Workers compensation carveout and occupational accident insurance both provide coverage for workplace injuries, yet they differ significantly in scope and application. Workers compensation carveout typically refers to a limited exclusion from standard workers compensation policies, often used for specific employee groups or job classifications, whereas occupational accident insurance offers broader, standalone benefits for accidents occurring during work but outside the parameters of workers compensation. Explore the key differences and benefits of each insurance type to determine the best fit for your business needs.

Why it is important

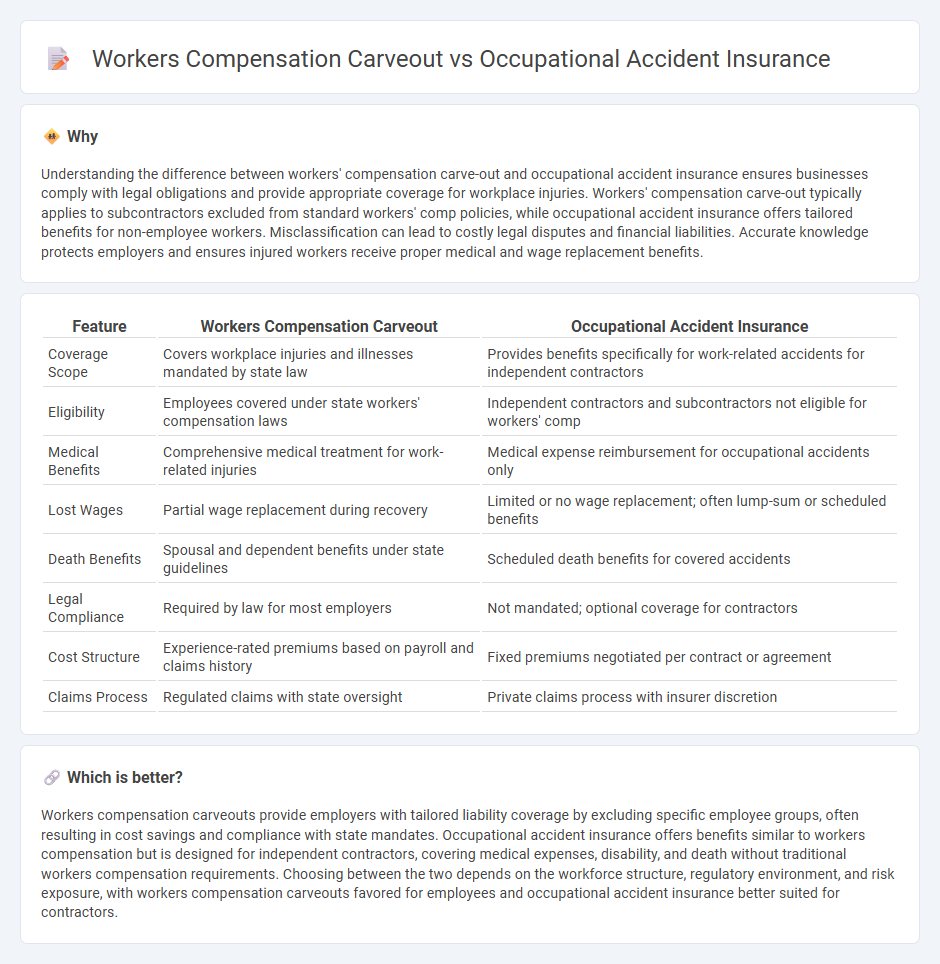

Understanding the difference between workers' compensation carve-out and occupational accident insurance ensures businesses comply with legal obligations and provide appropriate coverage for workplace injuries. Workers' compensation carve-out typically applies to subcontractors excluded from standard workers' comp policies, while occupational accident insurance offers tailored benefits for non-employee workers. Misclassification can lead to costly legal disputes and financial liabilities. Accurate knowledge protects employers and ensures injured workers receive proper medical and wage replacement benefits.

Comparison Table

| Feature | Workers Compensation Carveout | Occupational Accident Insurance |

|---|---|---|

| Coverage Scope | Covers workplace injuries and illnesses mandated by state law | Provides benefits specifically for work-related accidents for independent contractors |

| Eligibility | Employees covered under state workers' compensation laws | Independent contractors and subcontractors not eligible for workers' comp |

| Medical Benefits | Comprehensive medical treatment for work-related injuries | Medical expense reimbursement for occupational accidents only |

| Lost Wages | Partial wage replacement during recovery | Limited or no wage replacement; often lump-sum or scheduled benefits |

| Death Benefits | Spousal and dependent benefits under state guidelines | Scheduled death benefits for covered accidents |

| Legal Compliance | Required by law for most employers | Not mandated; optional coverage for contractors |

| Cost Structure | Experience-rated premiums based on payroll and claims history | Fixed premiums negotiated per contract or agreement |

| Claims Process | Regulated claims with state oversight | Private claims process with insurer discretion |

Which is better?

Workers compensation carveouts provide employers with tailored liability coverage by excluding specific employee groups, often resulting in cost savings and compliance with state mandates. Occupational accident insurance offers benefits similar to workers compensation but is designed for independent contractors, covering medical expenses, disability, and death without traditional workers compensation requirements. Choosing between the two depends on the workforce structure, regulatory environment, and risk exposure, with workers compensation carveouts favored for employees and occupational accident insurance better suited for contractors.

Connection

Workers' compensation carveout and occupational accident insurance both address workplace injuries but serve different coverage purposes. Workers' compensation carveout excludes certain employees from the employer's workers' compensation policy, often shifting those workers to alternative insurance like occupational accident insurance, which provides benefits for work-related injuries outside standard workers' comp frameworks. This connection allows employers, especially in industries with subcontractors or independent contractors, to manage risk and comply with regulations while ensuring injured workers receive medical and disability benefits.

Key Terms

Coverage scope

Occupational accident insurance primarily covers specific work-related injuries for independent contractors, limiting benefits to medical expenses and lost wages directly tied to the accident. Workers compensation carveouts exclude traditional workers compensation coverage, placing broader liability on employers or insurers to cover workplace injuries under alternative policies, often extending to employee claims. Explore detailed differences and coverage nuances to determine the best risk management strategy for your workforce.

Employer liability

Occupational accident insurance provides coverage for work-related injuries primarily for independent contractors, limiting employer liability by offering specific medical and disability benefits without classifying the worker as an employee. In contrast, workers' compensation carveout typically excludes certain employees or job roles from standard workers' compensation policies, which can shift or reduce the employer's financial responsibility for occupational injuries. Explore the detailed distinctions and implications for employer liability to make informed decisions on risk management strategies.

Benefit structure

Occupational accident insurance typically offers tailored benefit structures such as lump-sum payments, medical expense coverage, and disability benefits specifically designed for independent contractors or non-traditional workers. Workers' compensation carveouts modify existing workers' compensation policies, focusing on specialized or limited benefits for specific employee groups or job categories, often excluding certain claims or adjusting coverage limits. Explore the detailed differences and suitability for your workforce to optimize risk management and employee protection.

Source and External Links

Occupational Accident 5k - OOIDA - Provides up to $500,000 in coverage for medical expenses, disability income, and other benefits for eligible truck drivers.

Occupational Accident Insurance (OAI) | Insureon - Offers coverage for workplace injuries, including medical costs, lost wages, disability benefits, and death benefits, often used by independent contractors.

Occupational Accident Insurance Coverage | Aflac - Protects individuals, especially independent contractors, from financial losses due to workplace injuries, covering medical costs and lost wages.

dowidth.com

dowidth.com