Crop yield insurance protects farmers against losses in agricultural production due to natural disasters, pests, or adverse weather conditions, ensuring income stability despite fluctuating crop yields. Farm property insurance covers physical assets such as buildings, machinery, equipment, and livestock against risks like fire, theft, and vandalism. Explore the differences and benefits of each insurance type to safeguard your agricultural investment effectively.

Why it is important

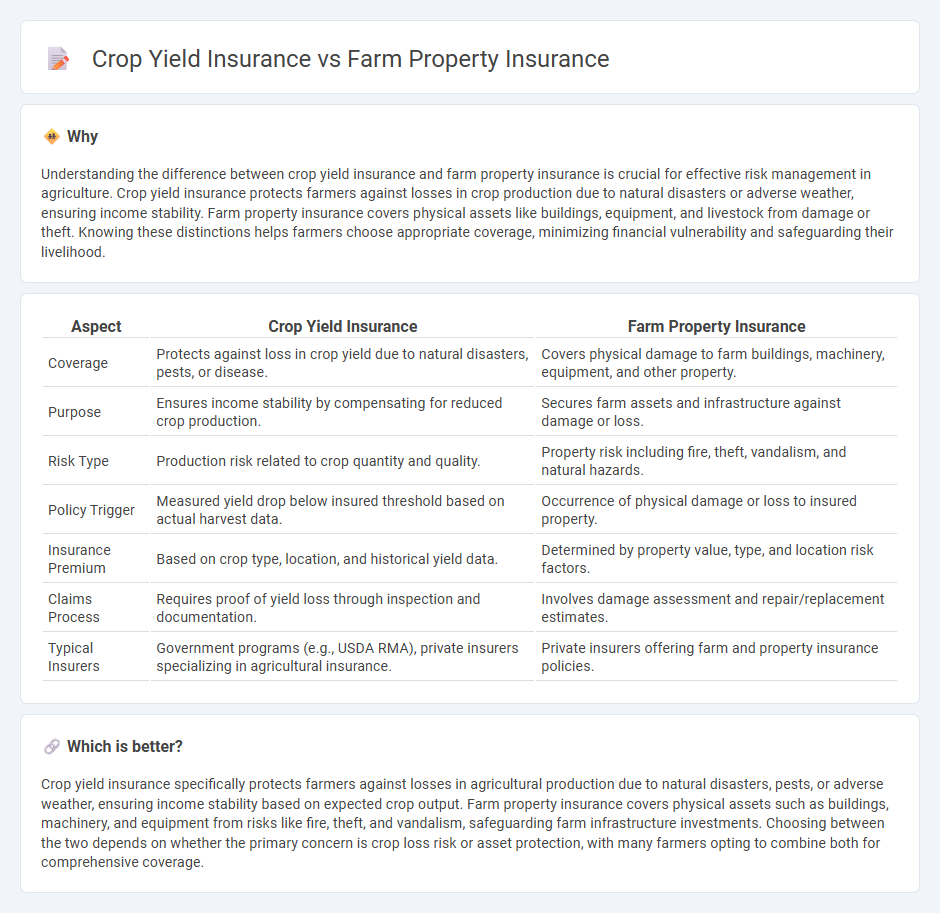

Understanding the difference between crop yield insurance and farm property insurance is crucial for effective risk management in agriculture. Crop yield insurance protects farmers against losses in crop production due to natural disasters or adverse weather, ensuring income stability. Farm property insurance covers physical assets like buildings, equipment, and livestock from damage or theft. Knowing these distinctions helps farmers choose appropriate coverage, minimizing financial vulnerability and safeguarding their livelihood.

Comparison Table

| Aspect | Crop Yield Insurance | Farm Property Insurance |

|---|---|---|

| Coverage | Protects against loss in crop yield due to natural disasters, pests, or disease. | Covers physical damage to farm buildings, machinery, equipment, and other property. |

| Purpose | Ensures income stability by compensating for reduced crop production. | Secures farm assets and infrastructure against damage or loss. |

| Risk Type | Production risk related to crop quantity and quality. | Property risk including fire, theft, vandalism, and natural hazards. |

| Policy Trigger | Measured yield drop below insured threshold based on actual harvest data. | Occurrence of physical damage or loss to insured property. |

| Insurance Premium | Based on crop type, location, and historical yield data. | Determined by property value, type, and location risk factors. |

| Claims Process | Requires proof of yield loss through inspection and documentation. | Involves damage assessment and repair/replacement estimates. |

| Typical Insurers | Government programs (e.g., USDA RMA), private insurers specializing in agricultural insurance. | Private insurers offering farm and property insurance policies. |

Which is better?

Crop yield insurance specifically protects farmers against losses in agricultural production due to natural disasters, pests, or adverse weather, ensuring income stability based on expected crop output. Farm property insurance covers physical assets such as buildings, machinery, and equipment from risks like fire, theft, and vandalism, safeguarding farm infrastructure investments. Choosing between the two depends on whether the primary concern is crop loss risk or asset protection, with many farmers opting to combine both for comprehensive coverage.

Connection

Crop yield insurance and farm property insurance both protect agricultural operations by mitigating financial risks, with crop yield insurance covering losses in crop production due to natural disasters or adverse weather conditions, while farm property insurance safeguards physical assets such as equipment, buildings, and livestock. These insurance types collectively ensure comprehensive risk management for farmers, enabling stability and recovery after unforeseen events. Combining crop yield and farm property insurance provides agricultural producers with a robust safety net against diverse operational risks.

Key Terms

Asset Coverage

Farm property insurance covers physical assets like buildings, machinery, and equipment against risks such as fire, theft, or natural disasters, ensuring the farm's infrastructure remains protected. Crop yield insurance, on the other hand, safeguards farmers against losses in crop production caused by adverse weather conditions, pests, or diseases, directly impacting income stability. Discover how each insurance type can secure different aspects of your agricultural business to enhance financial resilience.

Peril Insured

Farm property insurance primarily covers physical damages to buildings, equipment, and stored produce caused by perils such as fire, theft, or natural disasters. Crop yield insurance protects farmers against losses due to crop failure resulting from weather events, pests, or diseases that reduce harvest quantity. Explore the key differences and coverage specifics to determine which insurance best fits your agricultural risk management needs.

Indemnity Calculation

Farm property insurance calculates indemnity based on the actual cash value or replacement cost of damaged structures and equipment, protecting against physical losses from events like fire or storms. Crop yield insurance determines indemnity by comparing guaranteed production levels with actual harvest yields, compensating for shortfalls caused by drought, pests, or disease. Explore detailed comparisons of indemnity calculations to optimize your agricultural risk management strategy.

dowidth.com

dowidth.com