Flood risk modeling focuses on analyzing hydrological data, terrain elevation, and weather patterns to predict potential flood damage for insurance purposes, while credit risk modeling evaluates financial behavior, credit scores, and economic indicators to assess the likelihood of loan default. Both models utilize advanced statistical methods and machine learning algorithms but target fundamentally different data sets and risk outcomes. Explore further to understand how these specialized models enhance risk assessment and decision-making in insurance.

Why it is important

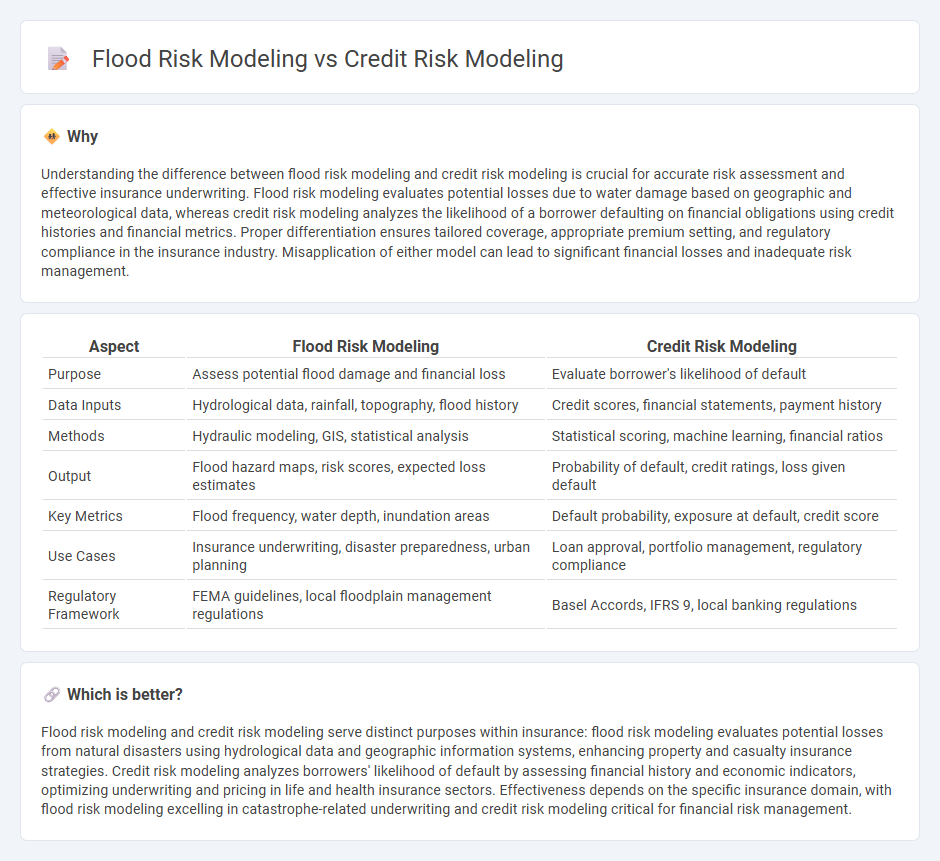

Understanding the difference between flood risk modeling and credit risk modeling is crucial for accurate risk assessment and effective insurance underwriting. Flood risk modeling evaluates potential losses due to water damage based on geographic and meteorological data, whereas credit risk modeling analyzes the likelihood of a borrower defaulting on financial obligations using credit histories and financial metrics. Proper differentiation ensures tailored coverage, appropriate premium setting, and regulatory compliance in the insurance industry. Misapplication of either model can lead to significant financial losses and inadequate risk management.

Comparison Table

| Aspect | Flood Risk Modeling | Credit Risk Modeling |

|---|---|---|

| Purpose | Assess potential flood damage and financial loss | Evaluate borrower's likelihood of default |

| Data Inputs | Hydrological data, rainfall, topography, flood history | Credit scores, financial statements, payment history |

| Methods | Hydraulic modeling, GIS, statistical analysis | Statistical scoring, machine learning, financial ratios |

| Output | Flood hazard maps, risk scores, expected loss estimates | Probability of default, credit ratings, loss given default |

| Key Metrics | Flood frequency, water depth, inundation areas | Default probability, exposure at default, credit score |

| Use Cases | Insurance underwriting, disaster preparedness, urban planning | Loan approval, portfolio management, regulatory compliance |

| Regulatory Framework | FEMA guidelines, local floodplain management regulations | Basel Accords, IFRS 9, local banking regulations |

Which is better?

Flood risk modeling and credit risk modeling serve distinct purposes within insurance: flood risk modeling evaluates potential losses from natural disasters using hydrological data and geographic information systems, enhancing property and casualty insurance strategies. Credit risk modeling analyzes borrowers' likelihood of default by assessing financial history and economic indicators, optimizing underwriting and pricing in life and health insurance sectors. Effectiveness depends on the specific insurance domain, with flood risk modeling excelling in catastrophe-related underwriting and credit risk modeling critical for financial risk management.

Connection

Flood risk modeling and credit risk modeling intersect through their reliance on predictive analytics to assess potential financial losses caused by environmental hazards. Flood risk models quantify the probability and impact of flooding on properties, which directly influences credit risk assessments for mortgages and loans in flood-prone areas. Integrating flood risk data enhances the accuracy of credit risk models by incorporating environmental factors that affect borrowers' ability to repay, thus optimizing risk management strategies.

Key Terms

**Credit risk modeling:**

Credit risk modeling employs statistical techniques and machine learning algorithms to predict the likelihood of borrower default based on financial history, credit scores, and economic indicators. It integrates variables such as loan types, interest rates, and macroeconomic factors to optimize risk assessment in banking and lending. Explore advanced methodologies and tools used in credit risk modeling for deeper insights.

Probability of Default (PD)

Credit risk modeling centers on estimating the Probability of Default (PD) to assess the likelihood that a borrower will fail to meet debt obligations, using financial data, credit history, and macroeconomic indicators. Flood risk modeling, in contrast, evaluates hydrological and meteorological data to predict flood occurrence and severity but does not incorporate PD, which is specific to credit risk. Explore deeper insights into how PD enhances credit risk assessment and its distinct difference from environmental risk models.

Exposure at Default (EAD)

Credit risk modeling quantifies Exposure at Default (EAD) by estimating potential losses when a borrower defaults on a financial obligation, utilizing historical lending data and borrower credit profiles. Flood risk modeling evaluates EAD by assessing the value of assets exposed to flooding hazards, integrating geographic, hydrological, and property data to forecast potential financial impacts. Discover more about how EAD metrics differ across these critical risk modeling domains.

Source and External Links

Credit Risk Modeling: Importance, Types & 10 Best Practices - A comprehensive guide on credit risk modeling, highlighting its importance, types, and best practices for financial institutions.

Credit Risk Analysis Models - An overview of credit risk analysis models used by lenders to determine the probability of default and make informed lending decisions.

Credit Risk Modelling - A look at the role of credit risk modeling in banking for measuring exposure, regulatory compliance, and business decisions.

dowidth.com

dowidth.com