Cyber risk insurance protects businesses against financial losses from data breaches, cyberattacks, and other digital threats, offering coverage for legal fees, notification costs, and business interruption. Commercial auto insurance provides liability and physical damage coverage for vehicles used in business operations, safeguarding companies from costs related to accidents, theft, or property damage. Explore the distinct benefits and coverage details to determine which policy best suits your business needs.

Why it is important

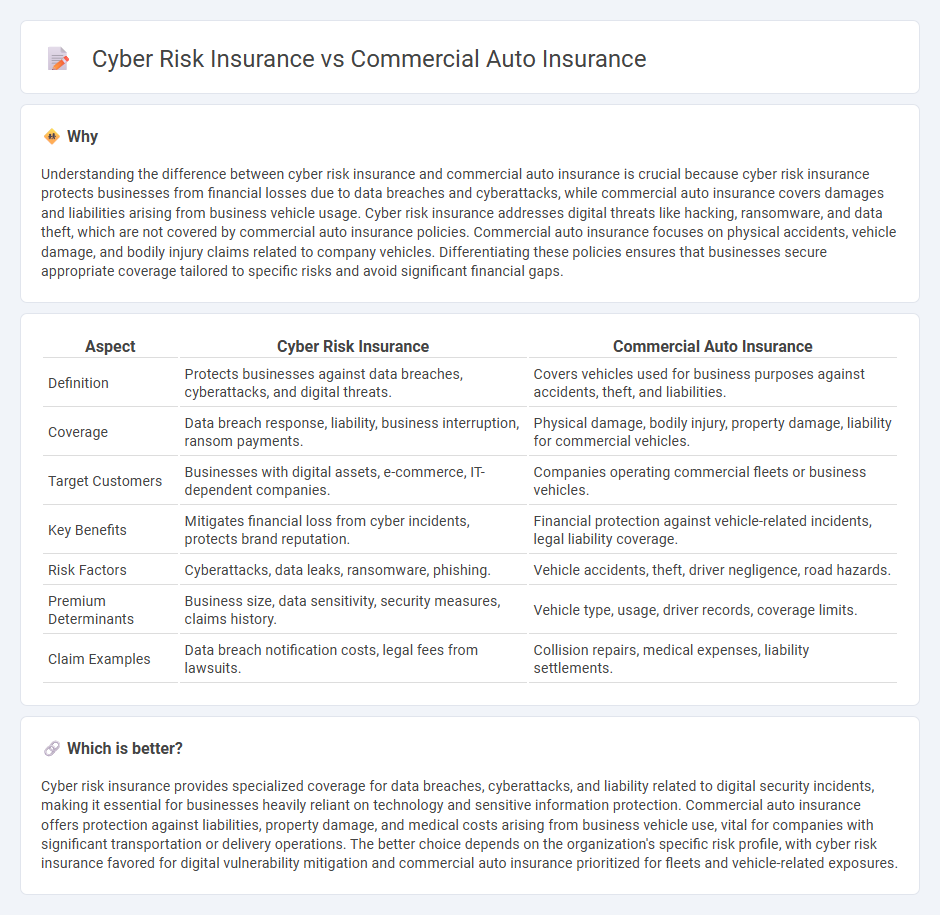

Understanding the difference between cyber risk insurance and commercial auto insurance is crucial because cyber risk insurance protects businesses from financial losses due to data breaches and cyberattacks, while commercial auto insurance covers damages and liabilities arising from business vehicle usage. Cyber risk insurance addresses digital threats like hacking, ransomware, and data theft, which are not covered by commercial auto insurance policies. Commercial auto insurance focuses on physical accidents, vehicle damage, and bodily injury claims related to company vehicles. Differentiating these policies ensures that businesses secure appropriate coverage tailored to specific risks and avoid significant financial gaps.

Comparison Table

| Aspect | Cyber Risk Insurance | Commercial Auto Insurance |

|---|---|---|

| Definition | Protects businesses against data breaches, cyberattacks, and digital threats. | Covers vehicles used for business purposes against accidents, theft, and liabilities. |

| Coverage | Data breach response, liability, business interruption, ransom payments. | Physical damage, bodily injury, property damage, liability for commercial vehicles. |

| Target Customers | Businesses with digital assets, e-commerce, IT-dependent companies. | Companies operating commercial fleets or business vehicles. |

| Key Benefits | Mitigates financial loss from cyber incidents, protects brand reputation. | Financial protection against vehicle-related incidents, legal liability coverage. |

| Risk Factors | Cyberattacks, data leaks, ransomware, phishing. | Vehicle accidents, theft, driver negligence, road hazards. |

| Premium Determinants | Business size, data sensitivity, security measures, claims history. | Vehicle type, usage, driver records, coverage limits. |

| Claim Examples | Data breach notification costs, legal fees from lawsuits. | Collision repairs, medical expenses, liability settlements. |

Which is better?

Cyber risk insurance provides specialized coverage for data breaches, cyberattacks, and liability related to digital security incidents, making it essential for businesses heavily reliant on technology and sensitive information protection. Commercial auto insurance offers protection against liabilities, property damage, and medical costs arising from business vehicle use, vital for companies with significant transportation or delivery operations. The better choice depends on the organization's specific risk profile, with cyber risk insurance favored for digital vulnerability mitigation and commercial auto insurance prioritized for fleets and vehicle-related exposures.

Connection

Cyber risk insurance and commercial auto insurance intersect as both cover risks associated with modern business operations involving connected vehicles and digital data. Cyber risk insurance protects against data breaches and cyberattacks that can compromise telematics systems in commercial vehicles, while commercial auto insurance addresses physical damages and liabilities from vehicle use. Businesses with fleets increasingly require integrated coverage to safeguard against intertwined cyber threats and traditional auto liabilities.

Key Terms

**Commercial Auto Insurance:**

Commercial auto insurance provides coverage for vehicles used in business operations, protecting against liabilities, physical damage, and medical expenses resulting from accidents involving company-owned or leased vehicles. It typically covers trucks, vans, and cars utilized for transporting goods, services, or employees, ensuring financial security from collision, theft, and third-party claims. Explore more about commercial auto insurance to safeguard your business assets and understand policy options tailored to your fleet's needs.

Liability Coverage

Commercial auto insurance primarily covers liability arising from bodily injury or property damage caused by vehicles used for business purposes, ensuring protection against claims when company vehicles are involved in accidents. Cyber risk insurance focuses on liability related to data breaches, cyberattacks, and privacy violations, offering coverage for legal fees, regulatory fines, and damages resulting from compromised digital assets. Explore detailed comparisons to understand which liability coverage best suits your business's risk profile.

Physical Damage

Commercial auto insurance primarily covers physical damage to vehicles caused by accidents, theft, or vandalism, ensuring business operations continue smoothly. Cyber risk insurance focuses on losses related to data breaches, cyberattacks, and digital disruptions, offering no protection for physical vehicle damage. Explore the distinctions further to determine which insurance best suits your business needs.

Source and External Links

Best Commercial Auto Insurance Companies for 2025 - This article provides insights into how commercial auto insurance works and recommends Progressive as a top choice for coverage.

Commercial Auto Insurance by Progressive - Offers comprehensive coverage for various business vehicles, including cars, trucks, and vans, with discounts and a repair network.

Texas Commercial Auto Insurance - Covers business-owned vehicles for accidents, including medical bills and legal fees, and is required for work-related vehicle use in Texas.

dowidth.com

dowidth.com