Insurance sandbox environments allow companies to test innovative products and services under regulatory supervision, accelerating market entry while ensuring compliance. Test-and-learn frameworks enable insurers to experiment with new strategies and customer experiences, using real-time data to optimize offerings and reduce risks. Explore how these approaches drive innovation and agility in the insurance industry.

Why it is important

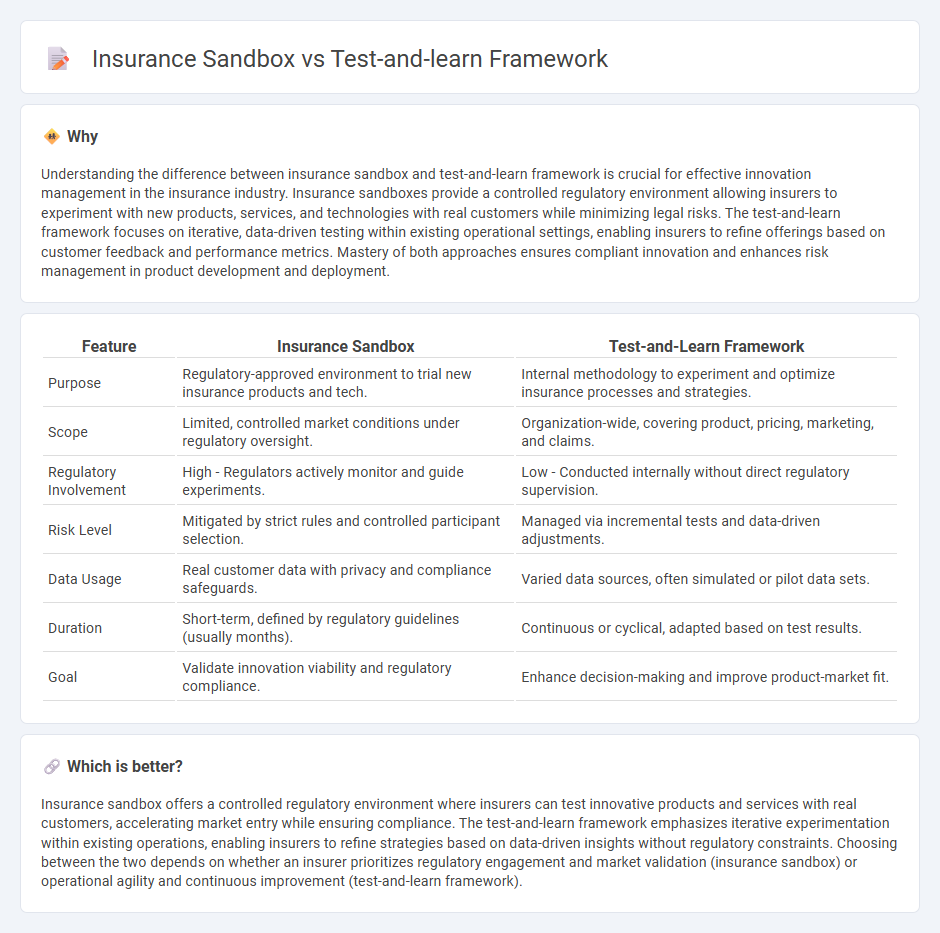

Understanding the difference between insurance sandbox and test-and-learn framework is crucial for effective innovation management in the insurance industry. Insurance sandboxes provide a controlled regulatory environment allowing insurers to experiment with new products, services, and technologies with real customers while minimizing legal risks. The test-and-learn framework focuses on iterative, data-driven testing within existing operational settings, enabling insurers to refine offerings based on customer feedback and performance metrics. Mastery of both approaches ensures compliant innovation and enhances risk management in product development and deployment.

Comparison Table

| Feature | Insurance Sandbox | Test-and-Learn Framework |

|---|---|---|

| Purpose | Regulatory-approved environment to trial new insurance products and tech. | Internal methodology to experiment and optimize insurance processes and strategies. |

| Scope | Limited, controlled market conditions under regulatory oversight. | Organization-wide, covering product, pricing, marketing, and claims. |

| Regulatory Involvement | High - Regulators actively monitor and guide experiments. | Low - Conducted internally without direct regulatory supervision. |

| Risk Level | Mitigated by strict rules and controlled participant selection. | Managed via incremental tests and data-driven adjustments. |

| Data Usage | Real customer data with privacy and compliance safeguards. | Varied data sources, often simulated or pilot data sets. |

| Duration | Short-term, defined by regulatory guidelines (usually months). | Continuous or cyclical, adapted based on test results. |

| Goal | Validate innovation viability and regulatory compliance. | Enhance decision-making and improve product-market fit. |

Which is better?

Insurance sandbox offers a controlled regulatory environment where insurers can test innovative products and services with real customers, accelerating market entry while ensuring compliance. The test-and-learn framework emphasizes iterative experimentation within existing operations, enabling insurers to refine strategies based on data-driven insights without regulatory constraints. Choosing between the two depends on whether an insurer prioritizes regulatory engagement and market validation (insurance sandbox) or operational agility and continuous improvement (test-and-learn framework).

Connection

Insurance sandboxes provide a controlled regulatory environment where insurers can experiment with innovative products and technologies without the full burden of compliance. The test-and-learn framework complements this by enabling insurers to iteratively test new policies, pricing models, or claims processes within the sandbox, using real-world data to assess performance and risks. This synergy accelerates product development while ensuring consumer protection and regulatory adherence in the insurance sector.

Key Terms

Experimentation

The test-and-learn framework emphasizes iterative experimentation and data-driven decision-making within real market conditions, enabling insurers to validate hypotheses and optimize products rapidly. Insurance sandboxes provide a controlled regulatory environment where innovative concepts can be tested with reduced compliance risk, fostering safer experimentation. Explore how these approaches differ in facilitating innovation and risk management in insurance.

Regulatory Oversight

The test-and-learn framework enables regulators to monitor innovations through controlled real-world experiments, balancing risk and agility in regulatory oversight. Insurance sandboxes provide a structured environment where insurers can pilot new products under direct supervision, ensuring compliance while fostering innovation. Explore further to understand how each approach enhances regulatory effectiveness in the insurance industry.

Innovation

Test-and-learn frameworks enable iterative experimentation with new insurance products and services, fostering rapid innovation through controlled real-world testing. Insurance sandboxes provide regulatory flexibility and oversight, allowing startups and incumbents to develop innovative solutions while managing compliance risks. Explore the nuances between these approaches to drive breakthroughs in insurance innovation.

Source and External Links

Test and learn - a playbook for mission-driven government - Test and learn is an iterative, flexible framework combining agile policy design with robust impact evaluation to adapt and scale policies based on ongoing data and evidence, widely applied in public service contexts.

What is 'Test and Learn'? - Public Digital - Test and learn is a cyclical, outcome-oriented working method emphasizing adaptability and humility, helping teams and organizations innovate through iteration and evidence-based learning amid uncertainty.

Test and Learn Culture: The Key to Data-Driven Optimization and ... - 'Test and learn' is a strategic process treating all changes as hypotheses to test, using continuous experimentation and data analysis to optimize digital experiences and foster innovation through a culture of learning.

dowidth.com

dowidth.com