Behavioral policy pricing tailors insurance premiums based on individual risk factors, such as driving habits or health behaviors, offering a personalized approach that aligns cost with actual behavior. Community rating sets uniform premiums for all members of a defined group, regardless of individual risk, promoting fairness and accessibility across the insured population. Explore deeper insights into how these pricing models impact policyholders and insurers alike.

Why it is important

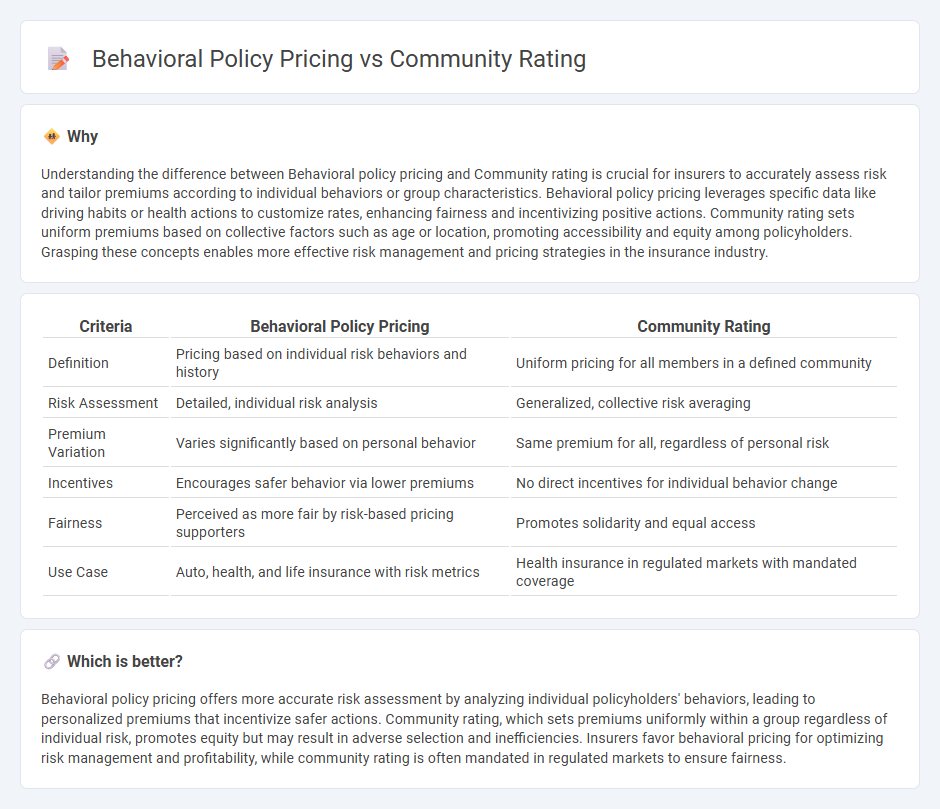

Understanding the difference between Behavioral policy pricing and Community rating is crucial for insurers to accurately assess risk and tailor premiums according to individual behaviors or group characteristics. Behavioral policy pricing leverages specific data like driving habits or health actions to customize rates, enhancing fairness and incentivizing positive actions. Community rating sets uniform premiums based on collective factors such as age or location, promoting accessibility and equity among policyholders. Grasping these concepts enables more effective risk management and pricing strategies in the insurance industry.

Comparison Table

| Criteria | Behavioral Policy Pricing | Community Rating |

|---|---|---|

| Definition | Pricing based on individual risk behaviors and history | Uniform pricing for all members in a defined community |

| Risk Assessment | Detailed, individual risk analysis | Generalized, collective risk averaging |

| Premium Variation | Varies significantly based on personal behavior | Same premium for all, regardless of personal risk |

| Incentives | Encourages safer behavior via lower premiums | No direct incentives for individual behavior change |

| Fairness | Perceived as more fair by risk-based pricing supporters | Promotes solidarity and equal access |

| Use Case | Auto, health, and life insurance with risk metrics | Health insurance in regulated markets with mandated coverage |

Which is better?

Behavioral policy pricing offers more accurate risk assessment by analyzing individual policyholders' behaviors, leading to personalized premiums that incentivize safer actions. Community rating, which sets premiums uniformly within a group regardless of individual risk, promotes equity but may result in adverse selection and inefficiencies. Insurers favor behavioral pricing for optimizing risk management and profitability, while community rating is often mandated in regulated markets to ensure fairness.

Connection

Behavioral policy pricing and community rating are interconnected methods used in insurance to balance individual risk assessment with fairness across a group. Behavioral pricing adjusts premiums based on an individual's actions, such as driving habits or health behaviors, while community rating sets uniform premiums regardless of personal risk. Combining these approaches helps insurers promote safer behavior without unfairly penalizing high-risk individuals in the same community.

Key Terms

Premium Calculation

Community rating bases premium calculation on the overall risk profile of a broad group without individual risk adjustments, promoting affordability and access. Behavioral policy pricing tailors premiums according to individual behaviors, such as lifestyle choices and health habits, leading to personalized but potentially variable costs. Explore detailed comparisons and impacts on policyholder premiums to understand which approach best suits specific insurance needs.

Risk Pooling

Community rating pricing pools risk by charging uniform premiums regardless of individual health factors, spreading costs evenly across all insured members. Behavioral policy pricing adjusts premiums based on an individual's behaviors, creating risk pools stratified by lifestyle choices or health habits to more accurately reflect expected costs. Explore how these pricing models impact insurance affordability and risk distribution in greater detail.

Individual Behavior

Community rating pricing pools risks and charges uniform premiums regardless of individual behavior, promoting equity by spreading costs across all members of a group. Behavioral policy pricing tailors premiums based on personal habits and risk factors, incentivizing healthier or safer choices through customized rates. Discover how individual behavior impacts insurance costs and the implications of each pricing model for consumers.

Source and External Links

What Is Community Rating in Health Insurance? - PCH Global - Community rating is a healthcare pricing model where insurance premiums are based on the average cost of healthcare services for all individuals within a geographic area, promoting fairness by charging everyone the same premium regardless of individual health status or history.

What is community rating? - Healthinsurance.org - Community rating in health insurance means insurers cannot charge higher premiums based on age, gender, health status, or claims history within a geographic area, though since 2014 under the ACA, premiums may vary by age, location, and tobacco use in a modified form of community rating.

Community Rating System | FEMA.gov - The Community Rating System is a voluntary program encouraging communities to improve floodplain management, which results in reduced flood insurance premiums for participating communities.

dowidth.com

dowidth.com