Workers compensation carveout specifically addresses coverage gaps related to workplace injuries and occupational diseases, ensuring employees receive appropriate benefits distinct from standard workers compensation policies. Professional liability insurance, also known as errors and omissions insurance, protects businesses and professionals against claims of negligence, errors, or omissions in the services they provide. Explore the key differences and benefits of these insurance options to determine the best fit for your organization's risk management needs.

Why it is important

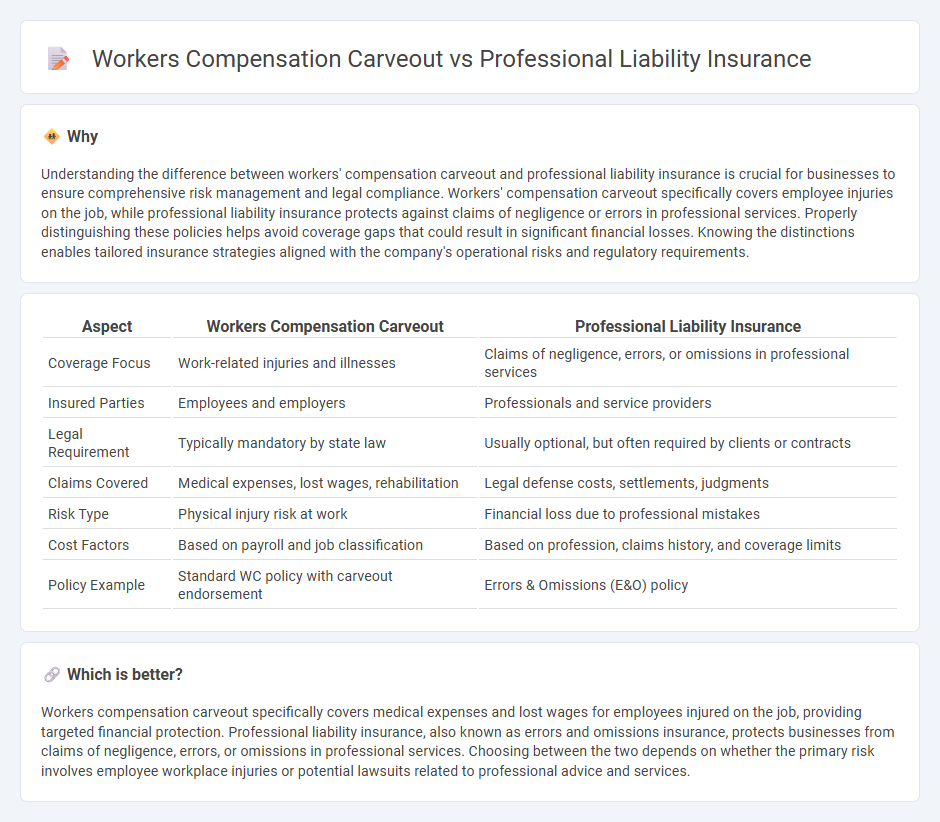

Understanding the difference between workers' compensation carveout and professional liability insurance is crucial for businesses to ensure comprehensive risk management and legal compliance. Workers' compensation carveout specifically covers employee injuries on the job, while professional liability insurance protects against claims of negligence or errors in professional services. Properly distinguishing these policies helps avoid coverage gaps that could result in significant financial losses. Knowing the distinctions enables tailored insurance strategies aligned with the company's operational risks and regulatory requirements.

Comparison Table

| Aspect | Workers Compensation Carveout | Professional Liability Insurance |

|---|---|---|

| Coverage Focus | Work-related injuries and illnesses | Claims of negligence, errors, or omissions in professional services |

| Insured Parties | Employees and employers | Professionals and service providers |

| Legal Requirement | Typically mandatory by state law | Usually optional, but often required by clients or contracts |

| Claims Covered | Medical expenses, lost wages, rehabilitation | Legal defense costs, settlements, judgments |

| Risk Type | Physical injury risk at work | Financial loss due to professional mistakes |

| Cost Factors | Based on payroll and job classification | Based on profession, claims history, and coverage limits |

| Policy Example | Standard WC policy with carveout endorsement | Errors & Omissions (E&O) policy |

Which is better?

Workers compensation carveout specifically covers medical expenses and lost wages for employees injured on the job, providing targeted financial protection. Professional liability insurance, also known as errors and omissions insurance, protects businesses from claims of negligence, errors, or omissions in professional services. Choosing between the two depends on whether the primary risk involves employee workplace injuries or potential lawsuits related to professional advice and services.

Connection

Workers' compensation carveout policies exclude specific employee groups or job classifications from standard workers' compensation coverage, often shifting their risk exposure. Professional liability insurance, also known as errors and omissions insurance, protects professionals against claims of negligence or inadequate work performance. The connection lies in mitigating overlapping risks: while workers' compensation carveouts remove certain employee risks, professional liability insurance provides targeted coverage for potential professional errors, ensuring comprehensive protection for businesses.

Key Terms

Negligence

Professional liability insurance covers claims arising from negligence, errors, or omissions in the performance of professional duties, protecting businesses from lawsuits related to inadequate or faulty services. Workers' compensation carveouts exclude coverage for certain employee injuries, particularly when negligence or intentional acts are involved, shifting the liability away from the employer's workers' compensation policy. Explore more about how these distinctions impact risk management and legal exposure in professional environments.

Occupational injury

Professional liability insurance covers claims related to negligence or errors in the performance of professional services, whereas workers' compensation carveouts specifically address occupational injuries sustained by employees during the course of their work. Occupational injury claims are typically excluded from professional liability policies and are instead managed under workers' compensation to ensure medical treatment and wage replacement benefits for injured workers. To understand the nuanced differences and coverage implications, explore detailed insights on occupational injury protections.

Coverage exclusion

Professional liability insurance primarily covers claims related to errors, omissions, or negligence in providing professional services, while workers' compensation carveouts specifically exclude coverage for workplace injuries and illnesses typically addressed under workers' compensation insurance. The exclusion in professional liability policies ensures that claims related to employee bodily injury or occupational disease are not covered, thereby shifting these risks to workers' compensation programs designed for such incidents. To understand the nuanced differences and implications of these coverage exclusions further, explore detailed insurance policy analyses.

Source and External Links

Professional Liability Insurance for Small Businesses | Hiscox - Professional liability insurance protects businesses from claims related to negligence, errors, or omissions in the advice or services provided, covering legal defense and damages if sued for professional mistakes.

Professional Liability Insurance - Get Online Quotes | Insureon - Also known as errors and omissions insurance, this coverage financially protects small businesses against lawsuits from clients over mistakes, missed deadlines, or unsatisfactory work related to professional services.

Professional Liability Insurance ~ Get a Free Quote | GEICO - Professional liability insurance covers claims for negligence, mistakes, copyright infringement, and personal injury related to services provided, protecting various professions by covering legal costs and damages.

dowidth.com

dowidth.com