Earthquake microinsurance offers targeted financial protection against seismic events for low-income households, covering damages and losses specific to earthquakes. Property microinsurance provides broader coverage against various risks such as fire, theft, and natural disasters, safeguarding small-scale assets and homes. Explore the differences and benefits of each microinsurance type to make an informed choice for your protection needs.

Why it is important

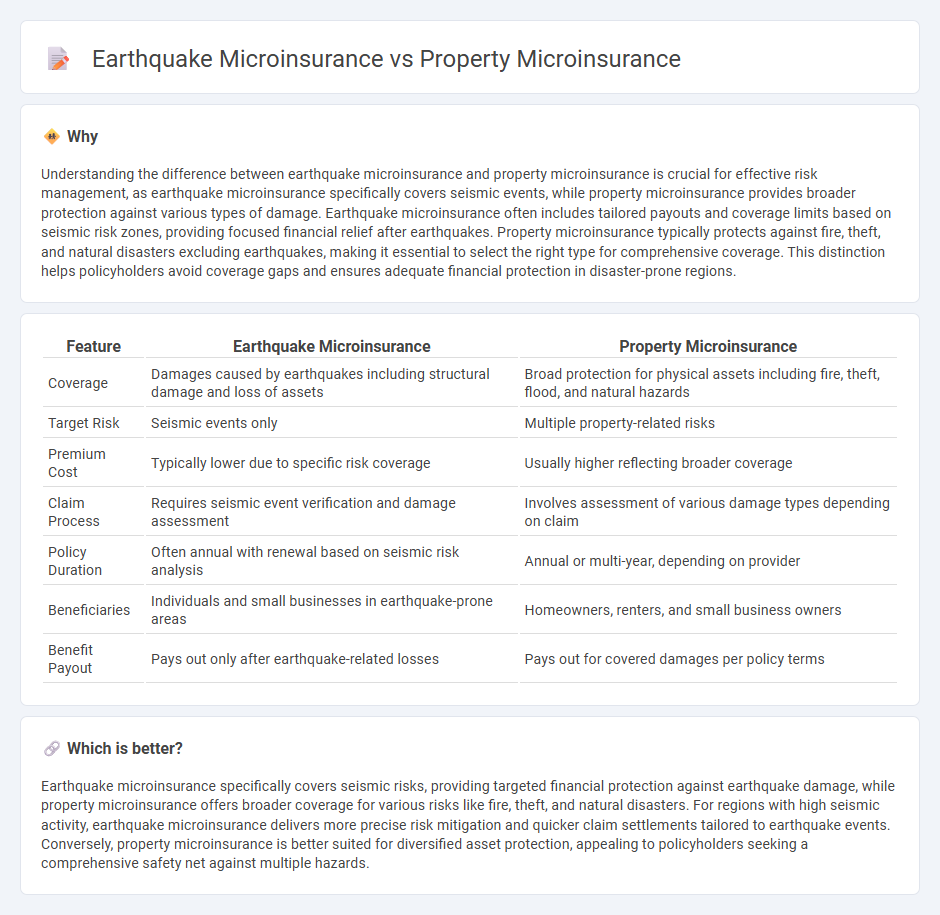

Understanding the difference between earthquake microinsurance and property microinsurance is crucial for effective risk management, as earthquake microinsurance specifically covers seismic events, while property microinsurance provides broader protection against various types of damage. Earthquake microinsurance often includes tailored payouts and coverage limits based on seismic risk zones, providing focused financial relief after earthquakes. Property microinsurance typically protects against fire, theft, and natural disasters excluding earthquakes, making it essential to select the right type for comprehensive coverage. This distinction helps policyholders avoid coverage gaps and ensures adequate financial protection in disaster-prone regions.

Comparison Table

| Feature | Earthquake Microinsurance | Property Microinsurance |

|---|---|---|

| Coverage | Damages caused by earthquakes including structural damage and loss of assets | Broad protection for physical assets including fire, theft, flood, and natural hazards |

| Target Risk | Seismic events only | Multiple property-related risks |

| Premium Cost | Typically lower due to specific risk coverage | Usually higher reflecting broader coverage |

| Claim Process | Requires seismic event verification and damage assessment | Involves assessment of various damage types depending on claim |

| Policy Duration | Often annual with renewal based on seismic risk analysis | Annual or multi-year, depending on provider |

| Beneficiaries | Individuals and small businesses in earthquake-prone areas | Homeowners, renters, and small business owners |

| Benefit Payout | Pays out only after earthquake-related losses | Pays out for covered damages per policy terms |

Which is better?

Earthquake microinsurance specifically covers seismic risks, providing targeted financial protection against earthquake damage, while property microinsurance offers broader coverage for various risks like fire, theft, and natural disasters. For regions with high seismic activity, earthquake microinsurance delivers more precise risk mitigation and quicker claim settlements tailored to earthquake events. Conversely, property microinsurance is better suited for diversified asset protection, appealing to policyholders seeking a comprehensive safety net against multiple hazards.

Connection

Earthquake microinsurance and property microinsurance are connected through their shared goal of providing financial protection to low-income individuals and communities against property damage caused by natural disasters. Both insurance types use affordable premiums and simplified claims processes to increase accessibility for vulnerable populations. They often overlap in coverage by addressing structural losses from earthquakes and other perils, enabling comprehensive risk mitigation for homeowners and small business owners.

Key Terms

Property Microinsurance:

Property microinsurance provides affordable coverage designed for low-income households to protect assets such as homes, household goods, and personal belongings against risks like fire, theft, and natural disasters. It typically features simplified claim processes and lower premiums to ensure accessibility and financial protection for vulnerable communities. Discover how property microinsurance safeguards livelihoods and promotes economic resilience in underserved populations.

Coverage Limit

Property microinsurance typically offers broader coverage limits to protect against various risks such as fire, theft, and natural disasters, whereas earthquake microinsurance focuses specifically on seismic events with coverage limits calibrated to address earthquake-related damages. Coverage limits in earthquake microinsurance are often determined based on regional seismic risk models and property values in high-risk zones, which can result in tailored payouts that differ significantly from general property policies. Explore detailed comparisons of coverage limits to determine the best fit for securing your assets against specific hazards.

Premium

Property microinsurance premiums vary based on factors such as property value, location, and coverage limits, typically offering affordable rates tailored for low-income households. Earthquake microinsurance premiums are often higher due to the increased risk and potential severity of earthquake damage, with pricing influenced by seismic zone, building structure, and historical data. Explore detailed premium comparisons and underwriting criteria to understand the cost-effectiveness of each microinsurance type.

Source and External Links

MILK Brief #18: Doing the Math - Property Microinsurance in Coastal Colombia - This brief explores the value proposition of a comprehensive property microinsurance policy in Colombia, focusing on its accessibility for low-income clients.

Microinsurance Schemes for Property - This document discusses microinsurance schemes for property, highlighting examples from Latin America and the challenges faced by such programs.

Feasibility Study for Property Microinsurance - Habitat for Humanity - This study examines the feasibility and potential of property microinsurance, particularly in addressing the needs of low-income households in Kenya.

dowidth.com

dowidth.com