On-demand insurance offers flexible coverage activated only when needed, providing convenience and cost savings for short-term or specific risks. Microinsurance delivers affordable policies tailored to low-income individuals, addressing essential protection gaps in underserved communities. Explore the distinctions and benefits of on-demand insurance versus microinsurance to determine the best fit for your needs.

Why it is important

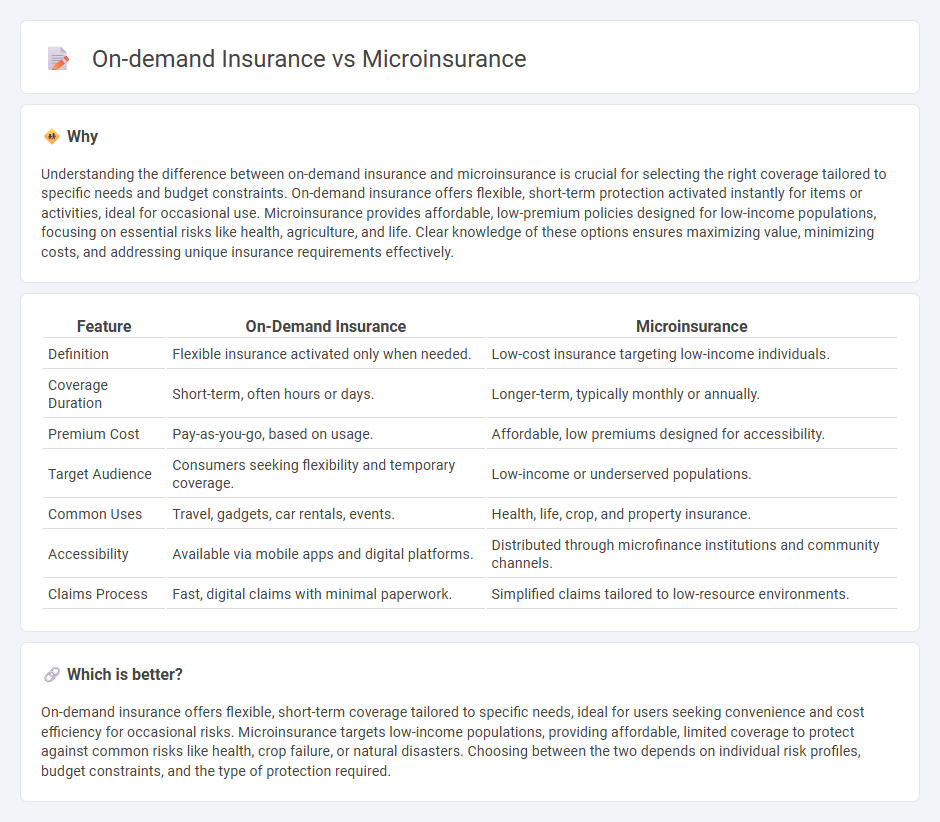

Understanding the difference between on-demand insurance and microinsurance is crucial for selecting the right coverage tailored to specific needs and budget constraints. On-demand insurance offers flexible, short-term protection activated instantly for items or activities, ideal for occasional use. Microinsurance provides affordable, low-premium policies designed for low-income populations, focusing on essential risks like health, agriculture, and life. Clear knowledge of these options ensures maximizing value, minimizing costs, and addressing unique insurance requirements effectively.

Comparison Table

| Feature | On-Demand Insurance | Microinsurance |

|---|---|---|

| Definition | Flexible insurance activated only when needed. | Low-cost insurance targeting low-income individuals. |

| Coverage Duration | Short-term, often hours or days. | Longer-term, typically monthly or annually. |

| Premium Cost | Pay-as-you-go, based on usage. | Affordable, low premiums designed for accessibility. |

| Target Audience | Consumers seeking flexibility and temporary coverage. | Low-income or underserved populations. |

| Common Uses | Travel, gadgets, car rentals, events. | Health, life, crop, and property insurance. |

| Accessibility | Available via mobile apps and digital platforms. | Distributed through microfinance institutions and community channels. |

| Claims Process | Fast, digital claims with minimal paperwork. | Simplified claims tailored to low-resource environments. |

Which is better?

On-demand insurance offers flexible, short-term coverage tailored to specific needs, ideal for users seeking convenience and cost efficiency for occasional risks. Microinsurance targets low-income populations, providing affordable, limited coverage to protect against common risks like health, crop failure, or natural disasters. Choosing between the two depends on individual risk profiles, budget constraints, and the type of protection required.

Connection

On-demand insurance and microinsurance both focus on providing flexible, affordable coverage tailored to specific, short-term needs, ideal for underserved markets and gig economy workers. These models leverage digital platforms and mobile technology to enable instant policy activation, improving accessibility and convenience. By addressing gaps in traditional insurance, they expand financial protection to low-income populations and individuals seeking customizable risk management solutions.

Key Terms

**Microinsurance:**

Microinsurance targets low-income individuals by providing affordable, tailored coverage for health, agriculture, and life risks, often facilitated through community-based models or mobile platforms. It emphasizes accessible premium payments and simplified claim processes to enhance financial inclusion in underserved markets. Explore more to understand how microinsurance transforms risk management for vulnerable populations.

Low Premiums

Microinsurance offers low premiums tailored for low-income populations, providing essential coverage with minimal financial burden, often targeting specific risks like health or crops. On-demand insurance delivers flexible, pay-as-you-go policies, allowing users to activate coverage only when needed, optimizing cost-efficiency for short-term or occasional protection. Explore how these innovative insurance models redefine affordability and accessibility for diverse customer needs.

Targeted Coverage

Microinsurance offers targeted coverage by providing low-cost, simplified insurance products tailored for low-income populations, protecting against specific risks such as health, crop failure, or natural disasters. On-demand insurance delivers flexible, pay-as-you-go protection that enables users to activate coverage only when needed, ideal for variable or short-term risks like travel, gadget, or auto insurance. Explore the key differences and advantages of these insurance models to determine which best suits your coverage needs.

Source and External Links

Microinsurance - Wikipedia - Microinsurance provides low-premium, limited-coverage insurance products tailored for low-income individuals, protecting them against specific risks like health issues, accidents, or loss of assets, and can be distributed through various channels including community groups and large insurers.

Background on: microinsurance and emerging markets | III - Microinsurance offers affordable, low-cost protection to people in developing countries who are typically excluded from traditional insurance or government programs, often bundled with small loans and characterized by high volume and efficient administration.

Microinsurance | Insurance - Milliman - Microinsurance is specifically designed for low-income populations, with products that are accessible, simple, and valuable, aiming to protect vulnerable groups from risks that could perpetuate poverty, such as illness, crop failure, or disasters.

dowidth.com

dowidth.com