NFT insurance protects digital assets by covering risks such as theft, fraud, and smart contract failures, ensuring the security of non-fungible tokens in blockchain markets. Microinsurance offers affordable coverage tailored to low-income individuals, addressing needs like health, agriculture, and disaster protection with low premiums and simplified claims. Discover how these innovative insurance models are transforming risk management in emerging digital and socioeconomic landscapes.

Why it is important

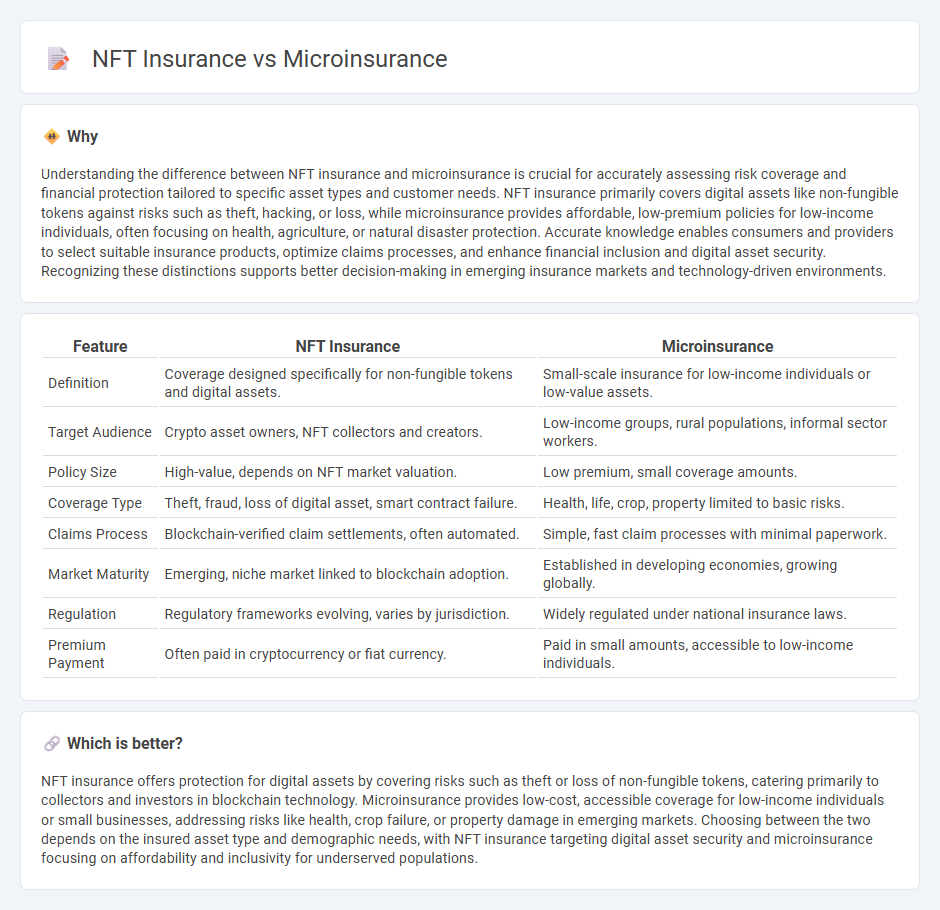

Understanding the difference between NFT insurance and microinsurance is crucial for accurately assessing risk coverage and financial protection tailored to specific asset types and customer needs. NFT insurance primarily covers digital assets like non-fungible tokens against risks such as theft, hacking, or loss, while microinsurance provides affordable, low-premium policies for low-income individuals, often focusing on health, agriculture, or natural disaster protection. Accurate knowledge enables consumers and providers to select suitable insurance products, optimize claims processes, and enhance financial inclusion and digital asset security. Recognizing these distinctions supports better decision-making in emerging insurance markets and technology-driven environments.

Comparison Table

| Feature | NFT Insurance | Microinsurance |

|---|---|---|

| Definition | Coverage designed specifically for non-fungible tokens and digital assets. | Small-scale insurance for low-income individuals or low-value assets. |

| Target Audience | Crypto asset owners, NFT collectors and creators. | Low-income groups, rural populations, informal sector workers. |

| Policy Size | High-value, depends on NFT market valuation. | Low premium, small coverage amounts. |

| Coverage Type | Theft, fraud, loss of digital asset, smart contract failure. | Health, life, crop, property limited to basic risks. |

| Claims Process | Blockchain-verified claim settlements, often automated. | Simple, fast claim processes with minimal paperwork. |

| Market Maturity | Emerging, niche market linked to blockchain adoption. | Established in developing economies, growing globally. |

| Regulation | Regulatory frameworks evolving, varies by jurisdiction. | Widely regulated under national insurance laws. |

| Premium Payment | Often paid in cryptocurrency or fiat currency. | Paid in small amounts, accessible to low-income individuals. |

Which is better?

NFT insurance offers protection for digital assets by covering risks such as theft or loss of non-fungible tokens, catering primarily to collectors and investors in blockchain technology. Microinsurance provides low-cost, accessible coverage for low-income individuals or small businesses, addressing risks like health, crop failure, or property damage in emerging markets. Choosing between the two depends on the insured asset type and demographic needs, with NFT insurance targeting digital asset security and microinsurance focusing on affordability and inclusivity for underserved populations.

Connection

NFT insurance provides coverage for digital assets by protecting against risks such as theft or fraud, while microinsurance offers affordable, low-premium policies tailored for underserved populations. Both insurance models leverage blockchain technology to enhance transparency, reduce costs, and streamline claims processing. The convergence of NFT insurance and microinsurance enables secure, accessible protection solutions in the evolving digital economy.

Key Terms

Accessibility

Microinsurance offers affordable, low-premium coverage tailored to low-income populations, increasing insurance accessibility in emerging markets. NFT insurance provides protection for digital assets like non-fungible tokens, catering to the growing blockchain and cryptocurrency ecosystem. Explore how these innovative insurance models enhance access and security in their respective domains.

Smart Contracts

Microinsurance leverages smart contracts to automate policy issuance and claim settlements, ensuring transparency and swift processing for low-income populations. NFT insurance employs smart contracts to provide decentralized and customizable coverage for digital assets, enabling seamless verification of ownership and claim validation. Explore how smart contracts revolutionize insurance models by enhancing efficiency and security.

Premium Structure

Microinsurance typically features low, affordable premiums designed to cover specific risks for low-income individuals, emphasizing accessibility and simplicity. NFT insurance premiums vary widely based on the rarity, value, and volatility of the underlying digital asset, often incorporating dynamic pricing models influenced by blockchain data. Explore deeper insights into premium structures shaping microinsurance and NFT insurance markets.

Source and External Links

Microinsurance - Microinsurance provides low-cost insurance coverage to low-income individuals, protecting them against specific risks with low premiums and limited coverage.

Background on: microinsurance and emerging markets - This article discusses how microinsurance offers low-cost protection to individuals in developing countries, often through partnerships with microfinance organizations.

Microinsurance - Microinsurance is designed to be affordable and accessible for low-income individuals, offering protection against various risks such as health issues and natural disasters.

dowidth.com

dowidth.com