Buy now insurance offers immediate coverage with flexible premiums, ideal for short-term financial protection and quick enrollment. Whole life insurance combines lifelong coverage with a cash value component, providing long-term financial security and potential asset growth. Explore the advantages of both options to determine the best insurance strategy for your needs.

Why it is important

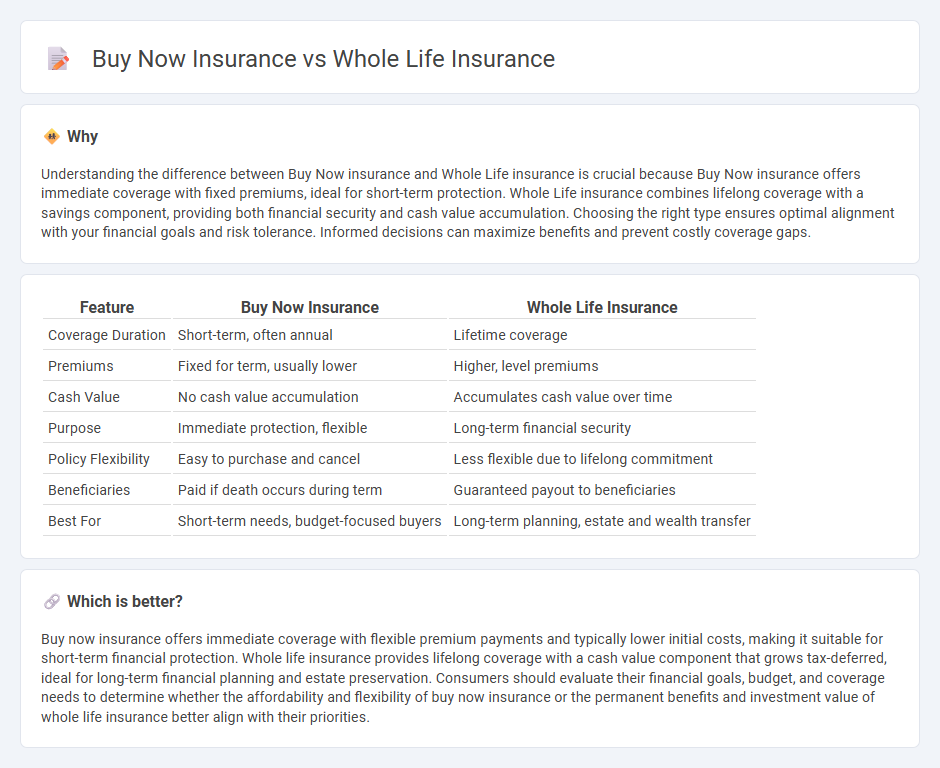

Understanding the difference between Buy Now insurance and Whole Life insurance is crucial because Buy Now insurance offers immediate coverage with fixed premiums, ideal for short-term protection. Whole Life insurance combines lifelong coverage with a savings component, providing both financial security and cash value accumulation. Choosing the right type ensures optimal alignment with your financial goals and risk tolerance. Informed decisions can maximize benefits and prevent costly coverage gaps.

Comparison Table

| Feature | Buy Now Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Short-term, often annual | Lifetime coverage |

| Premiums | Fixed for term, usually lower | Higher, level premiums |

| Cash Value | No cash value accumulation | Accumulates cash value over time |

| Purpose | Immediate protection, flexible | Long-term financial security |

| Policy Flexibility | Easy to purchase and cancel | Less flexible due to lifelong commitment |

| Beneficiaries | Paid if death occurs during term | Guaranteed payout to beneficiaries |

| Best For | Short-term needs, budget-focused buyers | Long-term planning, estate and wealth transfer |

Which is better?

Buy now insurance offers immediate coverage with flexible premium payments and typically lower initial costs, making it suitable for short-term financial protection. Whole life insurance provides lifelong coverage with a cash value component that grows tax-deferred, ideal for long-term financial planning and estate preservation. Consumers should evaluate their financial goals, budget, and coverage needs to determine whether the affordability and flexibility of buy now insurance or the permanent benefits and investment value of whole life insurance better align with their priorities.

Connection

Buy now insurance offers immediate coverage with simplified application processes, providing a seamless entry into lifelong protection. Whole life insurance builds on this foundation by combining permanent coverage with a cash value component that grows over time. Together, these options cater to immediate financial security needs while ensuring long-term investment and protection benefits.

Key Terms

Cash Value

Whole life insurance accumulates cash value over time, offering a savings component that grows tax-deferred and can be borrowed against. Buy now insurance, often referring to term policies, provides coverage without cash value accumulation, making it more affordable but lacking investment features. Explore how cash value impacts your long-term financial strategy and policy benefits.

Term Length

Whole life insurance offers lifelong coverage with fixed premiums, making it a suitable choice for those seeking permanent financial protection and cash value accumulation. Buy now insurance, often referring to term insurance, provides coverage for a specific term length such as 10, 20, or 30 years, typically at lower initial costs but without cash value benefits. Explore further to determine which term length aligns best with your financial goals and coverage needs.

Premiums

Whole life insurance features fixed premiums that remain level throughout the policyholder's lifetime, providing predictable financial planning and guaranteed cash value accumulation. Buy now insurance, often referring to term or simplified issue policies, typically offers lower initial premiums but may increase upon renewal or lack cash value benefits. Explore the detailed comparison of premium structures to make an informed decision.

Source and External Links

Whole Life Insurance - Offers lifelong coverage with a guaranteed death benefit, level premiums that never increase, and a cash value component that grows tax-deferred over time.

Whole Life Insurance | Custom Cash Value Whole Life - Provides permanent coverage with fixed premiums, a guaranteed death benefit, and a cash value that can be accessed during your lifetime for needs like home purchases or retirement income (though withdrawals reduce the death benefit).

What Is Whole Life Insurance? - Covers you for life as long as premiums are paid, with fixed premiums and a fixed death benefit, plus a cash value you can borrow against or withdraw from.

dowidth.com

dowidth.com