Gig worker insurance typically offers flexible coverage tailored to self-employed individuals, often lacking employer-sponsored benefits such as health, disability, and unemployment insurance available to full-time employees. Full-time employee insurance generally includes comprehensive packages with employer contributions, encompassing medical, dental, vision, and retirement plans. Explore the key differences and options to determine the best insurance coverage for your work situation.

Why it is important

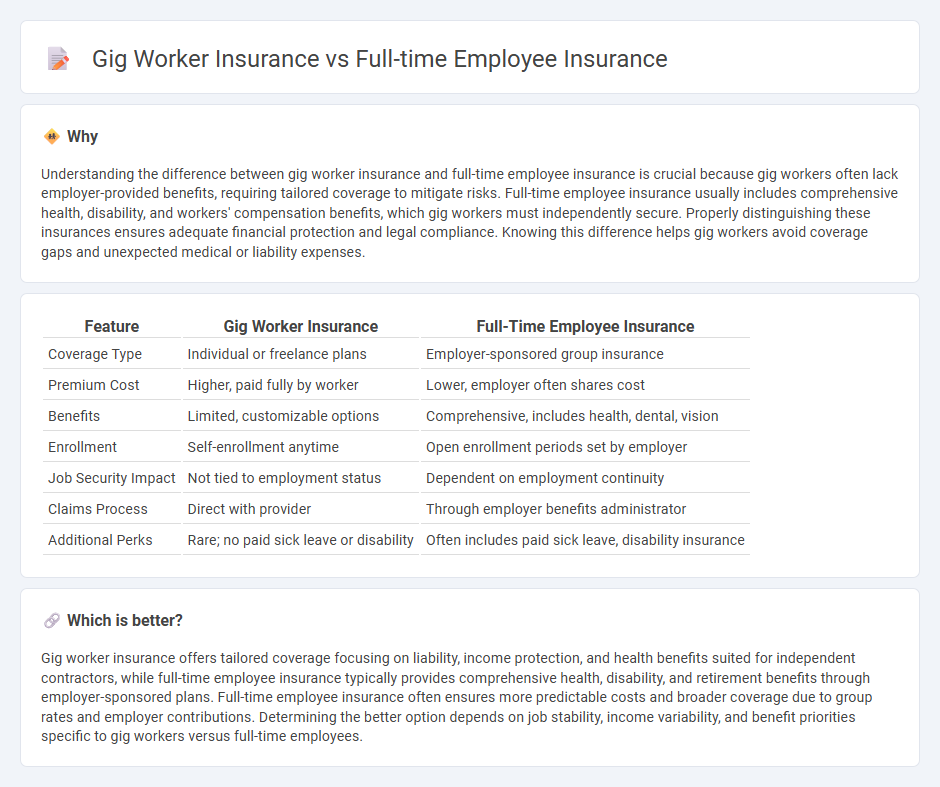

Understanding the difference between gig worker insurance and full-time employee insurance is crucial because gig workers often lack employer-provided benefits, requiring tailored coverage to mitigate risks. Full-time employee insurance usually includes comprehensive health, disability, and workers' compensation benefits, which gig workers must independently secure. Properly distinguishing these insurances ensures adequate financial protection and legal compliance. Knowing this difference helps gig workers avoid coverage gaps and unexpected medical or liability expenses.

Comparison Table

| Feature | Gig Worker Insurance | Full-Time Employee Insurance |

|---|---|---|

| Coverage Type | Individual or freelance plans | Employer-sponsored group insurance |

| Premium Cost | Higher, paid fully by worker | Lower, employer often shares cost |

| Benefits | Limited, customizable options | Comprehensive, includes health, dental, vision |

| Enrollment | Self-enrollment anytime | Open enrollment periods set by employer |

| Job Security Impact | Not tied to employment status | Dependent on employment continuity |

| Claims Process | Direct with provider | Through employer benefits administrator |

| Additional Perks | Rare; no paid sick leave or disability | Often includes paid sick leave, disability insurance |

Which is better?

Gig worker insurance offers tailored coverage focusing on liability, income protection, and health benefits suited for independent contractors, while full-time employee insurance typically provides comprehensive health, disability, and retirement benefits through employer-sponsored plans. Full-time employee insurance often ensures more predictable costs and broader coverage due to group rates and employer contributions. Determining the better option depends on job stability, income variability, and benefit priorities specific to gig workers versus full-time employees.

Connection

Gig worker insurance and full-time employee insurance intersect through shared coverage needs such as health, disability, and liability protection. Both insurance types aim to mitigate financial risks by offering tailored plans that address income variability and job security differences. Understanding these connections helps optimize benefits for diverse work arrangements within evolving labor markets.

Key Terms

Group Coverage

Group coverage under full-time employee insurance typically offers comprehensive health benefits negotiated by employers, resulting in lower premiums and broader plan options. Gig worker insurance often relies on individual plans, which can be costlier and less inclusive due to lack of group bargaining power. Explore more about how group coverage impacts insurance benefits for both full-time employees and gig workers.

Individual Policy

Individual insurance policies for full-time employees typically offer comprehensive coverage through employer-sponsored group plans, with lower premiums and benefits like health, dental, and vision included. Gig workers rely on individual policies that require them to shop independently, often facing higher costs and less extensive coverage due to the absence of employer subsidies. Explore detailed comparisons and personalized options to determine the best individual insurance policy for your employment status.

Portability

Full-time employee insurance typically offers limited portability, as coverage is tied to the employer and often ends when employment does. Gig worker insurance provides greater portability, allowing continuous coverage regardless of changing jobs or contracts, which is vital in the flexible gig economy. Explore detailed comparisons to understand which insurance type best fits your lifestyle and needs.

Source and External Links

Full-Time vs Part-Time Benefits: Why It Matters - SBMA - Employers with 50 or more full-time employees are required under the ACA's Employer Mandate to provide these employees with affordable health insurance meeting minimum essential coverage and value requirements, ensuring comprehensive and affordable plans for full-time staff.

Differences in Full Time vs. Part Time Benefits - Justworks - Full-time employees in the US typically receive employer-sponsored health insurance with significant premium contributions, along with other benefits like retirement plans and paid leave, which are less commonly provided to part-time employees.

Who's a full-time employee under the ACA? - Triton HR - Under the ACA, full-time employees are defined as those working an average of 30 hours or more per week, and employers must count these employees for health insurance coverage mandates.

dowidth.com

dowidth.com