Buy now insurance offers immediate coverage with flexible premiums tailored to urgent protection needs, while endowment insurance combines life protection with a savings component, providing a lump sum payout at maturity or upon the policyholder's death. Choosing between these options depends on individual financial goals, risk tolerance, and long-term planning preferences. Explore more to determine which insurance policy aligns best with your needs.

Why it is important

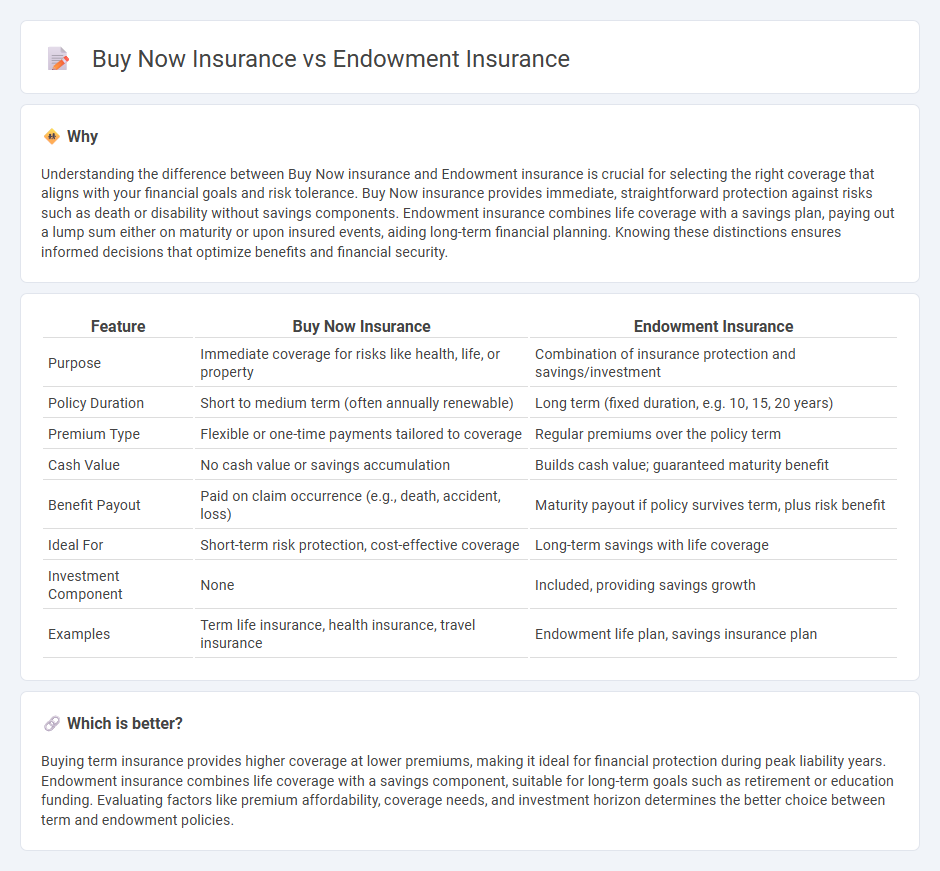

Understanding the difference between Buy Now insurance and Endowment insurance is crucial for selecting the right coverage that aligns with your financial goals and risk tolerance. Buy Now insurance provides immediate, straightforward protection against risks such as death or disability without savings components. Endowment insurance combines life coverage with a savings plan, paying out a lump sum either on maturity or upon insured events, aiding long-term financial planning. Knowing these distinctions ensures informed decisions that optimize benefits and financial security.

Comparison Table

| Feature | Buy Now Insurance | Endowment Insurance |

|---|---|---|

| Purpose | Immediate coverage for risks like health, life, or property | Combination of insurance protection and savings/investment |

| Policy Duration | Short to medium term (often annually renewable) | Long term (fixed duration, e.g. 10, 15, 20 years) |

| Premium Type | Flexible or one-time payments tailored to coverage | Regular premiums over the policy term |

| Cash Value | No cash value or savings accumulation | Builds cash value; guaranteed maturity benefit |

| Benefit Payout | Paid on claim occurrence (e.g., death, accident, loss) | Maturity payout if policy survives term, plus risk benefit |

| Ideal For | Short-term risk protection, cost-effective coverage | Long-term savings with life coverage |

| Investment Component | None | Included, providing savings growth |

| Examples | Term life insurance, health insurance, travel insurance | Endowment life plan, savings insurance plan |

Which is better?

Buying term insurance provides higher coverage at lower premiums, making it ideal for financial protection during peak liability years. Endowment insurance combines life coverage with a savings component, suitable for long-term goals such as retirement or education funding. Evaluating factors like premium affordability, coverage needs, and investment horizon determines the better choice between term and endowment policies.

Connection

Buy now insurance and endowment insurance are connected through their shared purpose of providing financial security by combining insurance protection with savings or investment benefits. Endowment insurance policies typically require an upfront or regular premium payment, which mirrors the concept of buy now insurance where coverage is secured immediately upon purchase. Both products appeal to individuals seeking a dual benefit of life coverage and the accumulation of a cash value over time, making the process of buying now essential to initiate the endowment plan's financial growth and protection features.

Key Terms

Maturity Benefit

Endowment insurance provides a guaranteed maturity benefit combining savings with life coverage, ensuring a lump sum payout upon policy term completion or death. Buy now insurance often emphasizes immediate protection with flexible premiums but may offer variable maturity benefits depending on the plan chosen. Explore detailed comparisons to understand which policy maximizes your financial security at maturity.

Premium Payment

Endowment insurance requires fixed premium payments over a predetermined policy term, ensuring both life coverage and savings accumulation. Buy now insurance offers flexible premium options, often allowing higher payments upfront to build cash value faster while maintaining risk protection. Explore detailed comparisons of premium structures to choose the best fit for your financial goals.

Death Benefit

Endowment insurance combines savings with life coverage, offering a guaranteed death benefit plus maturity proceeds if the policyholder survives the term. Buy now insurance prioritizes immediate death benefit coverage, typically with lower premiums and no maturity payout. Explore more to understand which policy maximizes your financial security goals.

Source and External Links

What is Endowment Life Insurance? - Endowment life insurance is a type of temporary life insurance that combines elements of term life insurance with a savings component, offering a guaranteed return based on conservative investments.

What Is Endowment Life Insurance? - Endowment life insurance provides a death benefit and a guaranteed lump sum payout at the end of the policy term, assuming all premiums are paid, and can be tailored to various life stages and financial goals.

Endowment Policy - An endowment policy is a life insurance contract designed to pay a lump sum after a specific term or on death, often used for long-term financial goals like repaying mortgages or funding education.

dowidth.com

dowidth.com