Digital nomad insurance offers tailored coverage, including travel-related risks and remote work liabilities, while traditional health insurance primarily covers medical expenses within a specific region or country. Unlike health insurance, digital nomad plans often incorporate emergency evacuation, trip interruption, and global telemedicine services. Explore comprehensive solutions to safeguard your health and work-life balance wherever your journey takes you.

Why it is important

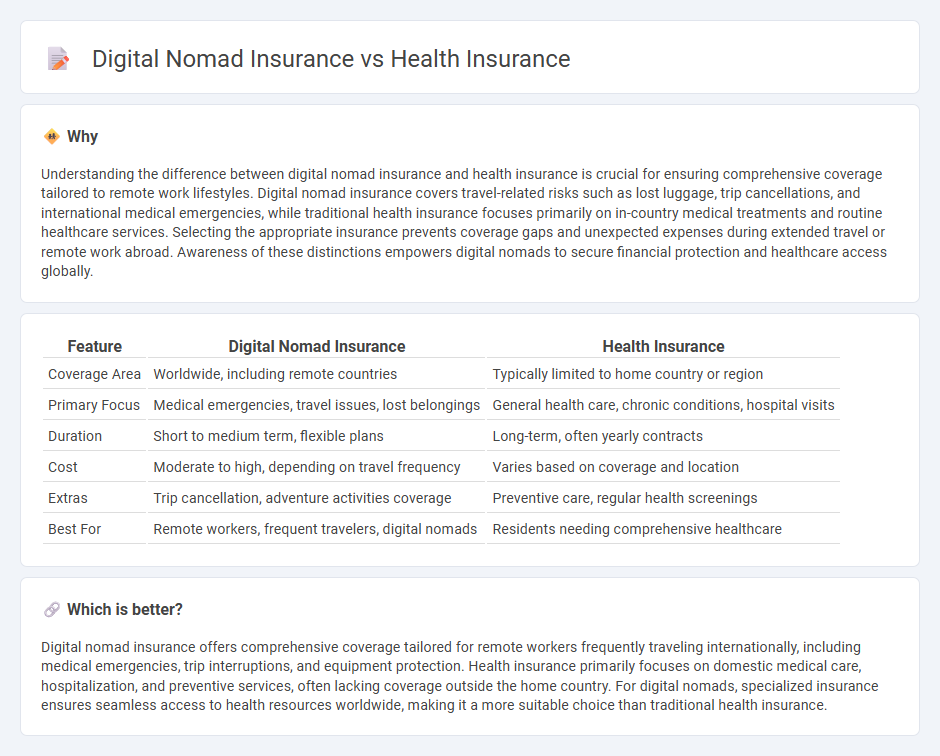

Understanding the difference between digital nomad insurance and health insurance is crucial for ensuring comprehensive coverage tailored to remote work lifestyles. Digital nomad insurance covers travel-related risks such as lost luggage, trip cancellations, and international medical emergencies, while traditional health insurance focuses primarily on in-country medical treatments and routine healthcare services. Selecting the appropriate insurance prevents coverage gaps and unexpected expenses during extended travel or remote work abroad. Awareness of these distinctions empowers digital nomads to secure financial protection and healthcare access globally.

Comparison Table

| Feature | Digital Nomad Insurance | Health Insurance |

|---|---|---|

| Coverage Area | Worldwide, including remote countries | Typically limited to home country or region |

| Primary Focus | Medical emergencies, travel issues, lost belongings | General health care, chronic conditions, hospital visits |

| Duration | Short to medium term, flexible plans | Long-term, often yearly contracts |

| Cost | Moderate to high, depending on travel frequency | Varies based on coverage and location |

| Extras | Trip cancellation, adventure activities coverage | Preventive care, regular health screenings |

| Best For | Remote workers, frequent travelers, digital nomads | Residents needing comprehensive healthcare |

Which is better?

Digital nomad insurance offers comprehensive coverage tailored for remote workers frequently traveling internationally, including medical emergencies, trip interruptions, and equipment protection. Health insurance primarily focuses on domestic medical care, hospitalization, and preventive services, often lacking coverage outside the home country. For digital nomads, specialized insurance ensures seamless access to health resources worldwide, making it a more suitable choice than traditional health insurance.

Connection

Digital nomad insurance and health insurance are interconnected by providing comprehensive medical coverage tailored for travelers living and working abroad. Health insurance policies within digital nomad plans often include international medical evacuation, emergency care, and telemedicine services to address the unique risks faced by remote workers. This integration ensures continuous health protection regardless of geographic location, combining flexibility with essential healthcare benefits.

Key Terms

**Health Insurance:**

Health insurance provides comprehensive medical coverage, including hospital stays, doctor visits, prescription medications, and emergency care, tailored to individual or family needs within a resident country. It often offers a broad network of healthcare providers and may include preventive services like vaccinations and screenings. Explore detailed benefits and coverage options to choose the best plan for your health and lifestyle.

Premium

Health insurance premiums for traditional plans typically vary based on age, location, and pre-existing conditions, often resulting in higher costs for comprehensive coverage. Digital nomad insurance premiums, by contrast, are generally more flexible and tailored to cover multi-country living, offering competitive rates that include travel-related risks and telehealth services. Explore detailed comparisons to understand which premium structure aligns best with your lifestyle and coverage needs.

Deductible

Health insurance typically has a fixed deductible amount that must be met before coverage begins, often tailored to long-term, location-specific care. Digital nomad insurance usually offers flexible deductible options that accommodate frequent travel and varied healthcare systems worldwide. Explore detailed comparisons to choose the best deductible plan for your lifestyle.

Source and External Links

Health insurance | USAGov - Offers information on major U.S. health insurance programs including Medicaid, Medicare, Affordable Care Act (ACA) Marketplace, and COBRA, with guidance on how to apply for each.

Individual and family health insurance plans - Provides tools to compare, quote, and enroll in individual and family health plans, with details on coverage for preventive care, mental health, prescriptions, and more.

Blue Shield of California: Health insurance plans - Offers a range of HMO, PPO, dental, and vision plans for individuals, families, and employers, with options for Medi-Cal and Medicare eligible individuals.

dowidth.com

dowidth.com