Pay-as-you-drive insurance calculates premiums based on the actual time a driver spends on the road, using data from driving hours and behavior, while pay-per-mile insurance charges customers according to the exact miles driven, promoting cost savings for low-mileage drivers. Both models leverage telematics technology to offer personalized rates and encourage safer, more economical driving habits. Discover how each option can optimize your insurance costs and suit your driving patterns.

Why it is important

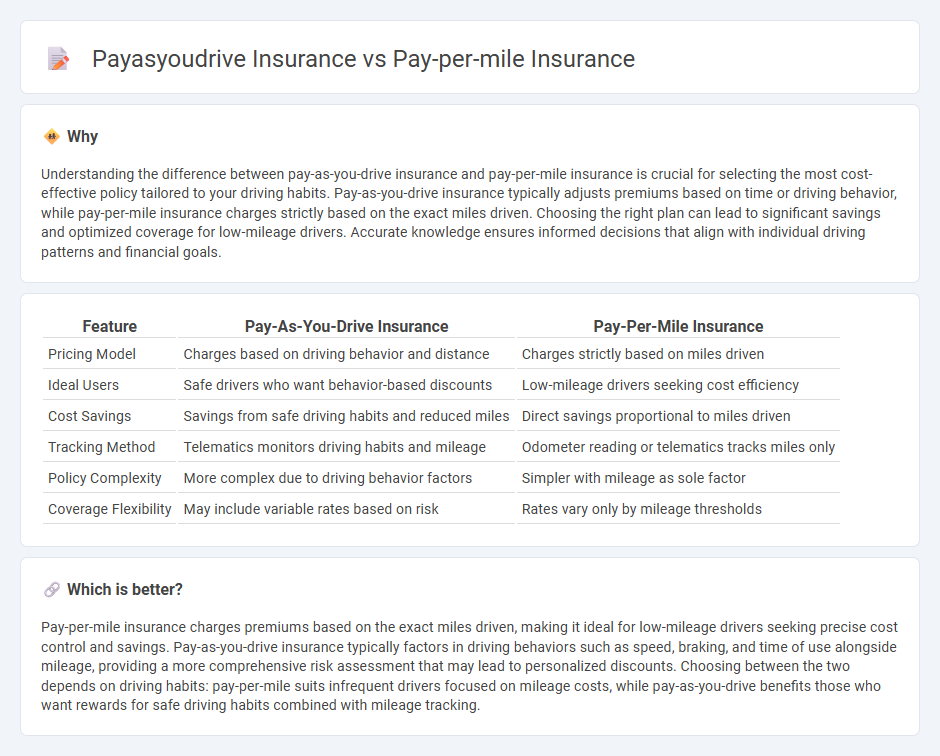

Understanding the difference between pay-as-you-drive insurance and pay-per-mile insurance is crucial for selecting the most cost-effective policy tailored to your driving habits. Pay-as-you-drive insurance typically adjusts premiums based on time or driving behavior, while pay-per-mile insurance charges strictly based on the exact miles driven. Choosing the right plan can lead to significant savings and optimized coverage for low-mileage drivers. Accurate knowledge ensures informed decisions that align with individual driving patterns and financial goals.

Comparison Table

| Feature | Pay-As-You-Drive Insurance | Pay-Per-Mile Insurance |

|---|---|---|

| Pricing Model | Charges based on driving behavior and distance | Charges strictly based on miles driven |

| Ideal Users | Safe drivers who want behavior-based discounts | Low-mileage drivers seeking cost efficiency |

| Cost Savings | Savings from safe driving habits and reduced miles | Direct savings proportional to miles driven |

| Tracking Method | Telematics monitors driving habits and mileage | Odometer reading or telematics tracks miles only |

| Policy Complexity | More complex due to driving behavior factors | Simpler with mileage as sole factor |

| Coverage Flexibility | May include variable rates based on risk | Rates vary only by mileage thresholds |

Which is better?

Pay-per-mile insurance charges premiums based on the exact miles driven, making it ideal for low-mileage drivers seeking precise cost control and savings. Pay-as-you-drive insurance typically factors in driving behaviors such as speed, braking, and time of use alongside mileage, providing a more comprehensive risk assessment that may lead to personalized discounts. Choosing between the two depends on driving habits: pay-per-mile suits infrequent drivers focused on mileage costs, while pay-as-you-drive benefits those who want rewards for safe driving habits combined with mileage tracking.

Connection

Pay-as-you-drive (PAYD) insurance and pay-per-mile insurance both use mileage-based metrics to determine premiums, promoting fairness by charging drivers based on actual road usage. PAYD insurance incorporates overall driving habits such as distance and sometimes driving behavior, while pay-per-mile insurance strictly charges per mile driven. Both models leverage telematics technology to track mileage and reduce risk for low-mileage drivers.

Key Terms

Telematics

Pay-per-mile insurance charges drivers based on the exact miles they drive, leveraging telematics devices to accurately track mileage, which directly correlates to premiums and offers cost savings for low-mileage drivers. Pay-as-you-drive insurance also uses telematics but incorporates additional driving behavior metrics such as speed, acceleration, and braking patterns to more comprehensively assess risk and determine personalized rates. Explore our in-depth analysis to understand how telematics transforms premium calculations in both insurance models.

Mileage Tracking

Pay-per-mile insurance charges customers based on the exact number of miles driven, using precise mileage tracking devices or smartphone apps to monitor and bill accordingly, ensuring fair pricing for low-mileage drivers. Pay-as-you-drive insurance also uses mileage tracking but often incorporates additional factors such as driving behavior and time of day to calculate premiums, offering a more comprehensive risk assessment. Explore more about how these mileage tracking methods impact your insurance costs and benefits.

Premium Calculation

Pay-per-mile insurance calculates premiums solely based on the exact miles driven, offering highly personalized rates for low-mileage drivers by charging a base fee plus a per-mile cost monitored via GPS or odometer readings. Pay-as-you-drive insurance incorporates additional factors such as driving behavior, time of day, and location along with mileage, resulting in a more comprehensive risk assessment that can influence premium adjustments dynamically. Explore how each model impacts both cost efficiency and risk management to determine the best fit for your driving habits.

Source and External Links

When to Consider Pay-Per-Mile Car Insurance - Capital One - Pay-per-mile insurance charges a variable premium based on mileage, typically using a flat base rate plus a per-mile charge, with mileage tracked via telematics devices or apps, and some providers may cap daily mileage charges.

Pay-Per-Mile Car Insurance: What You Should Know - NerdWallet - This insurance is best for drivers who don't drive often, offering potential savings of up to 40% for those who drive under 8,000-10,000 miles annually, but is not just a low-mileage discount like some traditional policies offer.

Pros and Cons of Pay-Per-Mile Car Insurance - Experian - Pay-per-mile insurance can cost less and offer full coverage for low-mileage drivers, but may have limited availability and your total monthly premium is calculated as: base rate + (miles driven x per-mile rate).

dowidth.com

dowidth.com