Drone insurance covers risks related to aerial operations, including liability for property damage and injury caused by drone flights, as well as coverage for theft or damage to the drone itself. Automobile insurance primarily protects against vehicle-related risks such as collision, liability for bodily injury, and property damage resulting from road accidents. Explore the differences in coverage options and legal requirements to determine which insurance best fits your needs.

Why it is important

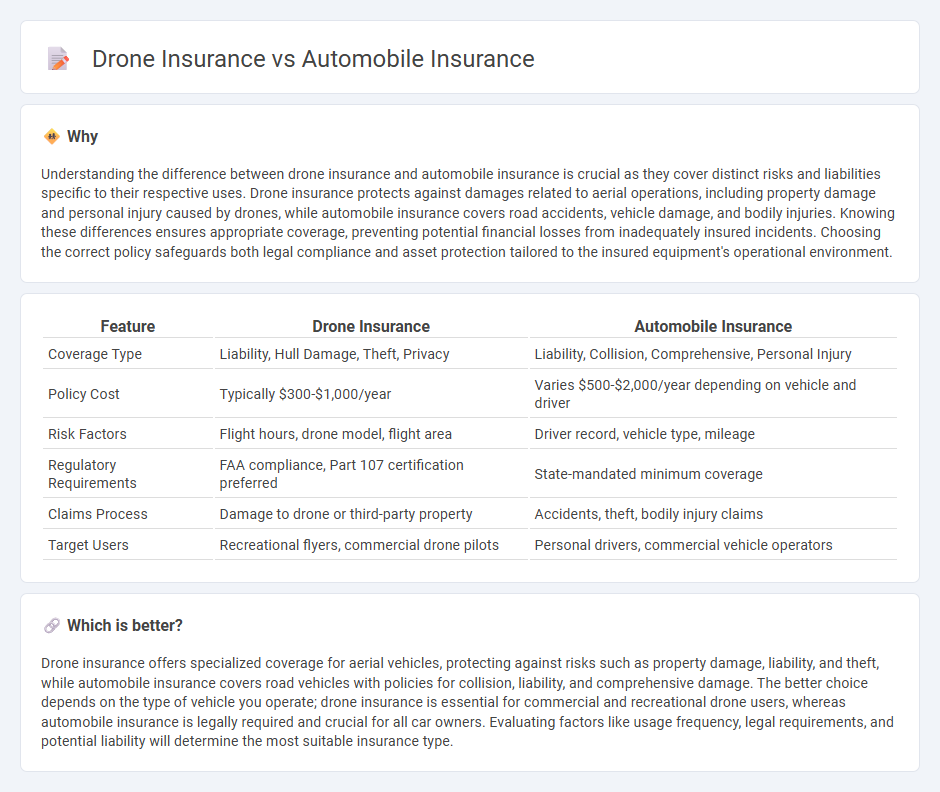

Understanding the difference between drone insurance and automobile insurance is crucial as they cover distinct risks and liabilities specific to their respective uses. Drone insurance protects against damages related to aerial operations, including property damage and personal injury caused by drones, while automobile insurance covers road accidents, vehicle damage, and bodily injuries. Knowing these differences ensures appropriate coverage, preventing potential financial losses from inadequately insured incidents. Choosing the correct policy safeguards both legal compliance and asset protection tailored to the insured equipment's operational environment.

Comparison Table

| Feature | Drone Insurance | Automobile Insurance |

|---|---|---|

| Coverage Type | Liability, Hull Damage, Theft, Privacy | Liability, Collision, Comprehensive, Personal Injury |

| Policy Cost | Typically $300-$1,000/year | Varies $500-$2,000/year depending on vehicle and driver |

| Risk Factors | Flight hours, drone model, flight area | Driver record, vehicle type, mileage |

| Regulatory Requirements | FAA compliance, Part 107 certification preferred | State-mandated minimum coverage |

| Claims Process | Damage to drone or third-party property | Accidents, theft, bodily injury claims |

| Target Users | Recreational flyers, commercial drone pilots | Personal drivers, commercial vehicle operators |

Which is better?

Drone insurance offers specialized coverage for aerial vehicles, protecting against risks such as property damage, liability, and theft, while automobile insurance covers road vehicles with policies for collision, liability, and comprehensive damage. The better choice depends on the type of vehicle you operate; drone insurance is essential for commercial and recreational drone users, whereas automobile insurance is legally required and crucial for all car owners. Evaluating factors like usage frequency, legal requirements, and potential liability will determine the most suitable insurance type.

Connection

Drone insurance and automobile insurance intersect through liability coverage, protecting operators from damages caused by accidents. Both insurance types mitigate financial risks associated with property damage, bodily injury, or third-party claims. Increasingly, insurers offer bundled policies that integrate drone and automobile coverage for commercial use to streamline risk management.

Key Terms

Liability Coverage

Automobile insurance liability coverage protects drivers against claims for bodily injury and property damage caused by car accidents, often including legal defense and settlement costs. Drone insurance liability coverage covers damages or injuries caused by drone operations, addressing risks like property damage, personal injury, and invasion of privacy, with policies tailored to commercial or recreational use. Explore detailed comparisons to understand how liability protections differ and ensure appropriate coverage for your specific needs.

Physical Damage Coverage

Physical damage coverage in automobile insurance typically includes protection against collisions, theft, vandalism, and natural disasters, offering comprehensive financial security for vehicles. Drone insurance physical damage coverage focuses on protecting the drone itself from accidents like crashes, water damage, or mechanical failure, often tailored to the unique risks of aerial operations. Explore detailed coverage differences and options to ensure optimal protection for your vehicle or drone.

Usage Restrictions

Automobile insurance policies typically cover vehicles used for personal or commercial transportation, with strict usage restrictions based on the vehicle's type, purpose, and location. Drone insurance, by contrast, imposes coverage limits tied to flight altitude, geographic zones, and specific applications such as recreational use or commercial operations like aerial photography. Explore further to understand how usage restrictions impact premium costs and liability in both insurance types.

Source and External Links

Car Insurance - Travelers - Car insurance protects you from costs related to accidents and other losses, with common coverage types including liability, collision, and comprehensive insurance.

New York Car Insurance | Get a Quote - Liberty Mutual - New York requires minimum auto insurance coverage and faces some of the highest rates, averaging $349 per month for full coverage, with discounts available for safe driving and multi-car policies.

Progressive: An Insurance Company You Can Rely On - Progressive offers customizable auto insurance with a reputation for strong savings, customer support 24/7, and additional insurance products to meet diverse customer needs.

dowidth.com

dowidth.com