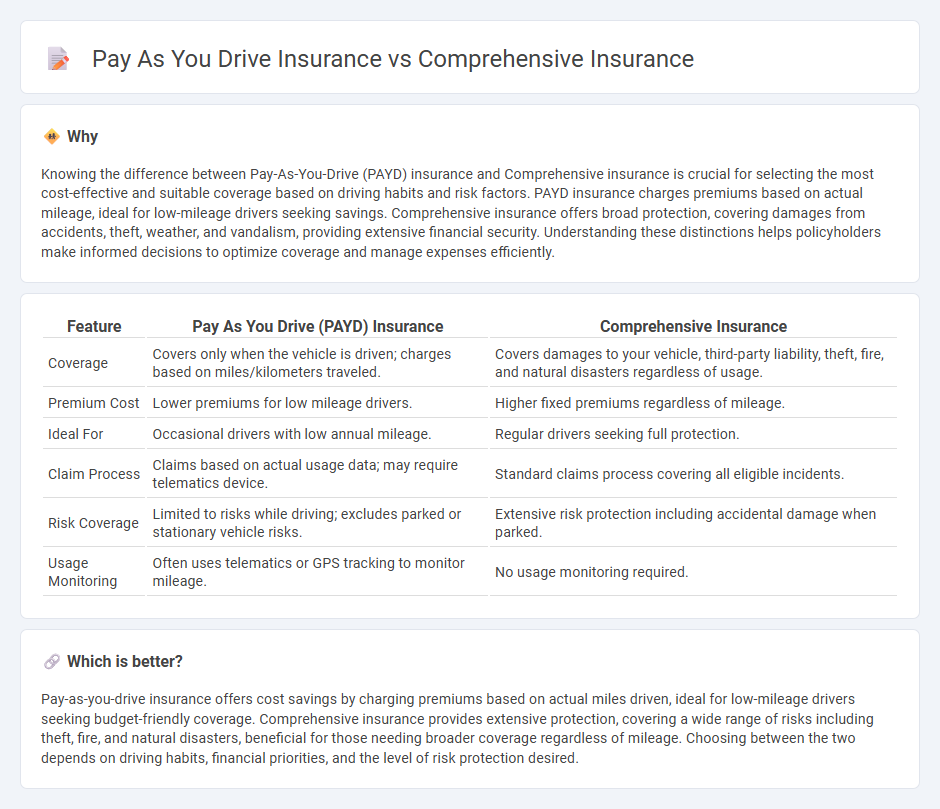

Knowing the difference between Pay-As-You-Drive (PAYD) insurance and Comprehensive insurance is crucial for selecting the most cost-effective and suitable coverage based on driving habits and risk factors. PAYD insurance charges premiums based on actual mileage, ideal for low-mileage drivers seeking savings. Comprehensive insurance offers broad protection, covering damages from accidents, theft, weather, and vandalism, providing extensive financial security. Understanding these distinctions helps policyholders make informed decisions to optimize coverage and manage expenses efficiently.

Comparison Table

| Feature | Pay As You Drive (PAYD) Insurance | Comprehensive Insurance |

|---|---|---|

| Coverage | Covers only when the vehicle is driven; charges based on miles/kilometers traveled. | Covers damages to your vehicle, third-party liability, theft, fire, and natural disasters regardless of usage. |

| Premium Cost | Lower premiums for low mileage drivers. | Higher fixed premiums regardless of mileage. |

| Ideal For | Occasional drivers with low annual mileage. | Regular drivers seeking full protection. |

| Claim Process | Claims based on actual usage data; may require telematics device. | Standard claims process covering all eligible incidents. |

| Risk Coverage | Limited to risks while driving; excludes parked or stationary vehicle risks. | Extensive risk protection including accidental damage when parked. |

| Usage Monitoring | Often uses telematics or GPS tracking to monitor mileage. | No usage monitoring required. |

Which is better?

Pay-as-you-drive insurance offers cost savings by charging premiums based on actual miles driven, ideal for low-mileage drivers seeking budget-friendly coverage. Comprehensive insurance provides extensive protection, covering a wide range of risks including theft, fire, and natural disasters, beneficial for those needing broader coverage regardless of mileage. Choosing between the two depends on driving habits, financial priorities, and the level of risk protection desired.

Connection

Pay-as-you-drive insurance calculates premiums based on actual miles driven, promoting cost-efficiency and personalized coverage. Comprehensive insurance complements this by covering non-collision-related damages such as theft, vandalism, and natural disasters, ensuring broader protection beyond mileage risks. Together, they provide a tailored and extensive insurance solution that adapts to driving habits while safeguarding against diverse damages.

Key Terms

Coverage Scope

Comprehensive insurance offers extensive coverage, protecting against theft, vandalism, natural disasters, and collision damages, whereas pay-as-you-drive insurance bases premiums on actual mileage, primarily covering liability and minor damages. The scope of protection in comprehensive plans is broader, ideal for drivers seeking full financial security regardless of usage frequency. Explore detailed comparisons to determine which insurance best fits your driving habits and coverage needs.

Premium Calculation

Comprehensive insurance premiums are calculated based on factors such as vehicle value, coverage scope, driver profile, claims history, and geographic location, often resulting in higher fixed costs. Pay-as-you-drive (PAYD) insurance determines premiums primarily by actual mileage, incentivizing reduced driving and potentially lowering costs for low-mileage users through telematics data. Explore more details to understand which premium calculation model aligns best with your driving habits and budget needs.

Usage-Based Pricing

Comprehensive insurance covers a wide range of risks including theft, fire, and collision damage, offering broad protection regardless of driving habits. Pay-as-you-drive insurance utilizes telematics to measure actual mileage and driving behavior, enabling personalized premiums based on real-time usage and risk factors. Explore detailed comparisons and find the best fit for your driving needs by learning more about usage-based pricing models.

Source and External Links

Comprehensive Car Insurance Coverage - AAA Northern California - Pays to repair or replace your car if it's stolen or damaged by something other than a collision, including natural disasters, fire, vandalism, animal collisions, or falling objects.

What is comprehensive car insurance and what does it cover? | GEICO - Covers losses like theft, vandalism, hail, flooding, hitting an animal, glass breakage, or fire, but not damage from hitting another vehicle or object, which is covered by collision insurance.

The Difference Between Comprehensive and Collision Insurance - Protects your vehicle against non-collision events such as theft, vandalism, natural disasters, falling objects, animal collisions, fire, and explosions, with coverage limits based on the vehicle's actual cash value minus your deductible.

dowidth.com

dowidth.com