Digital health insurance offers personalized coverage through technology-driven platforms, enabling real-time access to medical records, telemedicine, and automated claims processing. Group health insurance provides collective benefits by covering employees of an organization under a single plan, often resulting in lower premiums and comprehensive wellness programs. Explore how these insurance types can fit your healthcare needs and budget.

Why it is important

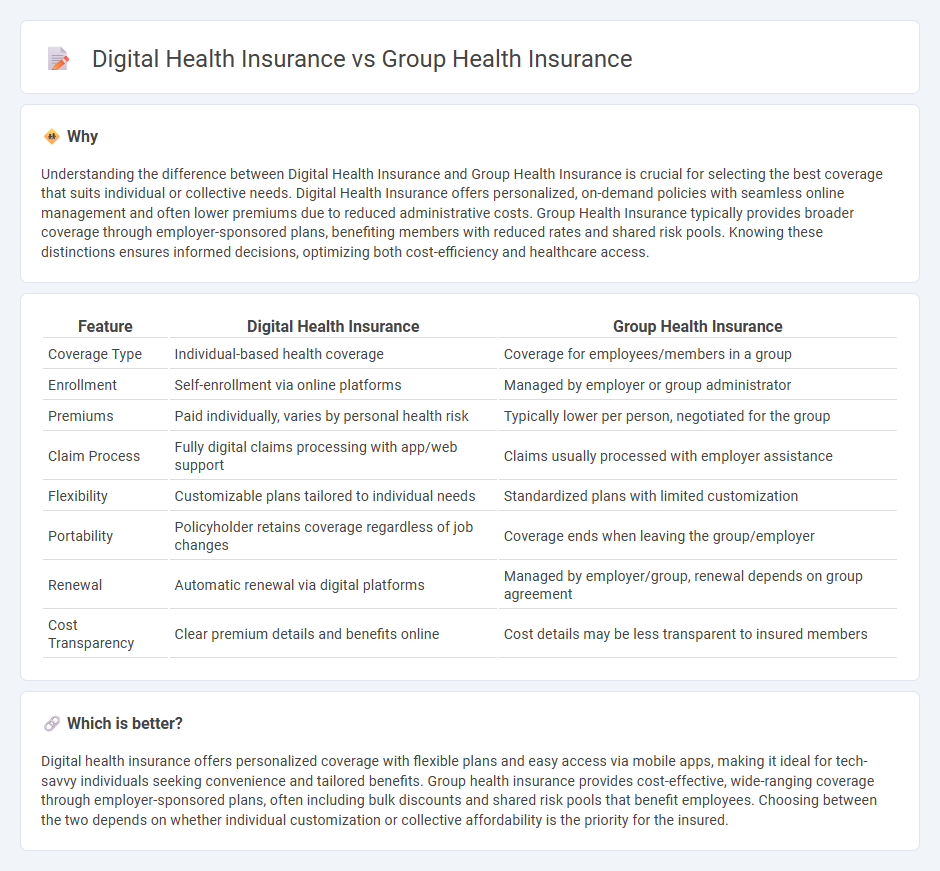

Understanding the difference between Digital Health Insurance and Group Health Insurance is crucial for selecting the best coverage that suits individual or collective needs. Digital Health Insurance offers personalized, on-demand policies with seamless online management and often lower premiums due to reduced administrative costs. Group Health Insurance typically provides broader coverage through employer-sponsored plans, benefiting members with reduced rates and shared risk pools. Knowing these distinctions ensures informed decisions, optimizing both cost-efficiency and healthcare access.

Comparison Table

| Feature | Digital Health Insurance | Group Health Insurance |

|---|---|---|

| Coverage Type | Individual-based health coverage | Coverage for employees/members in a group |

| Enrollment | Self-enrollment via online platforms | Managed by employer or group administrator |

| Premiums | Paid individually, varies by personal health risk | Typically lower per person, negotiated for the group |

| Claim Process | Fully digital claims processing with app/web support | Claims usually processed with employer assistance |

| Flexibility | Customizable plans tailored to individual needs | Standardized plans with limited customization |

| Portability | Policyholder retains coverage regardless of job changes | Coverage ends when leaving the group/employer |

| Renewal | Automatic renewal via digital platforms | Managed by employer/group, renewal depends on group agreement |

| Cost Transparency | Clear premium details and benefits online | Cost details may be less transparent to insured members |

Which is better?

Digital health insurance offers personalized coverage with flexible plans and easy access via mobile apps, making it ideal for tech-savvy individuals seeking convenience and tailored benefits. Group health insurance provides cost-effective, wide-ranging coverage through employer-sponsored plans, often including bulk discounts and shared risk pools that benefit employees. Choosing between the two depends on whether individual customization or collective affordability is the priority for the insured.

Connection

Digital health insurance leverages technology to streamline policy management, claims processing, and customer engagement, enhancing the efficiency of group health insurance plans. Group health insurance benefits from digital platforms by providing real-time access to coverage details, personalized health insights, and seamless communication between employers, insurers, and employees. Integrating digital solutions into group health insurance strengthens data analytics, risk assessment, and cost management for both insurers and policyholders.

Key Terms

Policyholder (Group / Individual)

Group health insurance primarily covers policyholders as members of an organization, enabling collective bargaining power and typically offering lower premiums for employees under one master policy. Digital health insurance targets individual policyholders, providing personalized coverage options and streamlined management through online platforms, enhancing accessibility and convenience. Explore the benefits and differences further to determine which option best suits your healthcare needs.

Underwriting Process (Manual / Automated)

Group health insurance underwriting typically involves a manual process where insurers assess risk based on aggregated employee data, leading to longer approval times and potential variability in coverage terms. Digital health insurance leverages automated underwriting powered by AI algorithms, enabling real-time risk assessment, faster policy issuance, and personalized premiums based on individual health metrics. Explore how automated underwriting transforms insurance efficiency and customer experience.

Claims Management (Traditional / Online Platform)

Group health insurance claims management traditionally involves manual paperwork, delayed approvals, and longer settlement times, impacting overall efficiency. Digital health insurance platforms streamline claims processing through automated submission, real-time tracking, and faster reimbursements, improving transparency and customer satisfaction. Explore how digital transformation revolutionizes claims management for enhanced group health coverage experience.

Source and External Links

Group Health Insurance through Trade Organizations - Provides group health insurance options through professional, trade, or membership organizations, offering affordable coverage by sharing medical costs among members.

Group Health Insurance Medical Plans - Offers employers a range of group health insurance plans with personalized whole health approaches and deep engagement with healthcare providers.

Health Insurance for Small Businesses - Provides group health insurance plans designed for small businesses, including flexible plan options and a nationwide provider network.

dowidth.com

dowidth.com