Buy-now-pay-later protection offers consumers flexible payment options by allowing them to spread the cost of insurance over time, enhancing affordability and immediate coverage access. Embedded insurance integrates coverage directly into the purchase process of goods or services, streamlining user experience and increasing policy adoption rates. Explore how these innovative insurance models transform risk management and customer satisfaction.

Why it is important

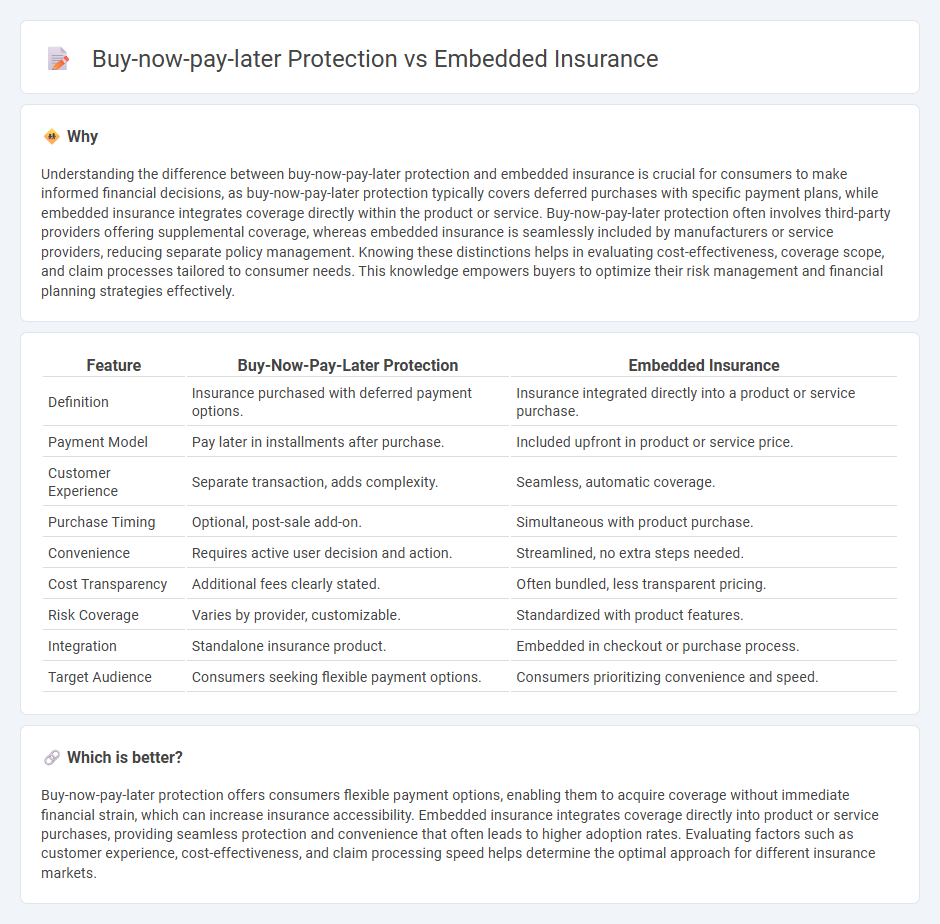

Understanding the difference between buy-now-pay-later protection and embedded insurance is crucial for consumers to make informed financial decisions, as buy-now-pay-later protection typically covers deferred purchases with specific payment plans, while embedded insurance integrates coverage directly within the product or service. Buy-now-pay-later protection often involves third-party providers offering supplemental coverage, whereas embedded insurance is seamlessly included by manufacturers or service providers, reducing separate policy management. Knowing these distinctions helps in evaluating cost-effectiveness, coverage scope, and claim processes tailored to consumer needs. This knowledge empowers buyers to optimize their risk management and financial planning strategies effectively.

Comparison Table

| Feature | Buy-Now-Pay-Later Protection | Embedded Insurance |

|---|---|---|

| Definition | Insurance purchased with deferred payment options. | Insurance integrated directly into a product or service purchase. |

| Payment Model | Pay later in installments after purchase. | Included upfront in product or service price. |

| Customer Experience | Separate transaction, adds complexity. | Seamless, automatic coverage. |

| Purchase Timing | Optional, post-sale add-on. | Simultaneous with product purchase. |

| Convenience | Requires active user decision and action. | Streamlined, no extra steps needed. |

| Cost Transparency | Additional fees clearly stated. | Often bundled, less transparent pricing. |

| Risk Coverage | Varies by provider, customizable. | Standardized with product features. |

| Integration | Standalone insurance product. | Embedded in checkout or purchase process. |

| Target Audience | Consumers seeking flexible payment options. | Consumers prioritizing convenience and speed. |

Which is better?

Buy-now-pay-later protection offers consumers flexible payment options, enabling them to acquire coverage without immediate financial strain, which can increase insurance accessibility. Embedded insurance integrates coverage directly into product or service purchases, providing seamless protection and convenience that often leads to higher adoption rates. Evaluating factors such as customer experience, cost-effectiveness, and claim processing speed helps determine the optimal approach for different insurance markets.

Connection

Buy-now-pay-later protection integrates insurance coverage into installment payment plans, reducing financial risk for consumers who split purchases into manageable payments. Embedded insurance seamlessly incorporates coverage within the product or service purchase process, enhancing convenience and ensuring immediate protection. Both models leverage digital platforms to streamline insurance acquisition, improve customer experience, and drive higher adoption rates in retail and e-commerce sectors.

Key Terms

Integration

Embedded insurance integrates coverage seamlessly within a product or service purchase, enhancing customer experience by reducing the need for separate transactions. Buy-now-pay-later (BNPL) protection, while often offered as an add-on, typically requires a distinct selection process and may not be fully integrated into the checkout flow. Explore how integrating these options impacts customer engagement and conversion efficiency in various industries.

Risk Coverage

Embedded insurance integrates risk coverage directly within the purchase process, offering seamless protection tailored to the specific product or service, enhancing customer convenience and reducing friction. Buy-now-pay-later protection provides risk mitigation for installment payments, focusing on safeguarding consumers against payment defaults, accidents, or loss during the financing period. Explore further to understand how these innovative insurance models impact consumer choice and risk management.

Real-time Underwriting

Embedded insurance integrates coverage directly into the purchase process, leveraging real-time underwriting to tailor premiums instantly based on customer data and risk profiles. Buy-now-pay-later protection uses similar real-time underwriting techniques but emphasizes flexible payment options concurrent with installment plans, enhancing affordability and accessibility. Explore how real-time underwriting is revolutionizing insurance and payment protection by unlocking seamless, personalized financial solutions.

Source and External Links

What is embedded insurance - Embedded insurance integrates relevant risk protection seamlessly into customers' purchase journeys, allowing them to add coverage at the point of sale without interrupting their buying experience, such as travel insurance with airline tickets or cellphone insurance with a new handset purchase.

Embedded insurance: Definition, types, benefits - Embedded insurance differs from traditional insurance by being directly incorporated into the product or service purchase process, enhancing accessibility and inclusivity by offering immediate coverage and simplifying access.

The Rise of Embedded Insurance: Opportunities & Challenges - The embedded insurance market is rapidly expanding, predicted to represent over 30% of insurance transactions by 2028, driven by enhanced customer experience and seamless integration at the point of sale across industries like ride-sharing and e-commerce.

dowidth.com

dowidth.com