Digital health insurance leverages technology to offer streamlined policy management, faster claims processing, and personalized health plans through mobile apps and online platforms. Indemnity health insurance provides policyholders the freedom to choose any healthcare provider and reimburses medical expenses based on actual costs incurred, without network restrictions. Explore the key differences and benefits of each insurance type to determine the best fit for your healthcare needs.

Why it is important

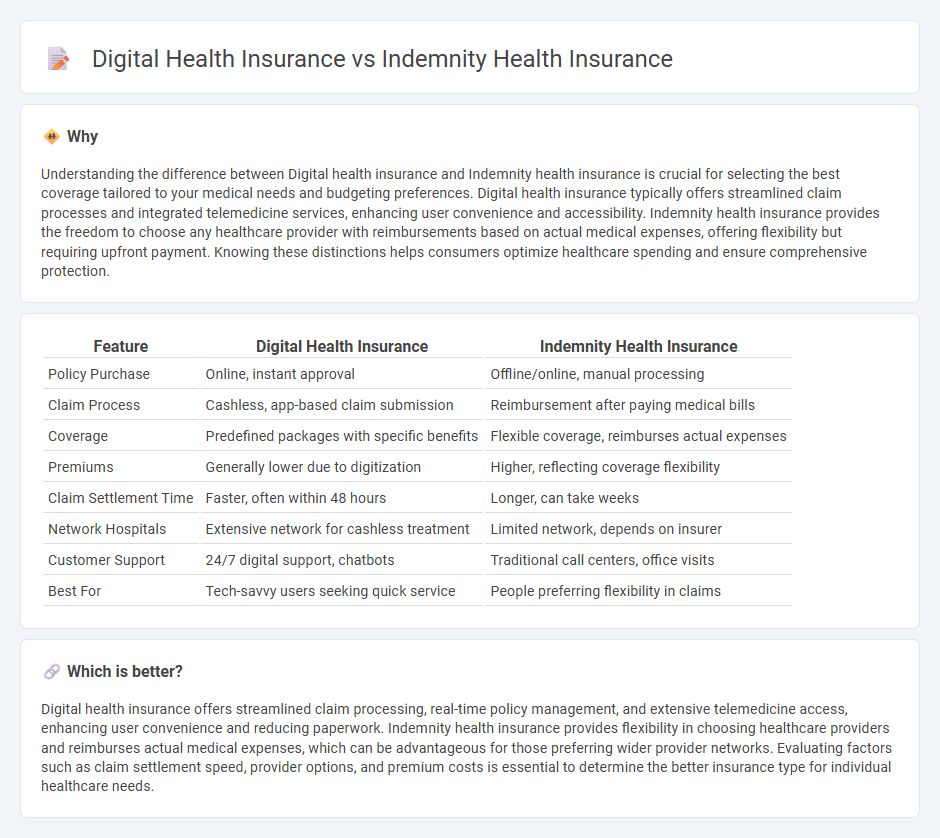

Understanding the difference between Digital health insurance and Indemnity health insurance is crucial for selecting the best coverage tailored to your medical needs and budgeting preferences. Digital health insurance typically offers streamlined claim processes and integrated telemedicine services, enhancing user convenience and accessibility. Indemnity health insurance provides the freedom to choose any healthcare provider with reimbursements based on actual medical expenses, offering flexibility but requiring upfront payment. Knowing these distinctions helps consumers optimize healthcare spending and ensure comprehensive protection.

Comparison Table

| Feature | Digital Health Insurance | Indemnity Health Insurance |

|---|---|---|

| Policy Purchase | Online, instant approval | Offline/online, manual processing |

| Claim Process | Cashless, app-based claim submission | Reimbursement after paying medical bills |

| Coverage | Predefined packages with specific benefits | Flexible coverage, reimburses actual expenses |

| Premiums | Generally lower due to digitization | Higher, reflecting coverage flexibility |

| Claim Settlement Time | Faster, often within 48 hours | Longer, can take weeks |

| Network Hospitals | Extensive network for cashless treatment | Limited network, depends on insurer |

| Customer Support | 24/7 digital support, chatbots | Traditional call centers, office visits |

| Best For | Tech-savvy users seeking quick service | People preferring flexibility in claims |

Which is better?

Digital health insurance offers streamlined claim processing, real-time policy management, and extensive telemedicine access, enhancing user convenience and reducing paperwork. Indemnity health insurance provides flexibility in choosing healthcare providers and reimburses actual medical expenses, which can be advantageous for those preferring wider provider networks. Evaluating factors such as claim settlement speed, provider options, and premium costs is essential to determine the better insurance type for individual healthcare needs.

Connection

Digital health insurance leverages technology to streamline claims processing, enhance customer experience, and enable real-time policy management, closely aligning with indemnity health insurance by facilitating direct reimbursement for medical expenses incurred. Indemnity health insurance offers policyholders the freedom to choose healthcare providers while receiving compensation based on actual medical costs, which digital platforms efficiently handle through automated claim submissions and transparent tracking. This integration drives improved operational efficiency and transparency, benefiting both insurers and insured parties in managing healthcare expenses.

Key Terms

Reimbursement

Indemnity health insurance offers reimbursement for a wide range of medical expenses after policyholders pay out-of-pocket and submit claims, ensuring flexibility in choosing healthcare providers. Digital health insurance streamlines the reimbursement process with faster claim settlements, minimal paperwork, and real-time tracking through mobile apps and online platforms. Explore how these features impact your healthcare experience and discover the best option for your needs.

Policy Administration

Indemnity health insurance typically involves manual policy administration with straightforward claim reimbursements based on actual expenses, while digital health insurance leverages automated platforms for real-time policy management and streamlined claim processing. Digital systems enhance accuracy, reduce paperwork, and improve customer experience through mobile apps and online portals. Explore the benefits of digital health insurance policy administration to optimize your coverage management.

Claims Process

Indemnity health insurance requires policyholders to pay medical bills upfront and submit claims for reimbursement, often involving detailed paperwork and longer processing times. Digital health insurance streamlines the claims process through automated claim submissions, real-time tracking, and faster settlements via mobile apps or online portals. Explore further to understand how digital solutions enhance efficiency and policyholder convenience.

Source and External Links

Indemnity Health Insurance Plans - Provides policyholders with flexibility in choosing healthcare providers and involves a claim reimbursement process where policyholders pay for services upfront and then receive reimbursement.

Hospital Indemnity Insurance - Supplements existing health insurance by providing cash payments to help cover expenses associated with hospital stays, such as deductibles and living costs.

Fixed Indemnity Insurance - Offers a fixed benefit for specific medical services without deductibles or copays, providing flexibility in choosing healthcare providers.

dowidth.com

dowidth.com