Microinsurance provides affordable coverage tailored for low-income individuals, protecting them against everyday risks such as health issues, crop failure, or small-scale property damage. Catastrophe insurance targets large-scale disasters like hurricanes, earthquakes, and floods, offering substantial payouts to businesses and governments to aid in recovery and minimize economic impact. Explore more to understand which insurance type suits your risk management needs effectively.

Why it is important

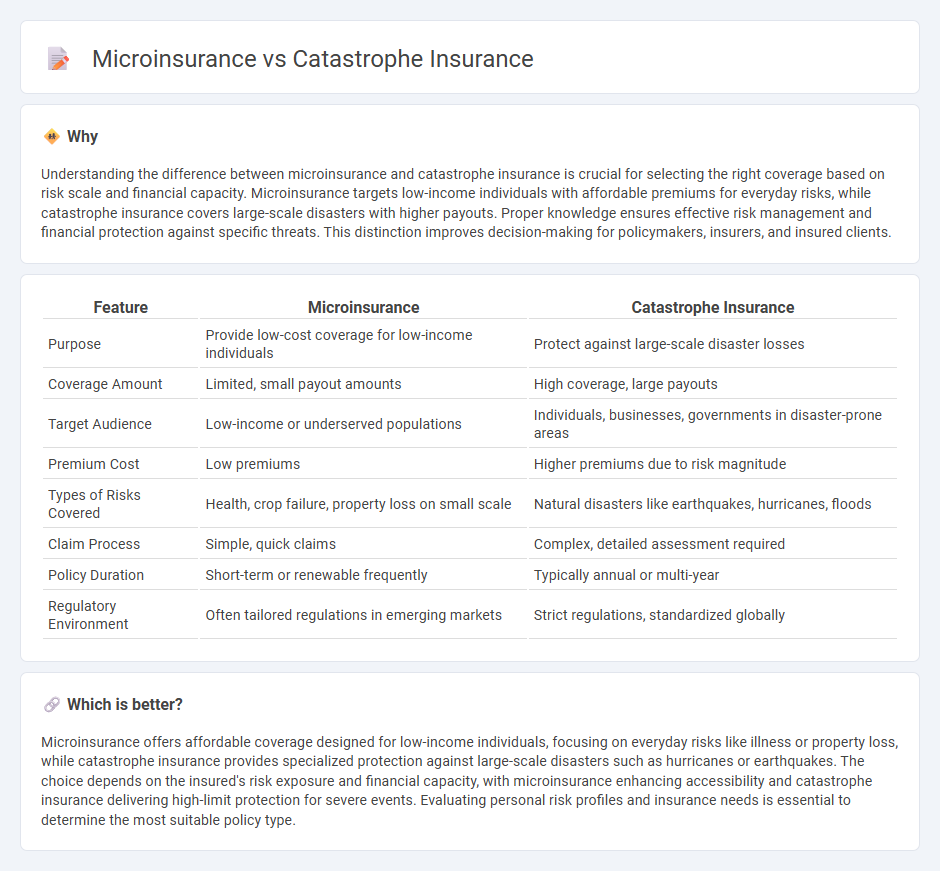

Understanding the difference between microinsurance and catastrophe insurance is crucial for selecting the right coverage based on risk scale and financial capacity. Microinsurance targets low-income individuals with affordable premiums for everyday risks, while catastrophe insurance covers large-scale disasters with higher payouts. Proper knowledge ensures effective risk management and financial protection against specific threats. This distinction improves decision-making for policymakers, insurers, and insured clients.

Comparison Table

| Feature | Microinsurance | Catastrophe Insurance |

|---|---|---|

| Purpose | Provide low-cost coverage for low-income individuals | Protect against large-scale disaster losses |

| Coverage Amount | Limited, small payout amounts | High coverage, large payouts |

| Target Audience | Low-income or underserved populations | Individuals, businesses, governments in disaster-prone areas |

| Premium Cost | Low premiums | Higher premiums due to risk magnitude |

| Types of Risks Covered | Health, crop failure, property loss on small scale | Natural disasters like earthquakes, hurricanes, floods |

| Claim Process | Simple, quick claims | Complex, detailed assessment required |

| Policy Duration | Short-term or renewable frequently | Typically annual or multi-year |

| Regulatory Environment | Often tailored regulations in emerging markets | Strict regulations, standardized globally |

Which is better?

Microinsurance offers affordable coverage designed for low-income individuals, focusing on everyday risks like illness or property loss, while catastrophe insurance provides specialized protection against large-scale disasters such as hurricanes or earthquakes. The choice depends on the insured's risk exposure and financial capacity, with microinsurance enhancing accessibility and catastrophe insurance delivering high-limit protection for severe events. Evaluating personal risk profiles and insurance needs is essential to determine the most suitable policy type.

Connection

Microinsurance and catastrophe insurance both provide financial protection against risks but target different scales of coverage; microinsurance offers affordable policies for low-income individuals facing everyday risks, while catastrophe insurance covers large-scale events like natural disasters. The connection lies in their shared goal to mitigate financial losses and enhance resilience for vulnerable populations facing unexpected calamities. Integrating microinsurance with catastrophe insurance can improve risk management by expanding coverage access and strengthening community-level disaster recovery.

Key Terms

Catastrophe insurance:

Catastrophe insurance provides comprehensive coverage against large-scale natural disasters such as hurricanes, earthquakes, and floods, offering substantial financial protection for individuals and businesses facing significant losses. These policies typically involve higher premiums and cover extensive damages to property and infrastructure, making them critical for high-risk areas prone to catastrophic events. Explore more to understand how catastrophe insurance can safeguard your assets and ensure financial resilience in disaster-prone regions.

Reinsurance

Reinsurance plays a crucial role in both catastrophe insurance and microinsurance by providing financial stability and risk mitigation for insurers facing large-scale claims from natural disasters or widespread losses in low-income communities. Catastrophe insurance relies heavily on reinsurance to handle massive, high-severity events, while microinsurance benefits from reinsurance through pooled risk and scalability in covering smaller, localized risks. Explore how reinsurance strategies enhance the resilience and sustainability of these insurance models for deeper insights.

Loss modeling

Catastrophe insurance employs sophisticated loss modeling techniques such as probabilistic catastrophe models integrating hazard, exposure, and vulnerability data to estimate potential financial losses from extreme events like hurricanes or earthquakes. Microinsurance utilizes simplified, cost-effective loss models tailored to low-income populations with limited data availability, often relying on index-based triggers or aggregated loss assessments to streamline claims processing. Discover how advanced loss modeling innovations are shaping the future of both insurance sectors for better risk management.

Source and External Links

Innovative Natural Disaster & Catastrophe Insurance - This insurance offers tailored, parametric-based coverage to help businesses minimize financial losses from natural disasters, using advanced risk modeling and multi-year protection options.

ICAT | Home - ICAT provides comprehensive catastrophe insurance for homeowners and businesses in high-risk regions, specializing in rapid claims processing and customized protection backed by decades of industry experience.

6 Tips for Catastrophe Insurance Coverage - Standard homeowners insurance often excludes certain disasters, so it's important to review your policy and consider additional coverage for risks like floods, earthquakes, or wind damage.

dowidth.com

dowidth.com