Flood risk modeling estimates the probability and potential impact of flood events by analyzing hydrological data, topography, and climate patterns to predict areas and assets at risk. Pricing modeling, on the other hand, uses these risk assessments along with insurance claims data, policyholder behavior, and market trends to calculate premiums that accurately reflect an individual's or property's flood exposure. Explore how integrating these models can enhance insurance accuracy and financial resilience.

Why it is important

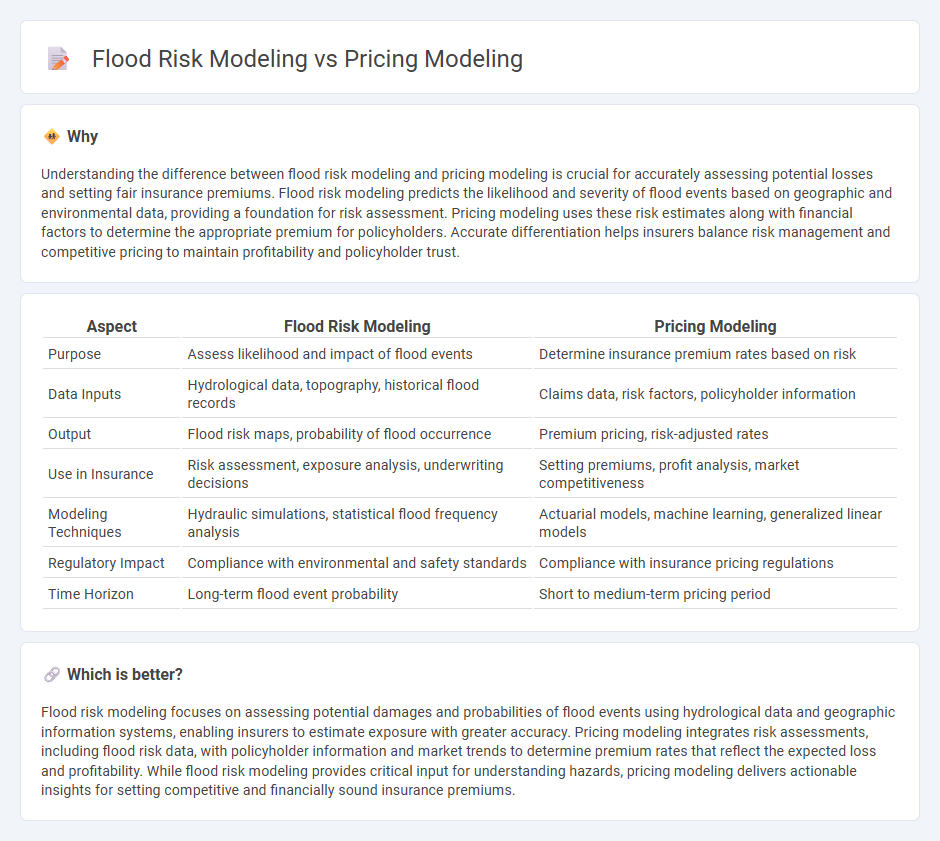

Understanding the difference between flood risk modeling and pricing modeling is crucial for accurately assessing potential losses and setting fair insurance premiums. Flood risk modeling predicts the likelihood and severity of flood events based on geographic and environmental data, providing a foundation for risk assessment. Pricing modeling uses these risk estimates along with financial factors to determine the appropriate premium for policyholders. Accurate differentiation helps insurers balance risk management and competitive pricing to maintain profitability and policyholder trust.

Comparison Table

| Aspect | Flood Risk Modeling | Pricing Modeling |

|---|---|---|

| Purpose | Assess likelihood and impact of flood events | Determine insurance premium rates based on risk |

| Data Inputs | Hydrological data, topography, historical flood records | Claims data, risk factors, policyholder information |

| Output | Flood risk maps, probability of flood occurrence | Premium pricing, risk-adjusted rates |

| Use in Insurance | Risk assessment, exposure analysis, underwriting decisions | Setting premiums, profit analysis, market competitiveness |

| Modeling Techniques | Hydraulic simulations, statistical flood frequency analysis | Actuarial models, machine learning, generalized linear models |

| Regulatory Impact | Compliance with environmental and safety standards | Compliance with insurance pricing regulations |

| Time Horizon | Long-term flood event probability | Short to medium-term pricing period |

Which is better?

Flood risk modeling focuses on assessing potential damages and probabilities of flood events using hydrological data and geographic information systems, enabling insurers to estimate exposure with greater accuracy. Pricing modeling integrates risk assessments, including flood risk data, with policyholder information and market trends to determine premium rates that reflect the expected loss and profitability. While flood risk modeling provides critical input for understanding hazards, pricing modeling delivers actionable insights for setting competitive and financially sound insurance premiums.

Connection

Flood risk modeling quantifies potential losses by analyzing historical flood data, hydrological patterns, and geographic vulnerabilities, which directly informs insurance pricing modeling. Accurate flood risk assessments enable insurers to determine appropriate premiums, allocate capital effectively, and manage policy portfolios with reduced exposure to catastrophic losses. Integration of flood risk modeling into pricing models ensures risk-based pricing, enhancing financial stability and regulatory compliance for insurance providers.

Key Terms

**Pricing modeling:**

Pricing modeling involves determining the optimal price of products or services based on market demand, competition, and cost factors, using algorithms and data analysis for revenue maximization. Techniques such as regression analysis, machine learning, and dynamic pricing strategies are commonly employed to forecast consumer behavior and adjust prices in real time. Explore innovative approaches and tools to enhance pricing accuracy and profitability.

Premium

Pricing modeling in insurance determines the premium by analyzing historical claims, risk factors, and loss distribution to ensure profitability and market competitiveness. Flood risk modeling assesses flood hazards, exposure, and vulnerability to estimate potential losses, directly influencing insurance premiums in flood-prone regions. Explore more to understand how integrating flood risk insights refines premium accuracy and enhances risk management strategies.

Loss ratio

Pricing modeling analyzes insurance premiums by assessing risk factors and expected loss ratios to ensure profitability, while flood risk modeling estimates potential damages and loss probabilities in flood-prone areas to support underwriting decisions. Loss ratio, calculated as claims paid divided by earned premiums, serves as a critical metric for evaluating pricing accuracy and adjusting premiums in both models. Explore further to understand how integrating these models optimizes insurance strategies and risk management.

Source and External Links

How to Choose a Pricing Model - Provides strategies for selecting pricing models tailored to specific business and customer needs, including subscription-based and dynamic pricing.

7 Common Pricing Models - Lists common pricing models such as cost-plus, value-based, and hourly pricing, highlighting their applications and advantages.

The 10 Most Common Pricing Models & How to Use Them Strategically - Explores ten prevalent pricing models including flat-rate, tiered, and freemium pricing, discussing strategic uses for each.

dowidth.com

dowidth.com