Crop microinsurance provides financial protection to small-scale farmers against losses caused by weather events, pests, or disease, ensuring their agricultural productivity and livelihood stability. Income protection insurance offers individuals a safety net by replacing a portion of their income during periods of disability or inability to work, maintaining financial security. Explore the differences and benefits of each insurance type to choose the coverage that best suits your needs.

Why it is important

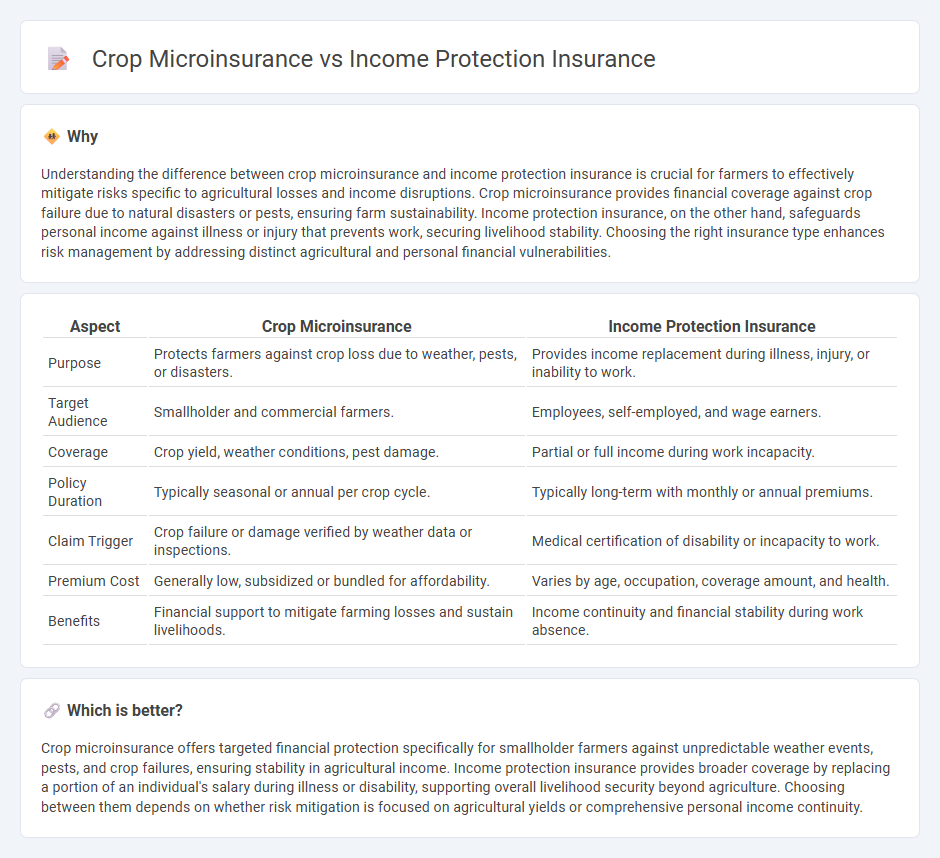

Understanding the difference between crop microinsurance and income protection insurance is crucial for farmers to effectively mitigate risks specific to agricultural losses and income disruptions. Crop microinsurance provides financial coverage against crop failure due to natural disasters or pests, ensuring farm sustainability. Income protection insurance, on the other hand, safeguards personal income against illness or injury that prevents work, securing livelihood stability. Choosing the right insurance type enhances risk management by addressing distinct agricultural and personal financial vulnerabilities.

Comparison Table

| Aspect | Crop Microinsurance | Income Protection Insurance |

|---|---|---|

| Purpose | Protects farmers against crop loss due to weather, pests, or disasters. | Provides income replacement during illness, injury, or inability to work. |

| Target Audience | Smallholder and commercial farmers. | Employees, self-employed, and wage earners. |

| Coverage | Crop yield, weather conditions, pest damage. | Partial or full income during work incapacity. |

| Policy Duration | Typically seasonal or annual per crop cycle. | Typically long-term with monthly or annual premiums. |

| Claim Trigger | Crop failure or damage verified by weather data or inspections. | Medical certification of disability or incapacity to work. |

| Premium Cost | Generally low, subsidized or bundled for affordability. | Varies by age, occupation, coverage amount, and health. |

| Benefits | Financial support to mitigate farming losses and sustain livelihoods. | Income continuity and financial stability during work absence. |

Which is better?

Crop microinsurance offers targeted financial protection specifically for smallholder farmers against unpredictable weather events, pests, and crop failures, ensuring stability in agricultural income. Income protection insurance provides broader coverage by replacing a portion of an individual's salary during illness or disability, supporting overall livelihood security beyond agriculture. Choosing between them depends on whether risk mitigation is focused on agricultural yields or comprehensive personal income continuity.

Connection

Crop microinsurance and income protection insurance are interconnected through their shared goal of safeguarding financial stability for individuals dependent on agriculture. Crop microinsurance mitigates risks related to crop failure and adverse weather, directly impacting farmers' income, while income protection insurance ensures a steady income flow during periods of illness, injury, or inability to work. Together, these insurance types form a comprehensive risk management strategy, enhancing resilience for farming households against diverse economic uncertainties.

Key Terms

**Income Protection Insurance:**

Income Protection Insurance safeguards policyholders by replacing a portion of lost income due to illness or injury, ensuring financial stability during periods of incapacity. This insurance typically covers up to 70% of regular earnings and is essential for individuals dependent on a steady income for daily expenses and long-term commitments. Discover how Income Protection Insurance can secure your financial future and provide peace of mind in uncertain times.

Benefit Period

Income protection insurance typically offers a benefit period ranging from short-term spans like 2 years to long-term coverage up to retirement age, ensuring continuous income replacement during disability. Crop microinsurance, however, provides coverage tied specifically to crop cycles, usually lasting only for the duration of a single growing season or harvest period. Explore the details of benefit periods and coverage specifics to determine which insurance product best supports your financial security.

Waiting Period

Income protection insurance typically features a waiting period ranging from 7 to 30 days before benefits commence, designed to support individuals during temporary loss of earnings due to illness or injury. Crop microinsurance often has a shorter waiting period, sometimes as brief as 3 to 7 days, addressing rapid onset agricultural risks such as drought or pest infestation to ensure timely financial aid for smallholder farmers. Explore detailed comparisons to understand how waiting periods impact claim processes and coverage effectiveness in both insurance types.

Source and External Links

What is income protection insurance? - Provides regular payments to replace part of your income if you are unable to work due to illness or an accident.

Income protection insurance - Offers flexible income protection that covers up to 60% of your gross annual income, with payouts continuing until you return to work or reach a specified age.

Income protection insurance - Also known as loss of earnings insurance, it pays benefits to policyholders who are incapacitated and unable to work due to illness or accident.

dowidth.com

dowidth.com