Credit life insurance provides coverage that pays off outstanding loans if the borrower passes away, ensuring financial obligations are met without burdening survivors. Funeral insurance, also known as burial insurance, offers a lump sum benefit specifically to cover end-of-life expenses such as funeral and burial costs. Discover more about the key differences and benefits of these insurance types to choose the right protection for your needs.

Why it is important

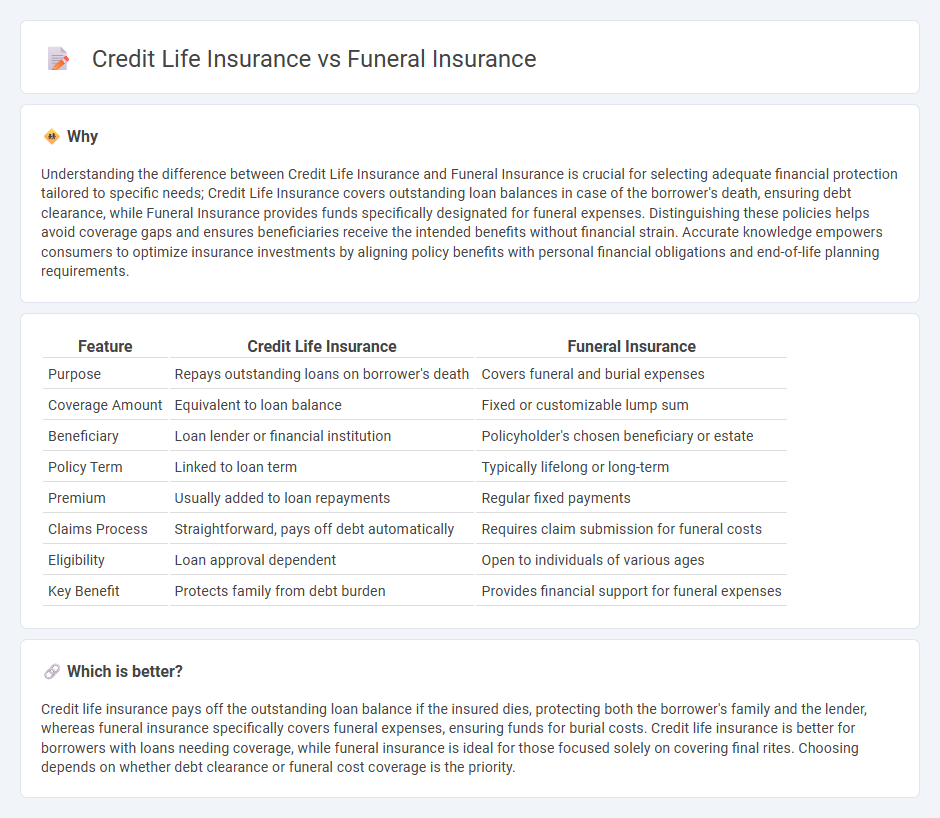

Understanding the difference between Credit Life Insurance and Funeral Insurance is crucial for selecting adequate financial protection tailored to specific needs; Credit Life Insurance covers outstanding loan balances in case of the borrower's death, ensuring debt clearance, while Funeral Insurance provides funds specifically designated for funeral expenses. Distinguishing these policies helps avoid coverage gaps and ensures beneficiaries receive the intended benefits without financial strain. Accurate knowledge empowers consumers to optimize insurance investments by aligning policy benefits with personal financial obligations and end-of-life planning requirements.

Comparison Table

| Feature | Credit Life Insurance | Funeral Insurance |

|---|---|---|

| Purpose | Repays outstanding loans on borrower's death | Covers funeral and burial expenses |

| Coverage Amount | Equivalent to loan balance | Fixed or customizable lump sum |

| Beneficiary | Loan lender or financial institution | Policyholder's chosen beneficiary or estate |

| Policy Term | Linked to loan term | Typically lifelong or long-term |

| Premium | Usually added to loan repayments | Regular fixed payments |

| Claims Process | Straightforward, pays off debt automatically | Requires claim submission for funeral costs |

| Eligibility | Loan approval dependent | Open to individuals of various ages |

| Key Benefit | Protects family from debt burden | Provides financial support for funeral expenses |

Which is better?

Credit life insurance pays off the outstanding loan balance if the insured dies, protecting both the borrower's family and the lender, whereas funeral insurance specifically covers funeral expenses, ensuring funds for burial costs. Credit life insurance is better for borrowers with loans needing coverage, while funeral insurance is ideal for those focused solely on covering final rites. Choosing depends on whether debt clearance or funeral cost coverage is the priority.

Connection

Credit life insurance and funeral insurance are connected through their primary goal of providing financial protection to beneficiaries in the event of the insured's death. Credit life insurance specifically covers outstanding loan balances, ensuring debts are paid off, while funeral insurance focuses on covering burial costs and related expenses. Together, they offer comprehensive support by alleviating financial burdens tied to death-related obligations.

Key Terms

Beneficiary

Funeral insurance specifically designates a beneficiary to cover final expenses such as burial, cremation, and related services, ensuring the family is not burdened with immediate costs. Credit life insurance names the lender as the beneficiary to pay off outstanding debts like mortgages or personal loans in case of the insured's death, protecting credit standing rather than personal beneficiaries. Explore detailed differences in coverage and beneficiary rights to choose the best fit for your financial security.

Coverage purpose

Funeral insurance is designed to cover end-of-life expenses such as burial, cremation, and related costs, ensuring financial relief for loved ones during a difficult time. Credit life insurance, on the other hand, exists primarily to pay off outstanding debts like mortgages, loans, or credit card balances if the borrower passes away. Explore detailed comparisons to understand which coverage aligns best with your financial protection needs.

Payout trigger

Funeral insurance payouts are triggered upon the policyholder's death to cover final expenses such as burial and cremation costs, ensuring immediate financial support for funeral arrangements. Credit life insurance, on the other hand, is designed to pay off outstanding debts or loans when the borrower passes away, protecting the borrower's family from financial burdens. Explore more about how these insurance types differently safeguard your financial responsibilities and loved ones.

Source and External Links

Final Expense & Burial Insurance in Texas - Funeral insurance, also known as burial or final expense insurance, is a type of whole life policy that helps cover funeral costs, medical bills, and other end-of-life expenses, with protections governed by federal Funeral Rule regulations on pricing and contracts.

Funeral insurance | Washington state Office of the Insurance Commissioner - There are two common types of funeral insurance: standard funeral insurance, which provides death benefits to beneficiaries for any use, and pre-need insurance, which locks in funeral costs at today's prices paid directly to the funeral provider, each with pros and cons regarding cost, coverage, and qualification ease.

Funeral Preplanning & Final Expense Insurance - Funeral insurance options include preplanning insurance to fund and select funeral products and final expense insurance that offers funds to beneficiaries for funeral and related expenses, aiming to reduce families' financial and emotional burdens with reliable, affordable coverage.

dowidth.com

dowidth.com