Insurtech platforms leverage advanced technology such as AI, big data, and automation to streamline insurance services, offering personalized and seamless user experiences. Microinsurance providers focus on delivering affordable, low-premium insurance products tailored for low-income populations, often addressing niche risks in emerging markets. Explore how these innovative models transform insurance access and affordability today.

Why it is important

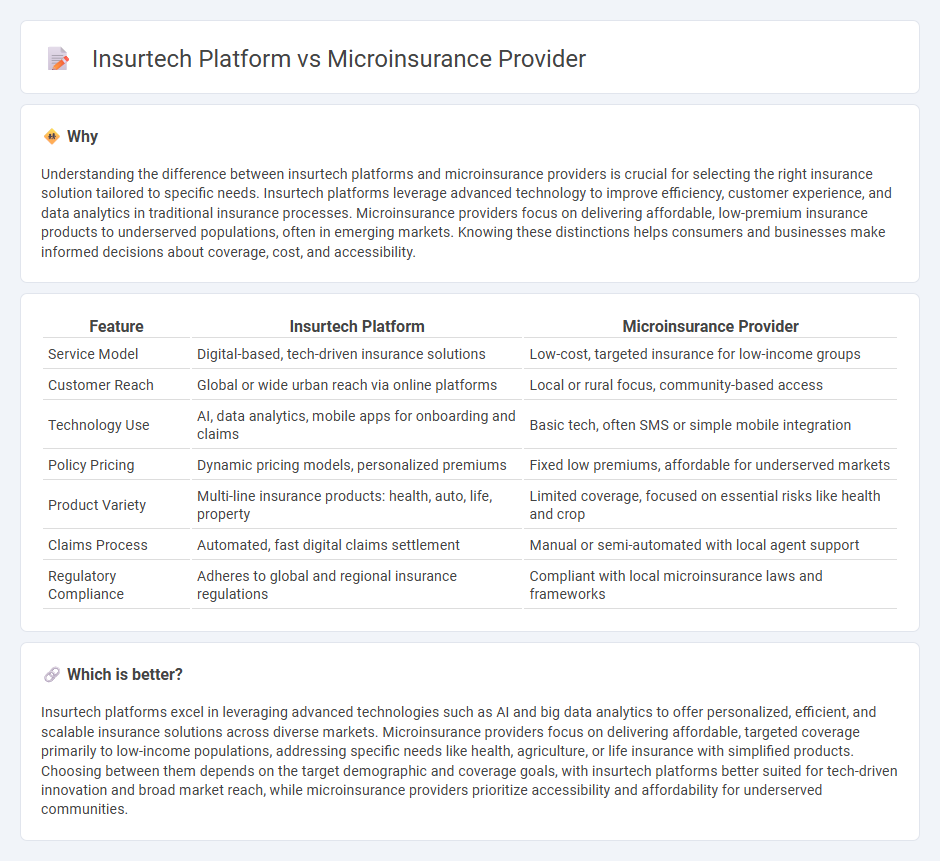

Understanding the difference between insurtech platforms and microinsurance providers is crucial for selecting the right insurance solution tailored to specific needs. Insurtech platforms leverage advanced technology to improve efficiency, customer experience, and data analytics in traditional insurance processes. Microinsurance providers focus on delivering affordable, low-premium insurance products to underserved populations, often in emerging markets. Knowing these distinctions helps consumers and businesses make informed decisions about coverage, cost, and accessibility.

Comparison Table

| Feature | Insurtech Platform | Microinsurance Provider |

|---|---|---|

| Service Model | Digital-based, tech-driven insurance solutions | Low-cost, targeted insurance for low-income groups |

| Customer Reach | Global or wide urban reach via online platforms | Local or rural focus, community-based access |

| Technology Use | AI, data analytics, mobile apps for onboarding and claims | Basic tech, often SMS or simple mobile integration |

| Policy Pricing | Dynamic pricing models, personalized premiums | Fixed low premiums, affordable for underserved markets |

| Product Variety | Multi-line insurance products: health, auto, life, property | Limited coverage, focused on essential risks like health and crop |

| Claims Process | Automated, fast digital claims settlement | Manual or semi-automated with local agent support |

| Regulatory Compliance | Adheres to global and regional insurance regulations | Compliant with local microinsurance laws and frameworks |

Which is better?

Insurtech platforms excel in leveraging advanced technologies such as AI and big data analytics to offer personalized, efficient, and scalable insurance solutions across diverse markets. Microinsurance providers focus on delivering affordable, targeted coverage primarily to low-income populations, addressing specific needs like health, agriculture, or life insurance with simplified products. Choosing between them depends on the target demographic and coverage goals, with insurtech platforms better suited for tech-driven innovation and broad market reach, while microinsurance providers prioritize accessibility and affordability for underserved communities.

Connection

Insurtech platforms leverage advanced technology to streamline insurance services, enabling microinsurance providers to efficiently offer affordable, tailored policies to underserved populations. By utilizing digital tools such as AI, blockchain, and mobile applications, these platforms enhance accessibility, reduce operational costs, and improve claims processing for microinsurance products. This technological integration facilitates scalable insurance solutions that address the unique risks faced by low-income individuals and communities.

Key Terms

**Microinsurance Provider:**

Microinsurance providers specialize in offering low-cost, tailored insurance products to underserved or low-income populations, focusing on simplified claims processes, affordable premiums, and accessible coverage. These providers often partner with local organizations and use distribution channels such as mobile networks and community agents to enhance reach and trust. Explore how microinsurance providers transform financial inclusion and protect vulnerable communities.

Premium Affordability

Microinsurance providers tailor policies with lower premiums targeting low-income populations, leveraging simplified coverage to enhance affordability and accessibility. Insurtech platforms use advanced data analytics and automation to streamline underwriting and distribution, potentially reducing costs but sometimes adding digital complexity that may affect premium pricing. Explore the differences in how each approach impacts premium affordability and customer reach.

Distribution Channels

Microinsurance providers leverage community-based agents and local partnerships to reach underserved populations effectively. Insurtech platforms utilize digital tools such as mobile apps, AI-driven chatbots, and online marketplaces to streamline customer acquisition and policy management. Explore deeper insights into how these differing distribution channels impact accessibility and scalability in the insurance market.

Source and External Links

Microinsurance Companies - Top Company List - Mordor Intelligence - Lists leading microinsurance providers including Allianz SE, AXA SA, Zurich Insurance Group, AIG, Hollard, Bajaj Allianz Life, and others operating globally in microinsurance markets.

Microinsurance | Insurance | Milliman | Worldwide - Describes microinsurance as tailored insurance for low-income individuals providing affordable coverage and delivery solutions, with consultancy services supporting sustainable microinsurance product development worldwide.

Top 5 Companies in the Global Microinsurance Market in 2025 - Highlights microinsurance leaders such as AsianLife & General Assurance Corporation (Philippines), SBI Life Insurance (India), AFPGEN, MIC Global, and CLIMBS Life & General Insurance Co-op focused on diverse, accessible insurance products for underserved markets.

dowidth.com

dowidth.com