Embedded insurance integrates coverage directly into the purchase of products or services, offering seamless protection without separate policy management. Group insurance provides collective coverage for members of a specific organization or group, often at reduced rates due to pooled risk. Explore the key differences and benefits of embedded insurance versus group insurance to determine the best fit for your needs.

Why it is important

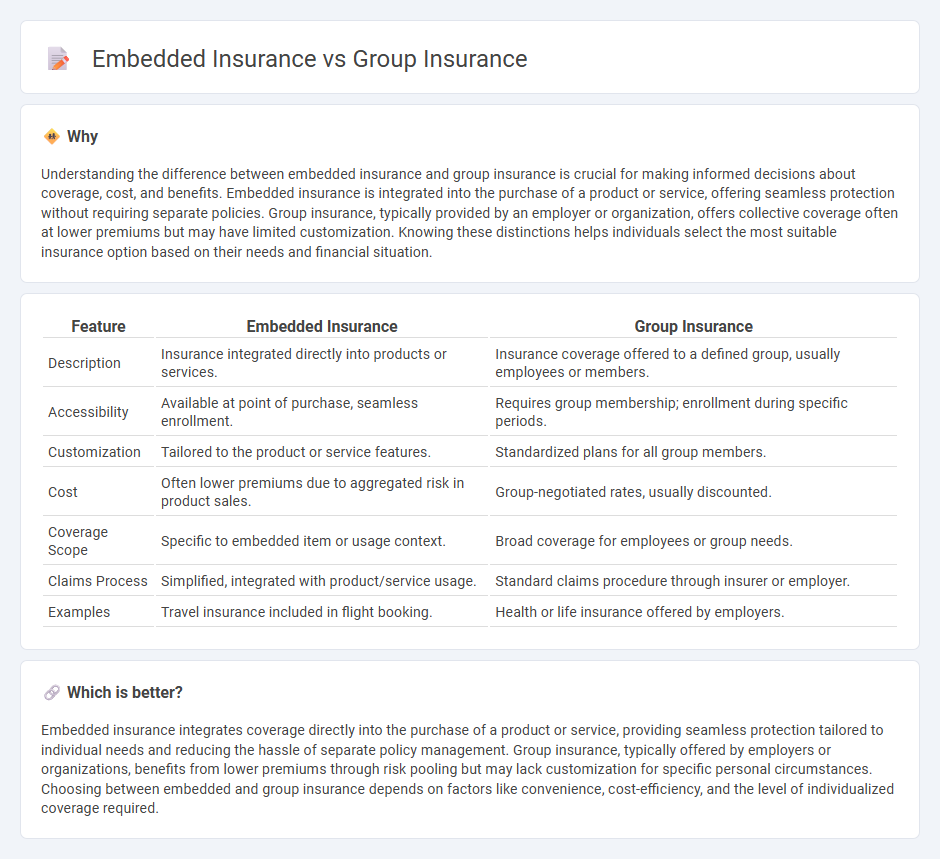

Understanding the difference between embedded insurance and group insurance is crucial for making informed decisions about coverage, cost, and benefits. Embedded insurance is integrated into the purchase of a product or service, offering seamless protection without requiring separate policies. Group insurance, typically provided by an employer or organization, offers collective coverage often at lower premiums but may have limited customization. Knowing these distinctions helps individuals select the most suitable insurance option based on their needs and financial situation.

Comparison Table

| Feature | Embedded Insurance | Group Insurance |

|---|---|---|

| Description | Insurance integrated directly into products or services. | Insurance coverage offered to a defined group, usually employees or members. |

| Accessibility | Available at point of purchase, seamless enrollment. | Requires group membership; enrollment during specific periods. |

| Customization | Tailored to the product or service features. | Standardized plans for all group members. |

| Cost | Often lower premiums due to aggregated risk in product sales. | Group-negotiated rates, usually discounted. |

| Coverage Scope | Specific to embedded item or usage context. | Broad coverage for employees or group needs. |

| Claims Process | Simplified, integrated with product/service usage. | Standard claims procedure through insurer or employer. |

| Examples | Travel insurance included in flight booking. | Health or life insurance offered by employers. |

Which is better?

Embedded insurance integrates coverage directly into the purchase of a product or service, providing seamless protection tailored to individual needs and reducing the hassle of separate policy management. Group insurance, typically offered by employers or organizations, benefits from lower premiums through risk pooling but may lack customization for specific personal circumstances. Choosing between embedded and group insurance depends on factors like convenience, cost-efficiency, and the level of individualized coverage required.

Connection

Embedded insurance integrates coverage options directly into the purchase of products or services, streamlining risk management for consumers. Group insurance leverages collective bargaining power to provide cost-effective and comprehensive coverage to members of a defined group, such as employees or association members. Both models enhance accessibility and affordability of insurance by embedding protection within existing transactions or communities, thereby optimizing risk pooling and reducing administrative overhead.

Key Terms

Policyholder

Group insurance offers coverage to multiple individuals under a single master policy, typically managed by an employer or organization, providing collective benefits and streamlined administration. Embedded insurance integrates insurance coverage directly into the purchase of a product or service, delivering seamless protection tailored to the policyholder's immediate needs without requiring separate policy management. Explore how each model enhances policyholder experience and discover which approach suits your insurance needs best.

Coverage Structure

Group insurance offers collective coverage under a single policy for members of an organization, typically providing standardized benefits and cost efficiencies. Embedded insurance integrates coverage directly into the purchase of a product or service, ensuring seamless protection tailored to the specific context, often activated automatically. Explore more to understand how these structures impact risk management and customer experience.

Distribution Channel

Group insurance is typically distributed through employers or organizations, enabling coverage for multiple individuals under a single policy, which streamlines administration and premium payments. Embedded insurance integrates coverage directly into the purchase of products or services, leveraging digital platforms and partners to provide seamless access at the point of sale. Explore the differences in these distribution strategies to discover which aligns best with your business needs.

Source and External Links

What is group insurance? Benefits and limitations [2025] | Thatch Blog - Group insurance is a health coverage policy offered by employers to a group of employees under a single master policy, often with employers covering part of the premiums, providing standardized benefits with some limitations versus individual plans.

What is Group Insurance & How Does It Work? - MetLife - Group insurance is coverage provided as part of an employee benefits package, generally at lower cost with the employer paying some premiums, and includes health, dental, vision, or other coverages for employees under one group associated with their workplace.

Group-term life insurance | Internal Revenue Service - Employer-provided group-term life insurance includes tax exclusions for coverage up to $50,000; amounts above that are taxable, and the employer's role in premium payments influences tax treatment.

dowidth.com

dowidth.com