Flood insurance integration protects homeowners from water damage losses by seamlessly incorporating coverage into property insurance policies, ensuring financial security against natural disasters. Travel insurance integration offers comprehensive protection for trip cancellations, medical emergencies, and lost belongings, enhancing client confidence during their journeys. Discover how integrating these insurance types can safeguard assets and experiences effectively.

Why it is important

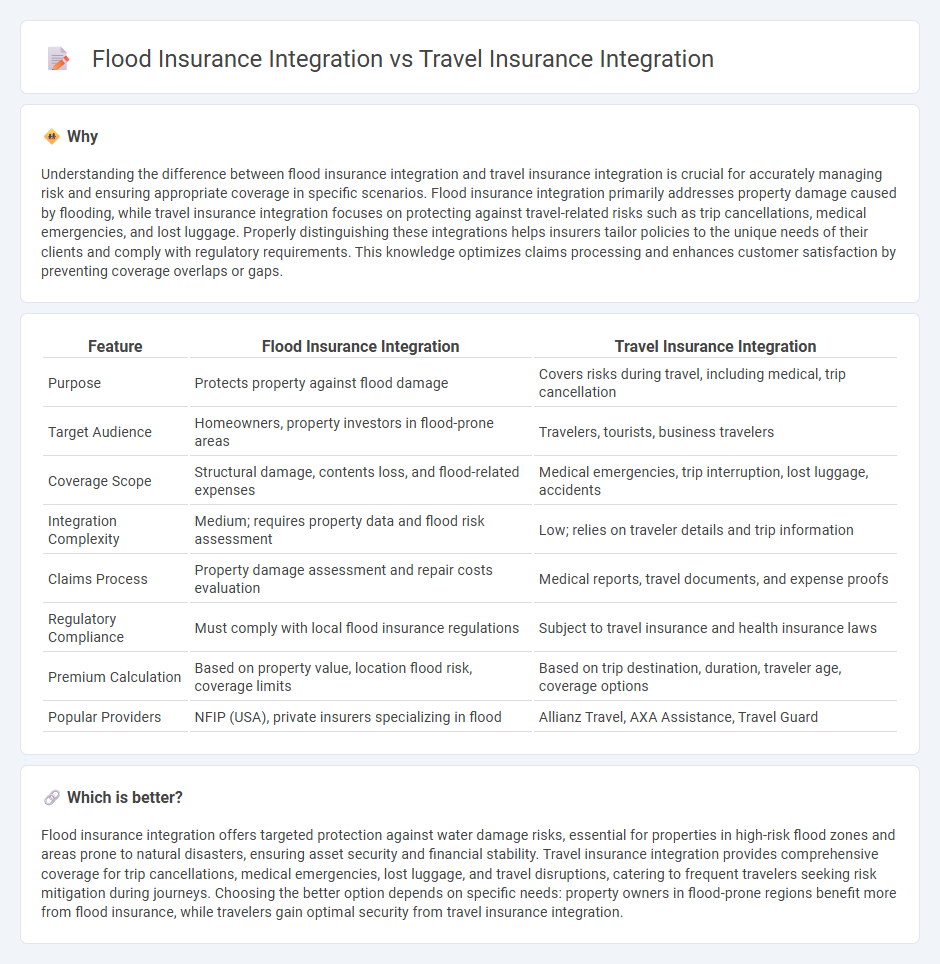

Understanding the difference between flood insurance integration and travel insurance integration is crucial for accurately managing risk and ensuring appropriate coverage in specific scenarios. Flood insurance integration primarily addresses property damage caused by flooding, while travel insurance integration focuses on protecting against travel-related risks such as trip cancellations, medical emergencies, and lost luggage. Properly distinguishing these integrations helps insurers tailor policies to the unique needs of their clients and comply with regulatory requirements. This knowledge optimizes claims processing and enhances customer satisfaction by preventing coverage overlaps or gaps.

Comparison Table

| Feature | Flood Insurance Integration | Travel Insurance Integration |

|---|---|---|

| Purpose | Protects property against flood damage | Covers risks during travel, including medical, trip cancellation |

| Target Audience | Homeowners, property investors in flood-prone areas | Travelers, tourists, business travelers |

| Coverage Scope | Structural damage, contents loss, and flood-related expenses | Medical emergencies, trip interruption, lost luggage, accidents |

| Integration Complexity | Medium; requires property data and flood risk assessment | Low; relies on traveler details and trip information |

| Claims Process | Property damage assessment and repair costs evaluation | Medical reports, travel documents, and expense proofs |

| Regulatory Compliance | Must comply with local flood insurance regulations | Subject to travel insurance and health insurance laws |

| Premium Calculation | Based on property value, location flood risk, coverage limits | Based on trip destination, duration, traveler age, coverage options |

| Popular Providers | NFIP (USA), private insurers specializing in flood | Allianz Travel, AXA Assistance, Travel Guard |

Which is better?

Flood insurance integration offers targeted protection against water damage risks, essential for properties in high-risk flood zones and areas prone to natural disasters, ensuring asset security and financial stability. Travel insurance integration provides comprehensive coverage for trip cancellations, medical emergencies, lost luggage, and travel disruptions, catering to frequent travelers seeking risk mitigation during journeys. Choosing the better option depends on specific needs: property owners in flood-prone regions benefit more from flood insurance, while travelers gain optimal security from travel insurance integration.

Connection

Flood insurance integration and travel insurance integration are connected through comprehensive risk management systems that assess both environmental and travel-related hazards. By combining flood insurance data with travel insurance platforms, providers can offer tailored coverage for customers facing potential flood risks during trips. This integration enhances policy customization and claims processing efficiency by leveraging geographic and travel itinerary information.

Key Terms

**Travel Insurance Integration:**

Travel insurance integration streamlines the process of embedding travel coverage options into booking platforms, offering real-time policy selection, instant quotes, and seamless claims submission for travelers. It leverages APIs to connect insurers with travel agencies, enhancing customer experience through automated underwriting and personalized coverage based on destination risks. Explore how travel insurance integration can increase revenue and customer satisfaction in your travel business.

Policy Aggregation

Policy aggregation in travel insurance integration consolidates multiple travel policies, streamlining claims processing and enhancing customer management through centralized data systems. Flood insurance integration focuses on aggregating localized flood risk policies, leveraging geographic information systems (GIS) to assess risk accurately and facilitate real-time premium adjustments. Discover how advanced policy aggregation technologies revolutionize both travel and flood insurance sectors to optimize coverage and customer experience.

Real-time Claims Processing

Real-time claims processing in travel insurance integration enables instant verification and settlement of claims related to trip cancellations, medical emergencies, and lost luggage, enhancing customer satisfaction and operational efficiency. Flood insurance integration specifically targets rapid assessment and approval of flood damage claims using real-time weather and damage data, reducing delays and improving risk management. Explore how these real-time claims processing technologies transform insurance sectors by streamlining customer experiences and minimizing fraud.

Source and External Links

Travel Insurance API - Trawex Technologies - Travel insurance integration connects insurance providers' systems to travel agents and booking platforms, enabling real-time access to insurance data, policy information, pricing, and customized plans for different types of travelers, enhancing travel protection offerings.

How do travel agencies handle travel insurance through their systems - Travel agencies integrate with insurance providers within booking systems to offer various insurance policy options, facilitate claims management, customize policies, and manage payments for a seamless customer experience.

How banks & fintechs leverage embedded travel insurance | Blog post - Embedded travel insurance provides seamless coverage via banks and fintechs directly in their products, enhancing customer loyalty through flexible, AI-driven claims and comprehensive travel protection without extra steps for the traveler.

dowidth.com

dowidth.com