Buy-now-pay-later protection offers consumers flexible payment options for individual purchases, ensuring coverage without immediate financial strain, while group insurance provides collective risk sharing and typically lower premiums through employer or association plans. Individual policies focus on personalized coverage, whereas group plans emphasize broad protection with simplified enrollment and reduced underwriting requirements. Explore the benefits and limitations of each to determine which insurance solution best fits your financial and coverage needs.

Why it is important

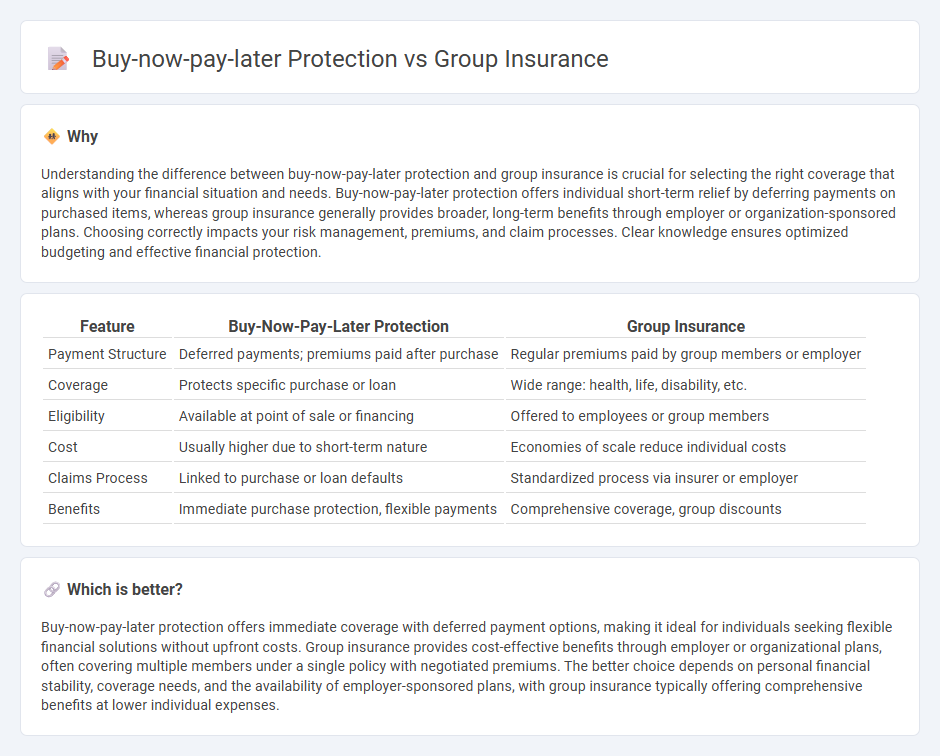

Understanding the difference between buy-now-pay-later protection and group insurance is crucial for selecting the right coverage that aligns with your financial situation and needs. Buy-now-pay-later protection offers individual short-term relief by deferring payments on purchased items, whereas group insurance generally provides broader, long-term benefits through employer or organization-sponsored plans. Choosing correctly impacts your risk management, premiums, and claim processes. Clear knowledge ensures optimized budgeting and effective financial protection.

Comparison Table

| Feature | Buy-Now-Pay-Later Protection | Group Insurance |

|---|---|---|

| Payment Structure | Deferred payments; premiums paid after purchase | Regular premiums paid by group members or employer |

| Coverage | Protects specific purchase or loan | Wide range: health, life, disability, etc. |

| Eligibility | Available at point of sale or financing | Offered to employees or group members |

| Cost | Usually higher due to short-term nature | Economies of scale reduce individual costs |

| Claims Process | Linked to purchase or loan defaults | Standardized process via insurer or employer |

| Benefits | Immediate purchase protection, flexible payments | Comprehensive coverage, group discounts |

Which is better?

Buy-now-pay-later protection offers immediate coverage with deferred payment options, making it ideal for individuals seeking flexible financial solutions without upfront costs. Group insurance provides cost-effective benefits through employer or organizational plans, often covering multiple members under a single policy with negotiated premiums. The better choice depends on personal financial stability, coverage needs, and the availability of employer-sponsored plans, with group insurance typically offering comprehensive benefits at lower individual expenses.

Connection

Buy-now-pay-later protection enhances group insurance by offering synchronized payment flexibility and coverage for collective policyholders. This integration supports businesses and organizations in managing cash flow while ensuring continuous insurance benefits for members. The combined approach reduces financial strain and promotes sustained participation in group insurance plans.

Key Terms

Underwriting

Underwriting in group insurance relies on collective risk assessment, leading to streamlined approvals and lower premiums for participants. Buy-now-pay-later protection involves individual underwriting, which evaluates personal creditworthiness and financial history to determine eligibility and terms. Explore our in-depth analysis to understand how underwriting impacts your choice between these protection options.

Premium Structure

Group insurance typically offers lower premiums due to risk pooling among members, leading to more affordable coverage compared to individual plans. Buy-now-pay-later protection schemes structure premiums as deferred payments, which may increase total cost owing to added fees or interest. Explore the differences in premium structures to make informed financial decisions about your insurance needs.

Risk Pooling

Group insurance leverages risk pooling by aggregating individuals into a single risk pool, spreading potential claims across many members to reduce individual financial impact. Buy-now-pay-later protection typically lacks broad risk pooling, as coverage is often limited to specific purchases and individuals, leading to higher risks for providers. Explore the differences in risk pooling methods and their implications for consumers to make informed protection choices.

Source and External Links

What is group insurance? Benefits and limitations [2025] | Thatch Blog - Group insurance provides health coverage to employees through a single master policy negotiated by the employer with insurers, often offering lower premiums and standardized benefits compared to individual insurance plans.

What is Group Insurance & How Does It Work? - MetLife - Group insurance is offered as part of employee benefits, where employers usually contribute to the premium, making it more affordable and covering members of an organization under one group plan.

What is a group in group health insurance? - PeopleKeep - Group health insurance typically covers employees and dependents under a single policy, with eligibility often starting from as few as two employees up to 50 for small group plans, and larger groups qualifying for large group coverage.

dowidth.com

dowidth.com