Pet insurance covers veterinary expenses for illnesses and accidents involving cats, dogs, and other animals, while life insurance provides financial support to beneficiaries after the insured person's death. Life insurance policies include term life, whole life, and universal life options, each varying in coverage duration and cash value accumulation. Discover how these insurance types protect your loved ones and pets by exploring their benefits and differences in detail.

Why it is important

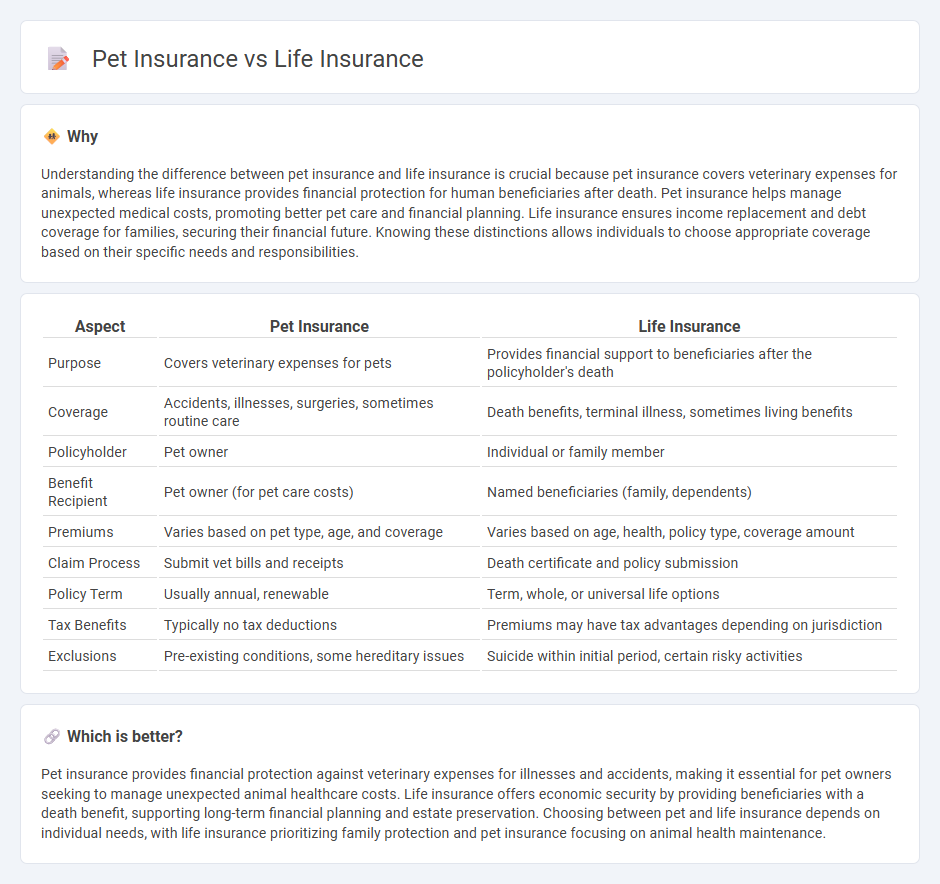

Understanding the difference between pet insurance and life insurance is crucial because pet insurance covers veterinary expenses for animals, whereas life insurance provides financial protection for human beneficiaries after death. Pet insurance helps manage unexpected medical costs, promoting better pet care and financial planning. Life insurance ensures income replacement and debt coverage for families, securing their financial future. Knowing these distinctions allows individuals to choose appropriate coverage based on their specific needs and responsibilities.

Comparison Table

| Aspect | Pet Insurance | Life Insurance |

|---|---|---|

| Purpose | Covers veterinary expenses for pets | Provides financial support to beneficiaries after the policyholder's death |

| Coverage | Accidents, illnesses, surgeries, sometimes routine care | Death benefits, terminal illness, sometimes living benefits |

| Policyholder | Pet owner | Individual or family member |

| Benefit Recipient | Pet owner (for pet care costs) | Named beneficiaries (family, dependents) |

| Premiums | Varies based on pet type, age, and coverage | Varies based on age, health, policy type, coverage amount |

| Claim Process | Submit vet bills and receipts | Death certificate and policy submission |

| Policy Term | Usually annual, renewable | Term, whole, or universal life options |

| Tax Benefits | Typically no tax deductions | Premiums may have tax advantages depending on jurisdiction |

| Exclusions | Pre-existing conditions, some hereditary issues | Suicide within initial period, certain risky activities |

Which is better?

Pet insurance provides financial protection against veterinary expenses for illnesses and accidents, making it essential for pet owners seeking to manage unexpected animal healthcare costs. Life insurance offers economic security by providing beneficiaries with a death benefit, supporting long-term financial planning and estate preservation. Choosing between pet and life insurance depends on individual needs, with life insurance prioritizing family protection and pet insurance focusing on animal health maintenance.

Connection

Pet insurance and life insurance both provide financial protection by mitigating unexpected costs associated with health and mortality risks. Pet insurance helps cover veterinary expenses and emergency care, while life insurance ensures financial security for beneficiaries after an individual's death. Both types of insurance play crucial roles in comprehensive risk management strategies for families who consider pets as part of their household.

Key Terms

Beneficiary (Life insurance)

Life insurance designates a beneficiary who receives the policy payout upon the insured's death, providing financial security to dependents or heirs. Pet insurance, conversely, does not have beneficiaries since it covers veterinary expenses for the insured pet rather than providing a death benefit. Explore the distinct purposes and benefits of each insurance type to make an informed choice.

Policyholder (Pet insurance)

Pet insurance safeguards policyholders by covering veterinary expenses, ensuring affordable access to medical care for their pets. Unlike life insurance, which provides financial support to beneficiaries after the policyholder's death, pet insurance focuses on enhancing the pet's health and well-being during its lifetime. Discover how comprehensive pet insurance plans can protect your furry family members and ease your financial worries.

Underwriting (Both)

Life insurance underwriting involves evaluating an applicant's age, health history, lifestyle, and financial status to determine risk and premium costs, while pet insurance underwriting primarily assesses the pet's breed, age, pre-existing conditions, and veterinary history. Both types of underwriting aim to balance risk and coverage but differ significantly in data sources and risk factors considered. Explore more about the intricate underwriting criteria that shape life and pet insurance policies.

Source and External Links

Life Insurance | Get Your Quote Today - Offers personalized life insurance quotes and coverage options to fit your needs and budget.

Life Insurance Policy - Get a Free Quote - Provides term life, whole life, and final expense life insurance policies with guaranteed-issue options for select products.

Life Insurance - Get a Free Quote Now - Helps determine life insurance needs and offers quotes for term, whole, and universal life policies.

dowidth.com

dowidth.com